Blockchain is a transformative technology that enables secure, transparent, and decentralized data recording. It underpins many modern applications, from cryptocurrencies like Bitcoin and Ethereum to industries such as supply chain management, healthcare, and smart contracts. This article provides a comprehensive and professional overview of blockchain, including its definition, mechanics, benefits, challenges, and applications.

Definition of Blockchain

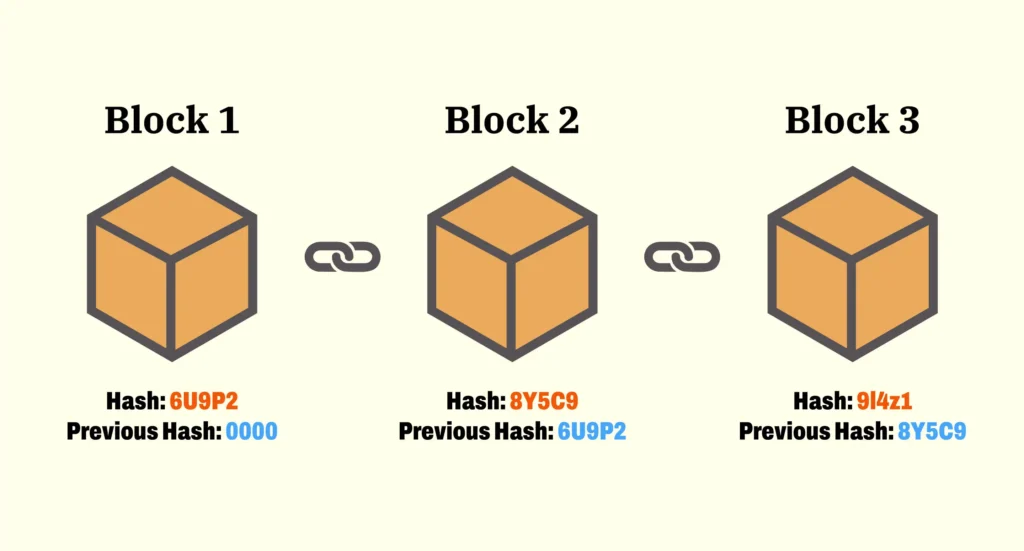

Blockchain is a distributed digital ledger that records transactions across a network of computers. Data is organized into “blocks,” which are chronologically linked to form a “chain,” hence the name “blockchain.” Each block contains a list of transactions, a timestamp, and a cryptographic hash that connects it to the previous block, making unauthorized alterations extremely difficult.

The hallmark of blockchain is its decentralization: no single entity controls the system. Instead, a network of nodes collaborates to validate and record transactions, ensuring data integrity.

How Does Blockchain Work?

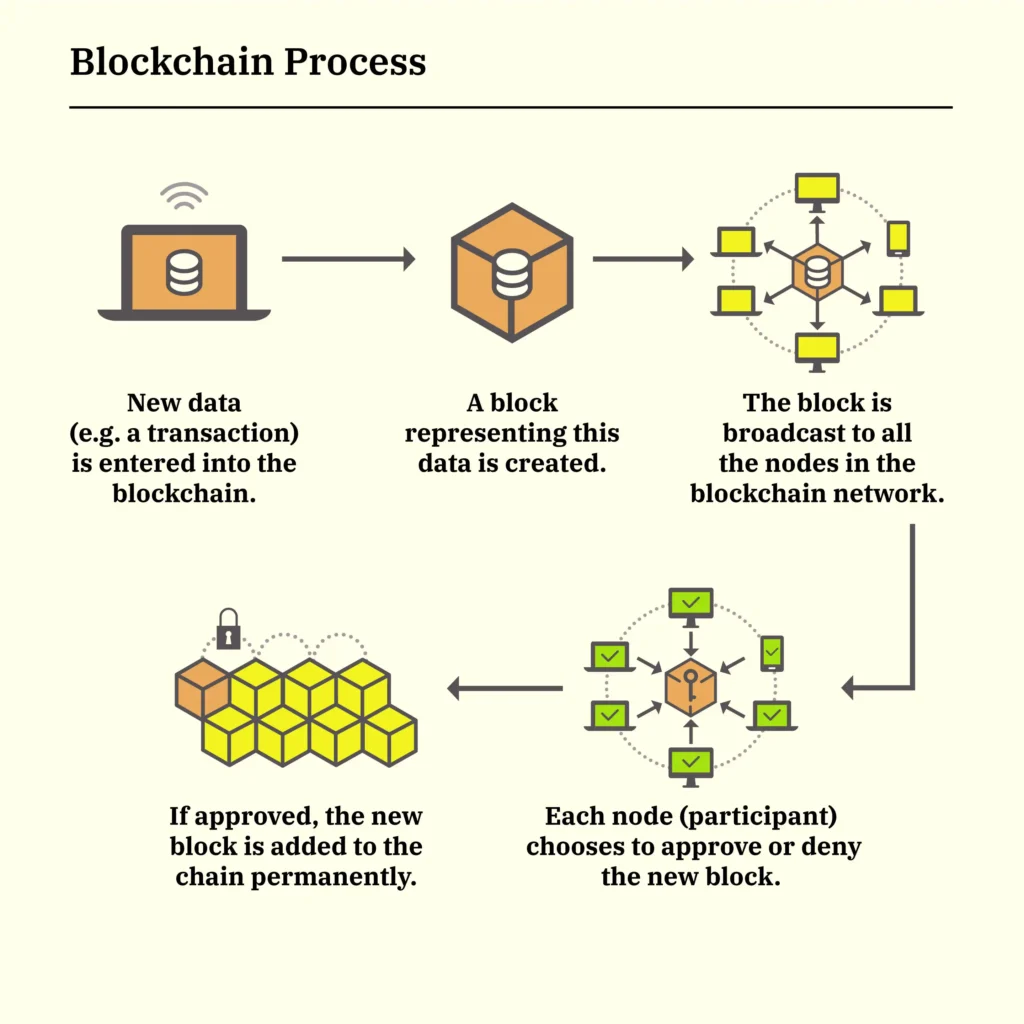

Blockchain operates on technical principles that ensure security and efficiency. Below is a step-by-step breakdown of its process:

- Transaction Initiation: A user creates a transaction, such as transferring cryptocurrency or registering a contract, and broadcasts it to the network.

- Transaction Validation: Nodes in the network receive the transaction and verify its legitimacy using specific algorithms (e.g., checking if the sender has sufficient funds).

- Block Formation: Validated transactions are grouped into a block. Each block includes:

- Transaction details.

- A unique cryptographic hash.

- The hash of the preceding block.

- Block Integration: The block is shared with all nodes for consensus. If validated, it is appended to the blockchain, becoming a permanent record.

- Network Synchronization: The ledger is updated across all nodes, ensuring every participant has an identical copy of the data.

Advantages of Blockchain

Blockchain offers compelling benefits that make it a powerful tool for businesses and individuals:

- Security: Cryptographic hashing and block linkage make data tampering nearly impossible, as altering one block requires changing all subsequent blocks across the network.

- Transparency: Transactions are visible to all network participants, fostering trust, particularly in industries where accountability is critical.

- Decentralization: By eliminating central intermediaries, blockchain reduces risks of single-point failures and lowers reliance on third parties, cutting costs.

- Efficiency: Blockchain streamlines processes by enabling near-instant transaction recording, bypassing lengthy traditional settlement systems.

- Immutability: Once recorded, data is virtually unchangeable, ensuring a reliable and tamper-proof record.

Challenges and Limitations

Despite its potential, blockchain faces obstacles that hinder its broader adoption:

- Scalability: High transaction volumes can strain some blockchain networks, leading to slower processing times.

- Energy Consumption: Consensus mechanisms like Proof of Work, used by Bitcoin, require significant computational power, raising environmental concerns.

- Cost: Developing and maintaining blockchain infrastructure can be resource-intensive, especially for smaller entities.

- Regulatory Uncertainty: Varying global regulations create legal complexities for blockchain deployment and compliance.

- Adoption Resistance: Limited understanding and the need to overhaul legacy systems slow blockchain integration in some sectors.

Applications of Blockchain

Blockchain’s versatility extends far beyond cryptocurrencies, impacting numerous industries:

- Finance:

- Facilitating fast, low-cost cross-border payments.

- Supporting central bank digital currencies (CBDCs).

- Enabling decentralized finance (DeFi) for peer-to-peer lending and borrowing.

- Supply Chain Management:

- Tracking products from origin to consumer to ensure authenticity and quality.

- Combating counterfeit goods.

- Healthcare:

- Securing patient records while maintaining privacy.

- Verifying the authenticity of pharmaceuticals.

- Smart Contracts:

- Automating agreements that execute when predefined conditions are met, reducing reliance on intermediaries.

- Digital Identity:

- Providing secure, verifiable identities, especially in regions lacking formal documentation.

- Electronic Voting:

- Enhancing the transparency and security of electoral processes.

The Future of Blockchain

Blockchain technology continues to evolve, with innovations addressing challenges like scalability and energy efficiency. As adoption grows, collaborations between governments, businesses, and developers are likely to establish global standards. Integration with emerging technologies, such as artificial intelligence and the Internet of Things (IoT), will further expand its potential, driving innovation across industries.

Conclusion

Blockchain is reshaping how we manage data and conduct transactions. Its security, transparency, and decentralization make it a cornerstone for building trust and efficiency in a digital world. While challenges remain, ongoing advancements are unlocking its full potential. Understanding blockchain is essential for navigating the future of technology, and its impact will only grow in the years ahead.