Introduction

Since its inception with Bitcoin in 2009, blockchain technology has grown into a foundational innovation with the potential to reshape industries. From finance to healthcare, logistics to voting systems, blockchain promises a future that is transparent, decentralized, and secure.

However, like any emerging technology, blockchain is not without its limitations. To make informed decisions—whether you’re an investor, developer, policy maker, or entrepreneur—it’s important to understand both the advantages and the disadvantages of blockchain.

In this article, we’ll explore the key strengths that make blockchain revolutionary, as well as the challenges and concerns that must be addressed for its mass adoption.

What is Blockchain in Simple Terms?

Blockchain is a decentralized, distributed ledger that records data in a series of blocks linked cryptographically. It is:

- Immutable – Once data is recorded, it cannot be changed.

- Transparent – All participants can verify the data.

- Decentralized – No single entity controls the system.

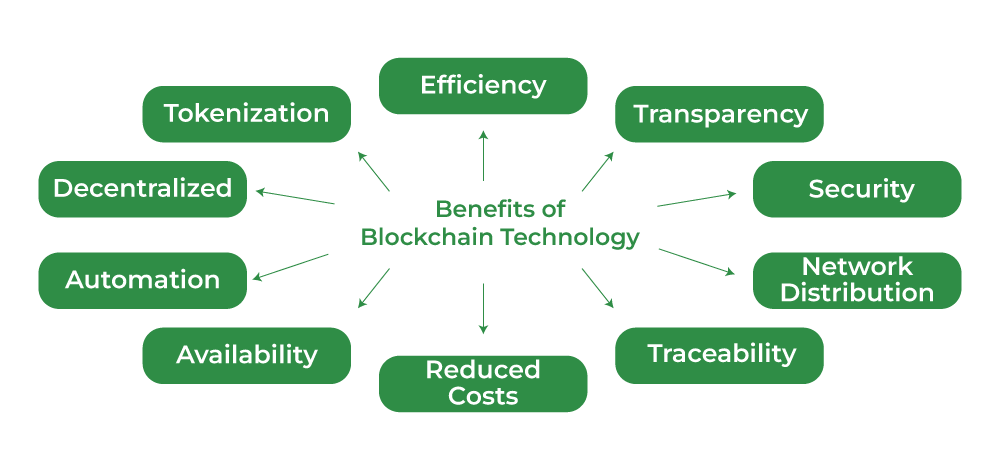

Advantages of Blockchain Technology

1. Decentralization

What it means: No central authority controls the blockchain. Instead, power is distributed across the network.

Benefits:

- Eliminates the need for middlemen (banks, clearing houses, etc.).

- Reduces the risk of corruption or manipulation.

- Enhances peer-to-peer interaction.

2. Transparency and Traceability

What it means: Transactions are visible to all participants and cannot be altered.

Benefits:

- All changes are recorded in real time.

- Easy to track the origin and journey of data or goods (ideal for supply chains).

- Builds trust among stakeholders, even in permissionless environments.

3. Security and Data Integrity

What it means: Data on the blockchain is secured with cryptographic algorithms and distributed across multiple nodes.

Benefits:

- Resistant to hacking or unauthorized changes.

- Each block is linked to the previous one, making tampering extremely difficult.

- Users control their own data using private keys.

4. Efficiency and Automation

What it means: Smart contracts (self-executing contracts) automate processes without human intervention.

Benefits:

- Faster transaction processing.

- Reduces manual paperwork.

- Enables decentralized apps (dApps) and autonomous business logic.

5. Reduced Costs

What it means: Blockchain can lower operational and transaction costs.

Benefits:

- Cuts out intermediaries.

- Streamlines processes through automation.

- Reduces overhead in recordkeeping, reconciliation, and auditing.

6. Improved Accessibility and Inclusion

What it means: Anyone with internet access can participate in a blockchain network.

Benefits:

- Empowers unbanked and underbanked populations.

- Enables micro-transactions and cross-border payments without banks.

- Opens up financial systems to a global audience.

7. Immutability

What it means: Once data is recorded on a blockchain, it cannot be altered retroactively.

Benefits:

- Reliable audit trails.

- Prevents fraud and manipulation.

- Ideal for records management (medical data, property titles, etc.).

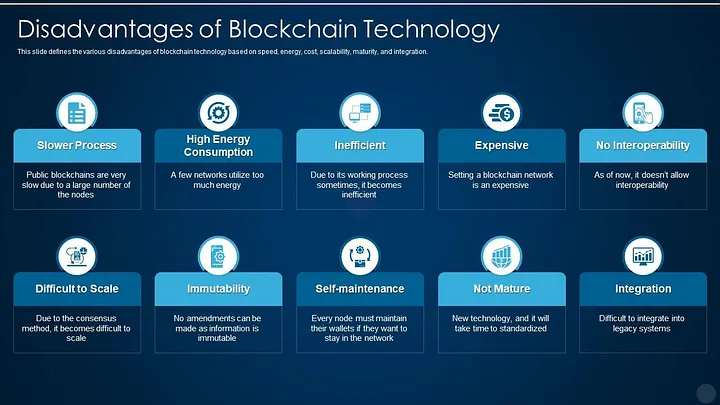

Disadvantages of Blockchain Technology

1. Scalability Issues

What it means: Most blockchains struggle to process a large number of transactions quickly.

Challenges:

- Bitcoin handles ~7 transactions per second; Ethereum ~30.

- Network congestion can cause delays and high fees.

- Scaling solutions (e.g., Layer 2) are still under development.

2. Energy Consumption

What it means: Proof-of-Work (PoW) blockchains like Bitcoin use significant computing power.

Challenges:

- High carbon footprint and environmental concerns.

- Calls for regulatory pressure and carbon taxes.

- Alternative mechanisms like Proof of Stake (PoS) aim to fix this.

3. Complexity and User Experience

What it means: Blockchain systems can be hard to understand and use for average users.

Challenges:

- Requires managing private keys and wallets.

- Irreversible transactions—mistakes can’t be undone.

- UX/UI for dApps still lags behind centralized apps.

4. Regulatory Uncertainty

What it means: Governments and regulators are still defining how blockchain fits into existing laws.

Challenges:

- Unclear tax treatment and compliance standards.

- Bans or restrictions in certain countries (e.g., China, India).

- Can stifle innovation or delay adoption.

5. Data Privacy Limitations

What it means: Public blockchains make data visible to everyone.

Challenges:

- Not ideal for storing sensitive personal or corporate data.

- GDPR and data privacy laws clash with blockchain’s immutability.

- Private/permissioned blockchains are emerging to address this.

6. Risk of Centralization in Practice

What it means: Though blockchain aims for decentralization, in practice, power can become concentrated.

Challenges:

- Large mining pools dominate PoW networks.

- Wealth concentration in PoS systems (rich get richer).

- Nodes controlled by a few entities in private blockchains.

7. Irreversibility of Transactions

What it means: Once a transaction is recorded, it can’t be undone.

Challenges:

- Mistakes are permanent (e.g., sending crypto to the wrong address).

- No central customer support to fix errors.

- Can cause loss of funds or assets.

Summary Table: Pros and Cons

| Advantages | Disadvantages |

|---|---|

| Decentralization | Scalability limitations |

| Transparency and traceability | High energy consumption (in PoW) |

| Security and immutability | Complex for non-technical users |

| Automation through smart contracts | Regulatory uncertainty |

| Lower transaction costs | Privacy concerns on public chains |

| Inclusive and borderless | Risk of centralization in large networks |

| Tamper-resistant audit trails | Irreversible transactions |

Conclusion

Blockchain is a game-changing technology with the potential to revolutionize entire industries—but it’s not a one-size-fits-all solution. While its strengths in security, transparency, and decentralization are unmatched, challenges related to scalability, regulation, and user adoption must be addressed for it to fulfill its promise.