Introduction

Blockchain technology has evolved far beyond its origins with Bitcoin. Today, blockchains power decentralized finance, supply chains, healthcare systems, identity verification, and much more. But not all blockchains are the same—they come in various types, each with its own architecture, level of access, and use cases.

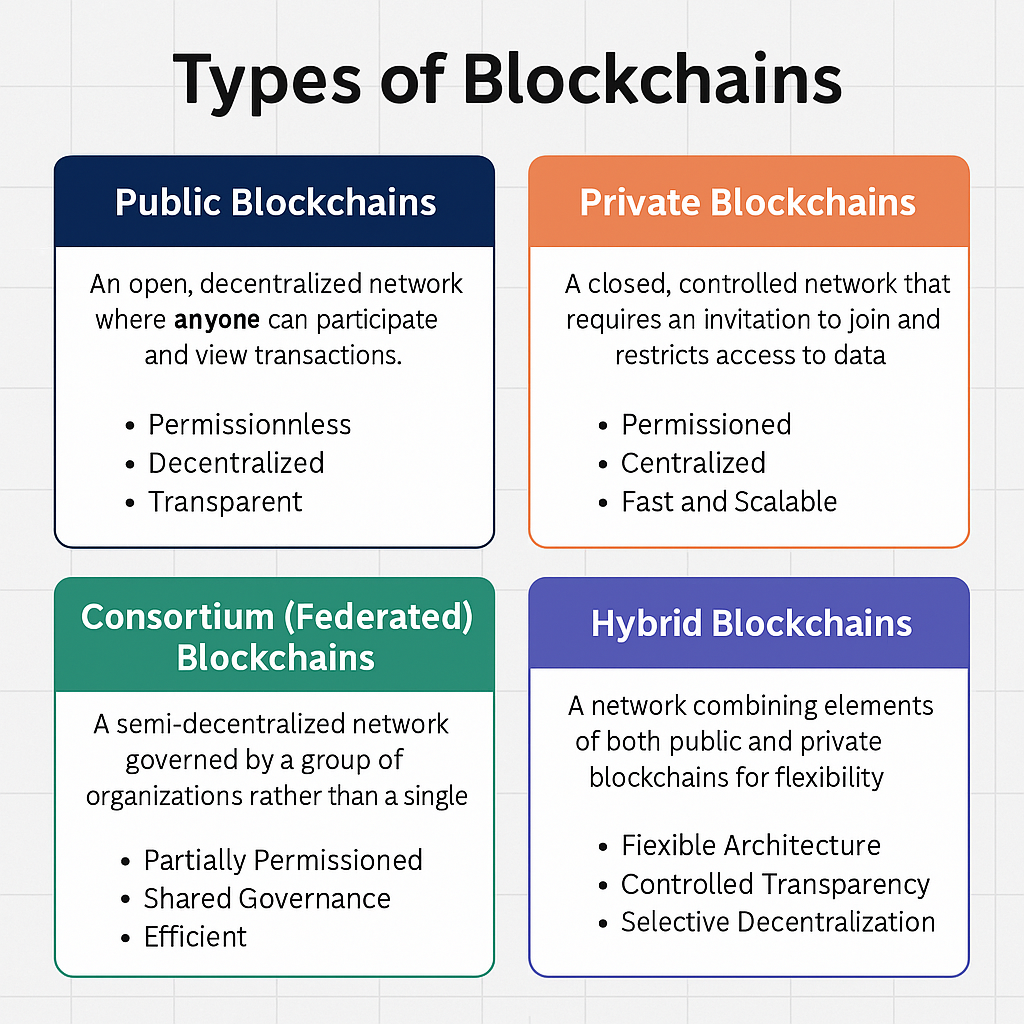

1. Public Blockchains

Definition

A public blockchain is an open, decentralized network where anyone can join, participate, and view the data. It is fully transparent and governed by consensus mechanisms such as Proof of Work (PoW) or Proof of Stake (PoS).

Key Characteristics

- Permissionless: No need for authorization to join or transact.

- Decentralized: No single entity controls the network.

- Transparent: All transactions are publicly viewable and auditable.

- Secure: Secured by cryptography and a global network of nodes/miners.

Popular Examples

- Bitcoin – The first and most well-known public blockchain.

- Ethereum – The foundation of smart contracts and decentralized apps.

- Litecoin, Solana, Cardano, etc.

Use Cases

- Digital currencies (e.g., BTC, ETH)

- Decentralized finance (DeFi)

- Non-Fungible Tokens (NFTs)

- Open-source decentralized applications (dApps)

Advantages

- High transparency and auditability

- Open participation encourages innovation

- Resistant to censorship and central control

Disadvantages

- Slower transaction speeds due to consensus complexity

- High energy consumption (especially PoW systems)

- Scalability issues in large-scale applications

2. Private Blockchains

Definition

A private blockchain is a closed network, where access is restricted to specific participants. It is centralized to some extent, often operated by a single organization or a controlled group.

Key Characteristics

- Permissioned: Only invited entities can participate.

- Central Governance: Operated by a single organization or administrator.

- Fast and Scalable: Due to fewer participants and simplified consensus.

- Customizable: Tailored rules, privacy controls, and data permissions.

Popular Platforms

- Hyperledger Fabric

- R3 Corda

- Quorum (by JP Morgan)

Use Cases

- Supply chain tracking

- Internal corporate processes

- Healthcare data sharing

- Interbank settlements

Advantages

- Greater control over data and access

- Faster and more scalable than public blockchains

- Lower energy requirements

- Enhanced privacy and confidentiality

Disadvantages

- Centralization may reduce trust

- Lower transparency

- Limited community participation

- Vulnerable to insider manipulation

3. Consortium (Federated) Blockchains

Definition

A consortium blockchain is a semi-decentralized blockchain managed by a group of pre-selected organizations. It offers a balance between decentralization and control.

Key Characteristics

- Partially Permissioned: Only selected entities validate blocks or transact.

- Shared Governance: Managed by multiple trusted participants.

- Efficient Consensus: Faster than public blockchains, but more distributed than private ones.

- Privacy + Collaboration: Combines the best of both private and public chains.

Popular Platforms

- Hyperledger Besu

- Ripple

- Energy Web Chain

Use Cases

- Banking consortia for payment processing

- Trade finance among institutions

- Insurance industry data sharing

- Government inter-agency coordination

Advantages

- Shared trust among multiple parties

- Improved efficiency and performance

- Enhanced privacy with collective governance

- Cost-effective collaboration model

Disadvantages

- Still requires trust among participants

- Not open to public participation

- Complex governance mechanisms

- Limited decentralization compared to public chains

4. Hybrid Blockchains

Definition

A hybrid blockchain combines features of both public and private blockchains, allowing an organization to choose what data remains public and what stays private.

Key Characteristics

- Flexible Architecture: Public and private components coexist.

- Controlled Transparency: Sensitive data stays private; other data can be open.

- Selective Decentralization: Some functions are decentralized; others are not.

- Smart Contract Integration: Public blockchains often used for final settlement or proof.

Popular Examples

- XDC Network

- Dragonchain

- IBM Food Trust (mixes public proof with private data)

Use Cases

- Enterprise blockchain solutions with public verification

- Healthcare systems with patient data privacy

- Public records with internal administrative processes

- Real estate and property ownership systems

Advantages

- Optimal balance between transparency and control

- More scalable and private than fully public chains

- Allows for regulatory compliance and data protection

- Combines strengths of public and private systems

Disadvantages

- More complex to implement and manage

- Risk of centralization in the private layer

- Not as open as public chains for developer innovation

Summary Table: Comparing Blockchain Types

| Type | Access | Governance | Transparency | Speed | Best For |

|---|---|---|---|---|---|

| Public | Open to all | Decentralized | High | Slow | Cryptocurrencies, dApps, DeFi |

| Private | Restricted | Centralized | Low to Medium | Fast | Enterprises, internal data systems |

| Consortium | Limited to group | Shared among members | Medium | Moderate | Banking, supply chains, B2B |

| Hybrid | Mixed | Mixed | Selective | Moderate | Enterprise solutions, regulation |

Conclusion

The type of blockchain you choose depends on your goals, audience, regulatory requirements, and need for decentralization. Public blockchains are ideal for open, trustless environments, while private and consortium blockchains serve best in enterprise and controlled settings. Hybrid blockchains, meanwhile, offer a middle path that combines security, transparency, and privacy.