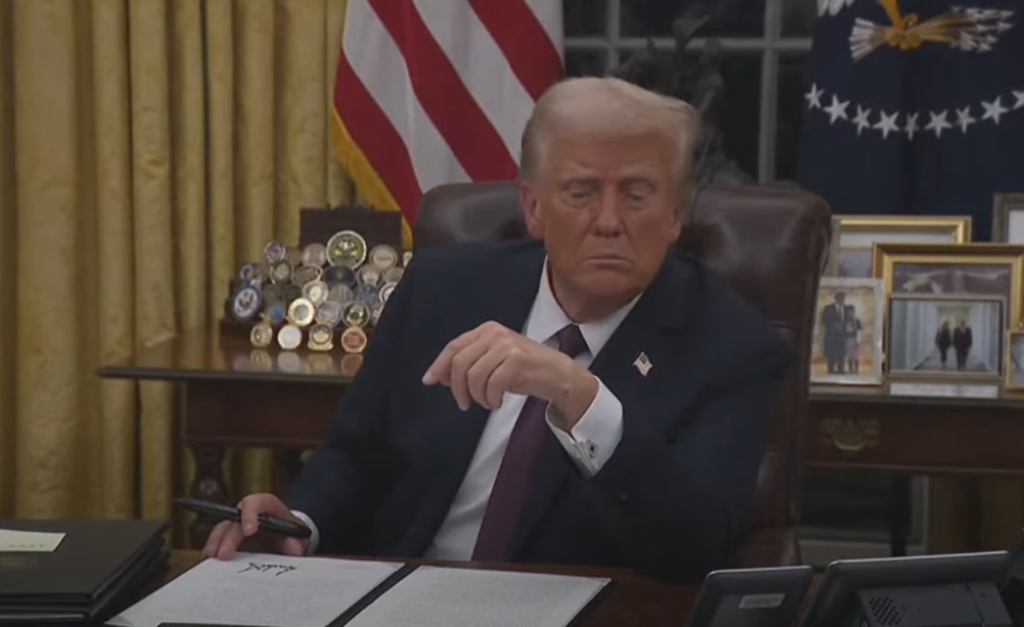

In a groundbreaking development, former President Donald Trump has reportedly proposed the creation of a sovereign wealth fund that could allocate up to $150 billion to Bitcoin. This move, if implemented, could mark a seismic shift in the global financial landscape and propel Bitcoin to unprecedented heights.

The Sovereign Fund Proposal

Trump’s proposal suggests the establishment of a U.S. sovereign wealth fund, similar to those in countries like Norway and Saudi Arabia, but with a unique twist: a significant portion of its assets would be invested in Bitcoin. This bold initiative aims to diversify the nation’s reserves and capitalize on the growing importance of digital assets.

Potential Impact on Bitcoin

- Massive Inflows: A $150 billion investment would represent a substantial inflow into the Bitcoin market, potentially driving its price to new all-time highs.

- Institutional Validation: Such a move would further legitimize Bitcoin as a strategic asset, encouraging other nations and institutions to follow suit.

- Market Confidence: The proposal could boost investor confidence, leading to increased adoption and innovation in the crypto space.

Challenges and Considerations

While the proposal is exciting, it also raises several questions:

- Regulatory Hurdles: Implementing such a fund would require navigating complex regulatory and political landscapes.

- Volatility: Bitcoin’s price volatility could pose risks to the stability of a sovereign fund.

- Public Perception: The idea of investing public funds in a decentralized asset like Bitcoin may face resistance from skeptics.

Broader Implications

Trump’s proposal underscores the growing recognition of Bitcoin as a legitimate asset class. If successful, it could pave the way for other countries to explore similar strategies, further integrating cryptocurrencies into the global financial system.

Conclusion

The prospect of a $150 billion sovereign fund investing in Bitcoin is a game-changer for the crypto industry. While challenges remain, the proposal highlights the increasing convergence of traditional finance and digital assets. As the world watches closely, this could be the beginning of a new era for Bitcoin and the broader crypto market.