Bitcoin at $95,000: A Battle for Dominance

Bitcoin (BTC) has once again reached the $95,000 psychological barrier, a level last seen in early March. This key resistance level has sparked debate among market analysts, with some predicting a bullish breakout and others calling for a pullback.

While $95,000 looms as a major hurdle, a confluence of bullish signals suggests a potential breakthrough.

Resurgent Institutional Demand: A Force for Growth

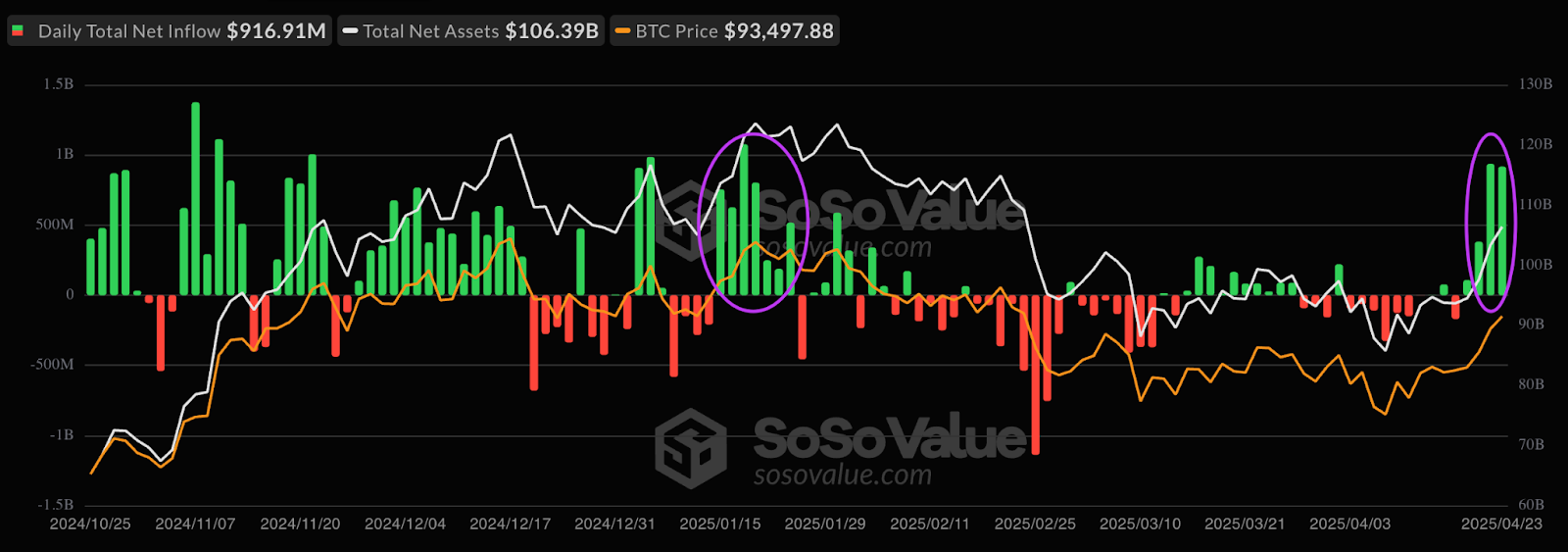

One of the most prominent bullish indicators is the surge in demand for Bitcoin Exchange-Traded Funds (ETFs). Spot Bitcoin ETFs witnessed record inflows in April, exceeding $900 million on both April 22nd and 23rd. These inflows, the highest since January 2025, reflect growing confidence among traditional finance players, indicating a significant shift toward Bitcoin as a mainstream asset.

Analysts, like Jamie Coutts, attribute this surge in institutional demand to global liquidity reaching new all-time highs, a historical catalyst for asset price rallies. As institutional investors continue to allocate capital to Bitcoin, the upward pressure on prices intensifies.

Hodling Strong: Reduced Sell Pressure

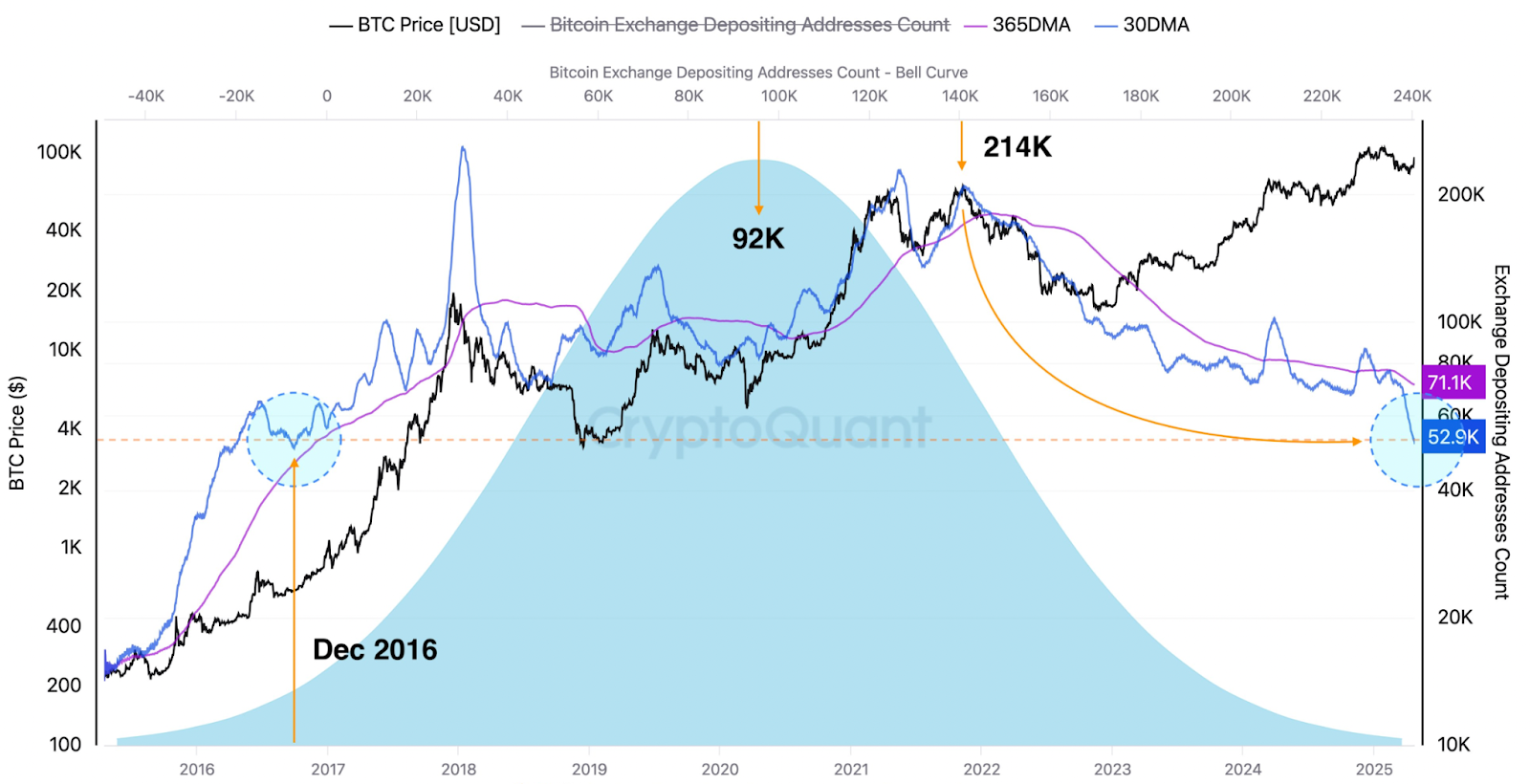

Another positive sign for Bitcoin is the declining flow of coins to exchanges. Bitcoin exchange inflows, a proxy for potential sell pressure, have dropped dramatically since February 2025, reaching their lowest point since December 2016. This decrease suggests that investors are holding onto their Bitcoin, rather than selling, creating a more robust base for further price appreciation.

Analysts, like CryptoQuant’s Axel Adler Jr., highlight the decreasing number of addresses depositing Bitcoin to exchanges as a testament to the growing “HODL” sentiment among investors. This prolonged trend significantly reduces selling pressure, paving the way for a potential breakout.

Negative Funding Rates: A Short Squeeze in the Making?

While Bitcoin’s price has been soaring, perpetual futures funding rates have remained negative, implying that short sellers are paying long holders. This seemingly contradictory situation points to a potential short squeeze, where short positions are liquidated as prices rise, further propelling the price upward.

CryptoQuant contributor Darkfost emphasized the significance of negative funding rates on Binance, historically preceding notable Bitcoin rallies. This divergence between Bitcoin’s price and funding rates could be a precursor to a significant push toward $100,000.

Technical Support: A Safety Net for Bulls

Bitcoin’s recent price action has been bolstered by its breakout above the 200-day Simple Moving Average (SMA), a significant technical indicator that has historically served as a support level during market rallies. This break above the 200-day SMA adds to the bullish sentiment and suggests that the potential for a sustained upward trend is strong.

The next resistance levels to watch are the $95,000 and $100,000 psychological levels. If Bitcoin manages to break through these levels, the path toward the January 2025 all-time high above $109,000 could open up. However, a failure to break through these resistance levels could lead to a pullback toward the $89,000–$90,000 zone.

Conclusion

Bitcoin’s current position at $95,000 is a pivotal moment for the cryptocurrency. While the market continues to be volatile, the confluence of bullish indicators, ranging from institutional demand to negative funding rates, suggests a potential breakout to new highs. However, investors should remain cautious and conduct thorough research before making any investment decisions. The cryptocurrency market is unpredictable, and price fluctuations can be significant.