Ethereum’s Price Surge: A Symphony of Bullish Signals

Ethereum (ETH) has been on a tear recently, reaching a new high at $1,860 on April 28th, its highest level since April 2nd. Analysts are buzzing with excitement, and several factors point to a potential breakout towards the coveted $2,000 mark.

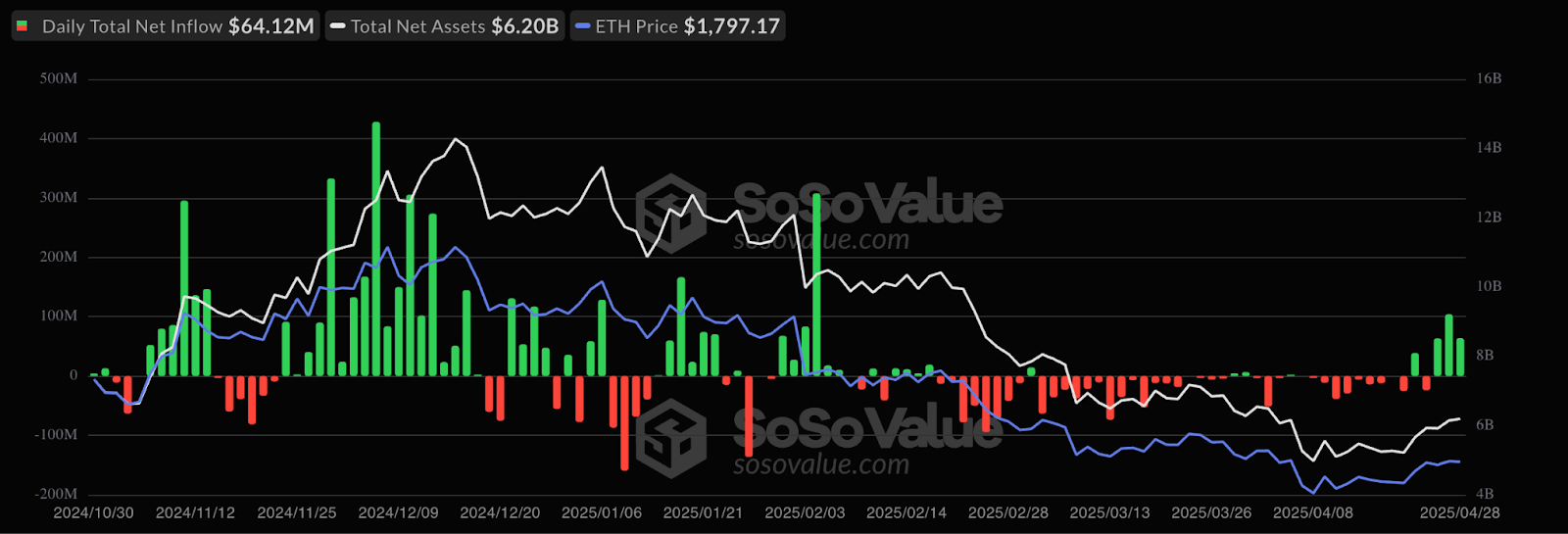

The resurgence of institutional demand is a key catalyst. Ethereum exchange-traded funds (ETFs) have witnessed significant inflows, indicating a growing appetite from traditional finance players. The week ending April 25th saw a whopping $151.7 million inflow into Ethereum ETFs, the highest since February 2025. This trend signifies a shift in sentiment, with investors seeking out digital assets as a potential safe haven amidst economic uncertainties.

Ethereum’s Network Strength: A Solid Foundation

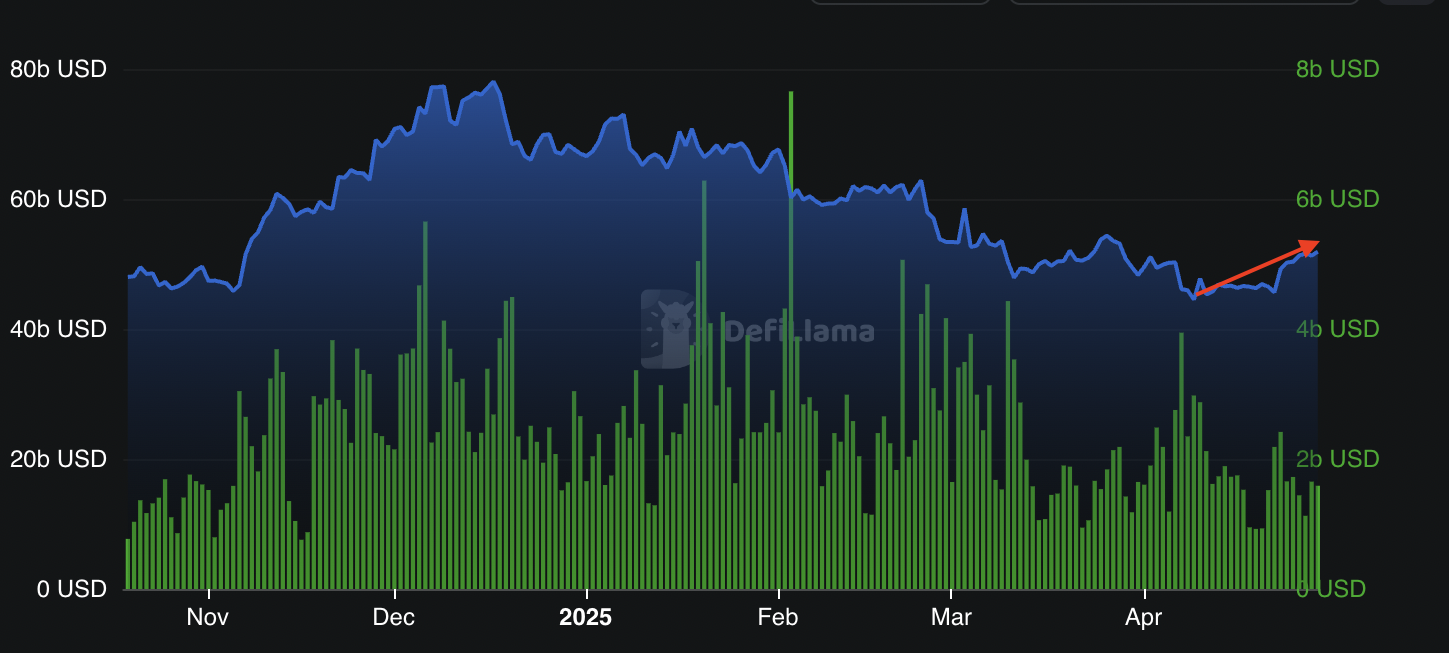

Beyond institutional interest, Ethereum’s robust network activity is another compelling driver. The total value locked (TVL) on the Ethereum network stands at a formidable $51.8 billion, highlighting its dominance in the decentralized finance (DeFi) landscape. Over the past week, Ethereum’s TVL has seen an impressive 16% increase, with prominent DeFi protocols like Aave, Lido, and EigenLayer recording substantial gains.

This growth underscores Ethereum’s position as the leading layer-1 blockchain, attracting developers and users alike. Furthermore, daily decentralized exchange (DEX) volumes have increased by over 30%, reinforcing the network’s vitality and the increasing demand for decentralized applications (dApps) built on its infrastructure.

Technical Analysis: A Bullish Flag Pattern

Technical indicators also paint a bullish picture. The ETH/USD pair has formed a classic bull flag pattern on the four-hour chart, which signals a potential continuation of the upward momentum. The flagpole’s height suggests a price target of $2,100, representing a 15% increase from the current price. A break above the flag’s upper boundary at $1,800 would confirm this bullish signal.

“Once ETH confirms this 4H close above resistance [$1,800], Ether and altcoins will finally get their time to shine. I can feel it in my bones, $2,000 ETH coming fast.” – Kiran Gadakh

While the overall sentiment is positive, it’s essential to acknowledge that price movements in the cryptocurrency market can be volatile. Analysts like Nebraskangooner warn that a rejection at $1,800 could lead to a pullback towards support levels around $1,600. Therefore, investors should always exercise caution and conduct thorough due diligence before making any investment decisions.

Conclusion: A Promising Outlook for Ethereum

The confluence of institutional demand, robust network activity, and a bullish technical outlook suggests a compelling case for Ethereum’s price to break through the $2,000 mark. However, it’s crucial to remain vigilant and consider potential risks, as market conditions can change rapidly.