XRP Bulls Hopeful as ETF Approval Odds Surge

The XRP (XRP) community is buzzing with optimism following a significant increase in the likelihood of spot XRP exchange-traded funds (ETFs) being approved in the United States. This optimism is fueled by a recent shift in leadership at the US Securities and Exchange Commission (SEC) and a strengthening market structure for XRP.

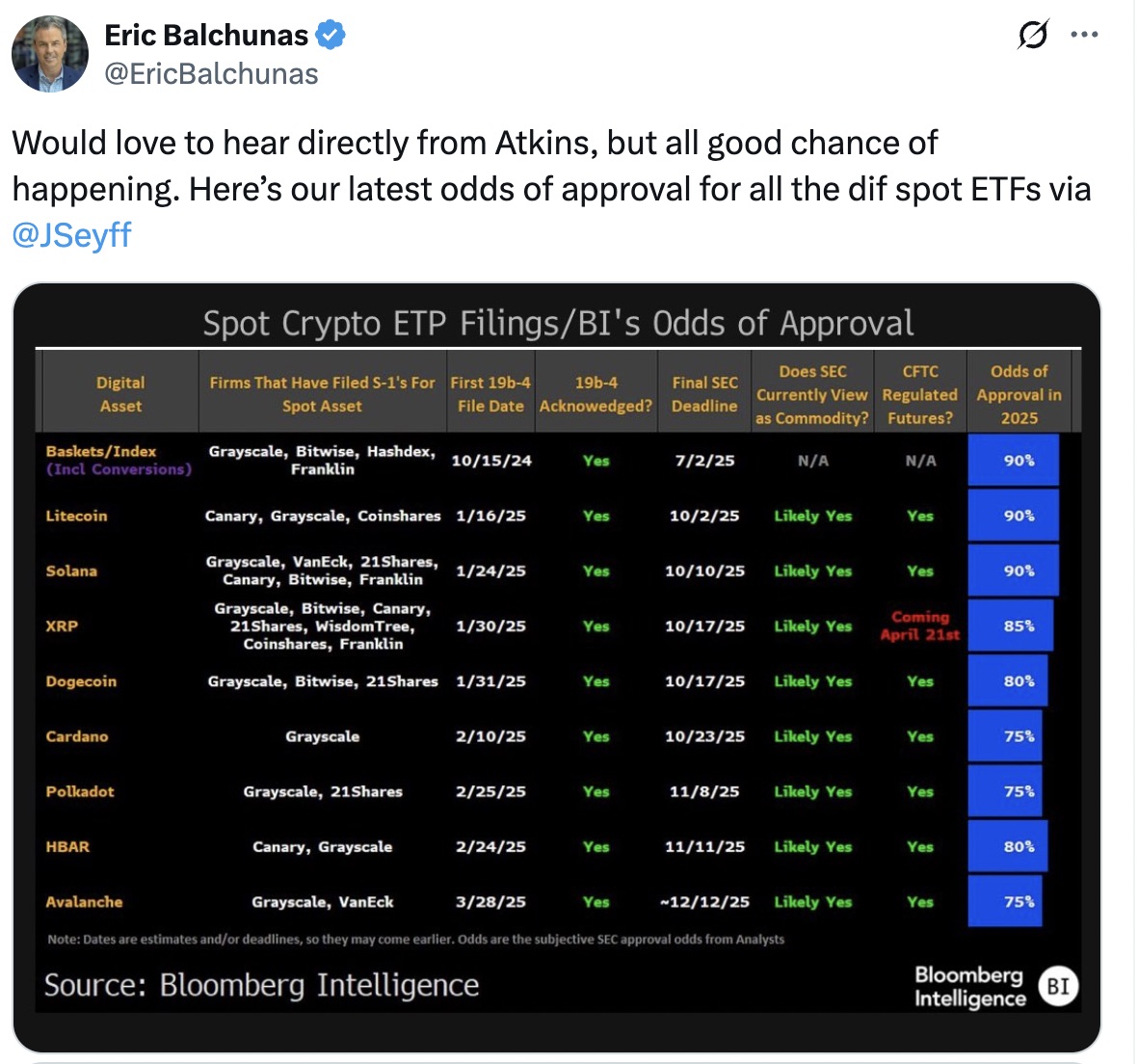

Bloomberg senior ETF analysts have upgraded their chances of XRP ETF approval to 85% for 2025, a considerable jump from their previous prediction of 65% just two months ago. This heightened optimism coincides with the SEC‘s recent appointment of a new Chair, Gary Gensler, who has expressed a more open stance towards crypto regulation.

Further bolstering the bullish sentiment is the rising probability of an XRP ETF approval by December 31st, which is now at 80% on the prediction market platform Polymarket. This surge in bullish bets reflects growing confidence among market participants.

Technical Analysis Hints at Potential Upside

Technical analysis charts currently show XRP trading within a falling wedge pattern, a bullish reversal signal. This pattern indicates weakening downward momentum and suggests that the price could break above the upper trendline at $2.40, potentially leading to a target of $3.74.

The relative strength index (RSI) also supports the bullish outlook, trading above the midline, indicating that the market conditions still favor upward price movement. However, to sustain the ongoing recovery, XRP price needs to hold the support at $2.20 and overcome the resistance between $2.80 and $3.00.

Analysts Predict a Potential Breakout

Several analysts remain optimistic about XRP‘s potential for a significant rebound, with some even predicting a return to all-time highs. Popular trader Dark Defender believes the recent correction is part of an Elliott Wave pattern that will eventually lead to “XRP continuing its climb to the top.”

Fellow trader Allincrypto echoes this sentiment, stating that XRP is “heading to $19.27” based on the breakout from the falling wedge pattern. He describes the current pullback as “textbook perfect” and sees the falling wedge as a continuation pattern pointing towards a higher target.

Institutional Interest Key to Future Growth

The potential approval of spot XRP ETFs could have a significant impact on XRP‘s price trajectory. It would unlock a wave of institutional capital, attracting large investors who are currently hesitant to invest directly in cryptocurrencies due to regulatory uncertainty. This influx of institutional capital could lead to a substantial increase in demand for XRP.

While the exact timelines for ETF approvals remain uncertain, the growing probability of their approval in the near future signals a significant step towards mainstream adoption for XRP. This, coupled with the bullish technical indicators and analysts’ predictions, suggests that XRP may be poised for a strong run in the coming months and years.

It is important to note that this article is for informational purposes only and does not constitute investment advice. Investing in cryptocurrencies carries significant risk, and readers should conduct their own research before making any investment decisions.