Core Scientific Navigates Bitcoin Halving, Embraces AI

Core Scientific, a publicly traded Bitcoin mining giant, has reported its Q1 2025 earnings, revealing a tale of two forces: the impact of the Bitcoin halving and the company’s strategic pivot towards artificial intelligence (AI) and high-performance computing (HPC).

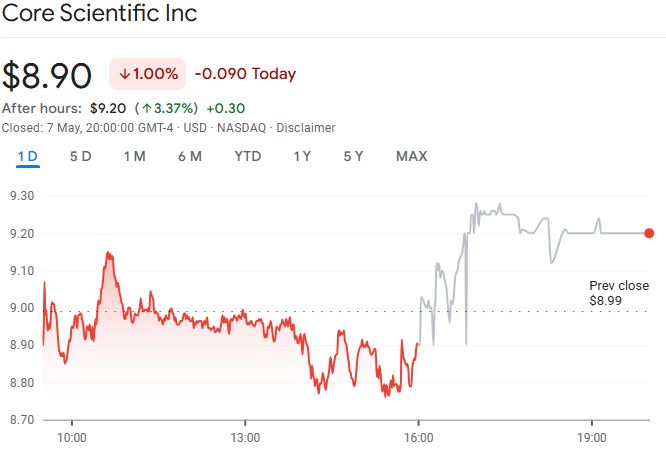

Despite a net profit of $580 million, more than double its Q1 2024 earnings, Core Scientific fell short of analysts’ revenue estimates. This miss can be attributed to the Bitcoin halving event on April 20, 2024, which cut mining rewards in half, coupled with the company’s transition to HPC hosting, primarily used for AI applications.

Halving‘s Impact on Revenue

The Bitcoin halving, a predetermined event that reduces the block reward for miners, significantly impacted Core Scientific‘s mining revenue. The company reported a drop in Bitcoin (BTC) mined and total revenue, reflecting the reduced rewards. This decline was partially offset by a 74% increase in the average Bitcoin price and a 33% decrease in power costs.

Shifting Gears: Embracing AI and HPC

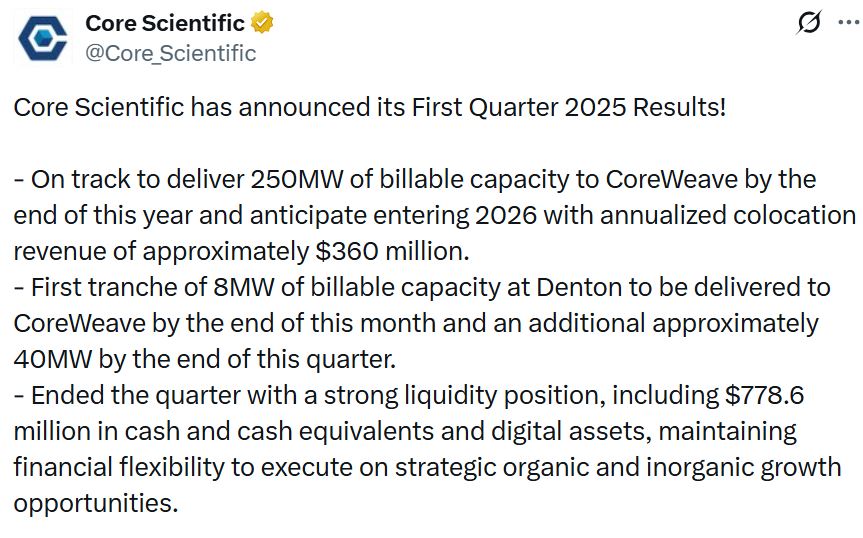

Core Scientific‘s strategic shift away from Bitcoin mining towards AI and HPC is a key factor shaping its future. The company has identified a surge in demand for high-performance data infrastructure, viewing this as an opportunity for growth. In February, Core Scientific inked a deal with AI startup CoreWeave for a $1.2 billion data center expansion, a move that indicates the company’s commitment to the AI and HPC space.

Industry-Wide Trend: Miners Transitioning to AI

Core Scientific‘s shift towards AI and HPC is not isolated. The mining industry is witnessing a growing trend of miners diversifying their operations to capitalize on the burgeoning AI market. This move is driven by the potential for significant revenue streams from hosting AI workloads.

“Our first quarter was an inflection point, as we positioned ourselves at the center of one of the most important shifts in modern computing. The demand for high-performance data infrastructure has accelerated, and we are well-positioned to capitalize on this growth,” said Adam Sullivan, Core Scientific CEO.

VanEck, an asset manager, estimated that if publicly traded Bitcoin mining companies allocated 20% of their energy capacity to AI and HPC by 2027, they could generate an additional $13.9 billion in annual profits over 13 years.

Core Scientific‘s Future: AI-Driven Growth

Core Scientific‘s Q1 2025 performance showcases the company’s ability to adapt to market shifts and capitalize on emerging opportunities. The company’s strategic shift towards AI and HPC has positioned it for potential growth in a rapidly evolving technological landscape. However, it remains to be seen how the company will navigate the challenges of balancing its traditional Bitcoin mining operations with its burgeoning AI and HPC business.