Bitcoin‘s Potential Bull Run: A Trump-Fueled Surge?

The cryptocurrency market is abuzz with speculation, fueled by the potential impact of former President Donald Trump‘s proposed spending bill, dubbed the “Big Beautiful Bill.” Historical data suggests a fascinating, and potentially profitable, correlation between increased U.S. government spending, rising national debt, and the performance of Bitcoin.

This isn’t the first time Trump‘s actions have been linked to significant Bitcoin price movements. Back in late 2020, when Trump signed a major spending bill, Bitcoin experienced a substantial surge, gaining approximately 38% in the weeks following the event. Now, with a new spending package on the horizon, market participants are closely watching to see if history repeats itself. Some analysts are even projecting a Bitcoin price target of $150,000 if the same pattern unfolds.

The Debt Ceiling and Bitcoin‘s Response

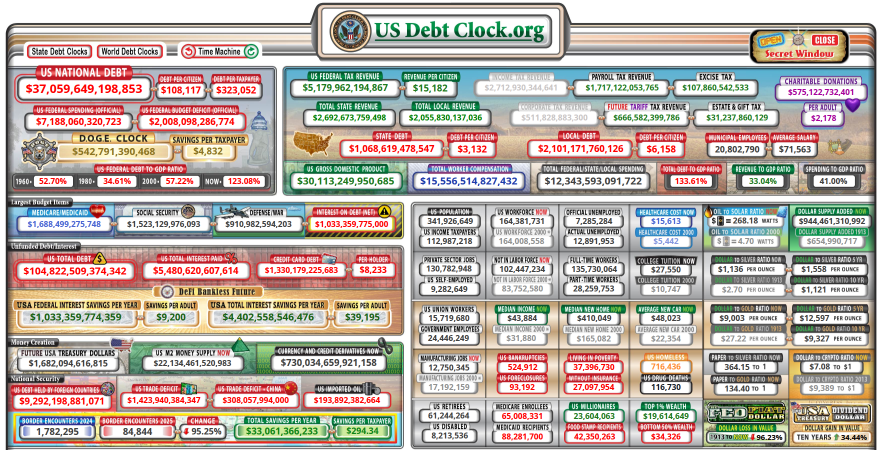

The core of this analysis lies in the potential impact of increased U.S. national debt. The “Big Beautiful Bill” is anticipated to lead to a significant expansion of the national debt, possibly reaching $40 trillion by 2025. This projected surge in debt levels is what’s capturing the attention of Bitcoin enthusiasts.

Historically, Bitcoin has shown a positive reaction to signals of increased U.S. borrowing. This is often attributed to the perception of Bitcoin as a hedge against inflation and currency devaluation. As the government borrows more and potentially weakens the dollar, investors might seek safe havens, and Bitcoin often fits that bill.

Beyond the Bill: Global Liquidity and M2 Money Supply

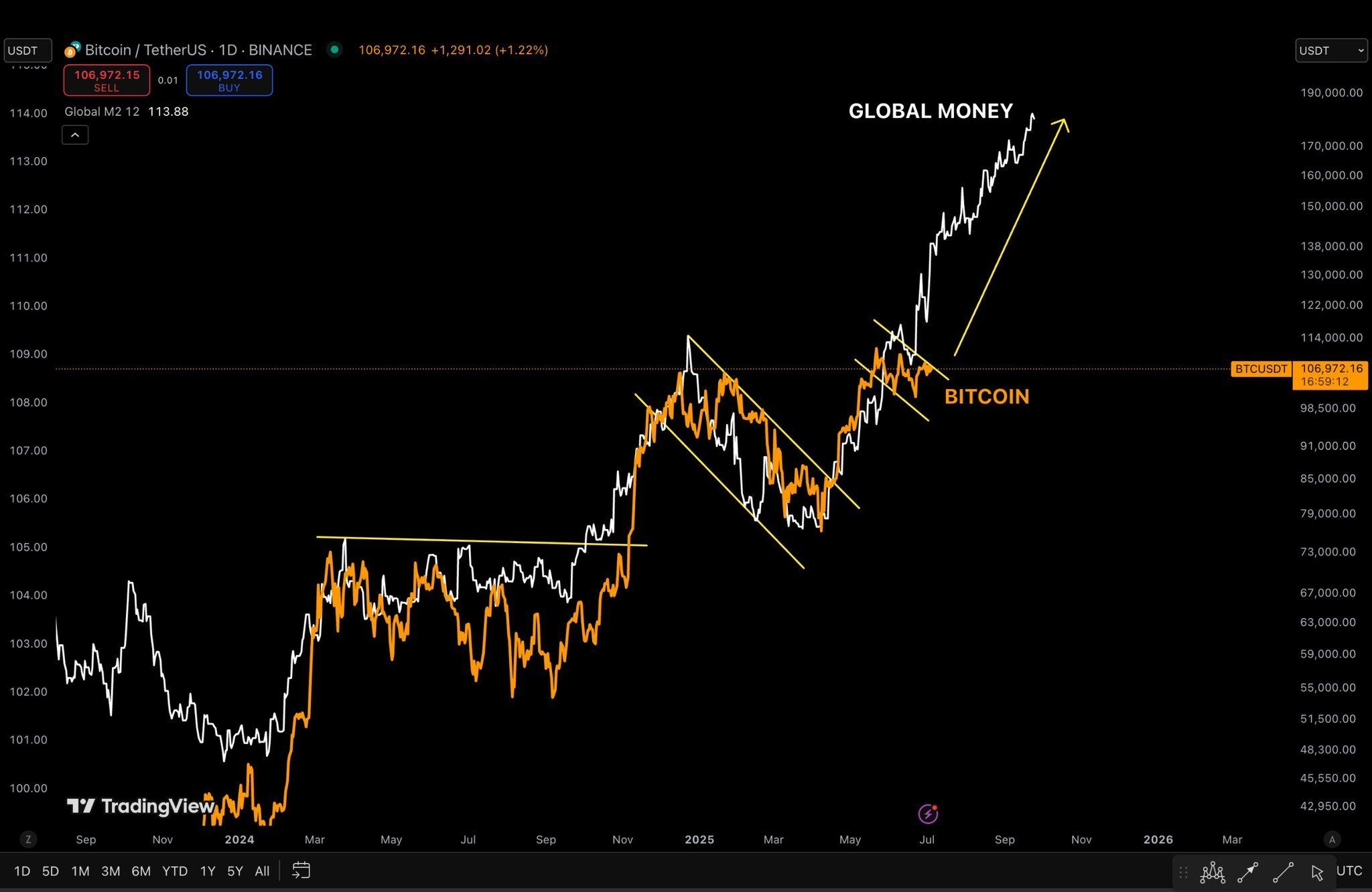

While the “Big Beautiful Bill” is a key catalyst, the broader market context is equally important. Several analysts point to the expanding global M2 money supply as another bullish factor for Bitcoin. M2, a measure of the money supply that includes cash, checking deposits, and easily convertible assets, has been steadily increasing, providing additional liquidity that can flow into riskier assets like Bitcoin.

The correlation between Bitcoin‘s price and the M2 money supply is well-documented, with Bitcoin generally tracking the growth of M2, albeit with a slight delay. This suggests that as global liquidity continues to increase, Bitcoin may continue to benefit.

Potential Risks and Considerations

Of course, it’s crucial to approach these projections with a healthy dose of caution. While historical trends provide valuable insights, the future is never guaranteed. The crypto market is inherently volatile, and various factors could influence Bitcoin‘s price, including regulatory developments, macroeconomic conditions, and shifts in investor sentiment.

“Every investment and trading move involves risk, and readers should conduct their own research when making a decision.”

Furthermore, it’s essential to recognize that even if Bitcoin experiences a price surge in response to the “Big Beautiful Bill“, it may not be a straight shot upwards. Some analysts suggest that the market could peak before M2 reaches its ultimate high. This means careful timing and strategic decision-making are key.

The Bottom Line

The potential impact of the “Big Beautiful Bill” on Bitcoin is a compelling narrative that highlights the complex interplay of fiscal policy, global liquidity, and cryptocurrency markets. While the historical correlation and current market trends are intriguing, investors should remain vigilant, conduct thorough research, and carefully manage their risks.