Bitcoin‘s Ascent: A New Benchmark

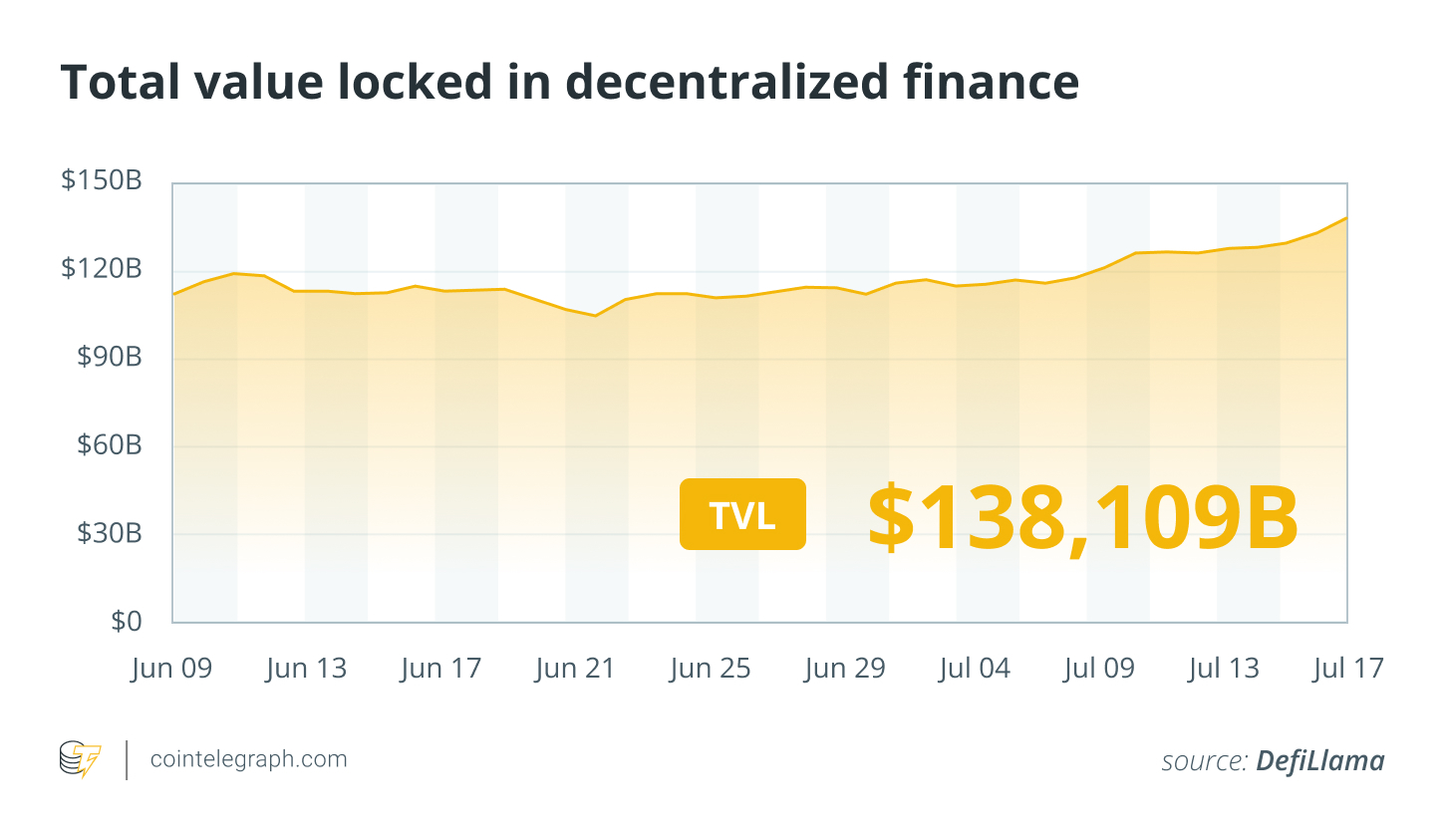

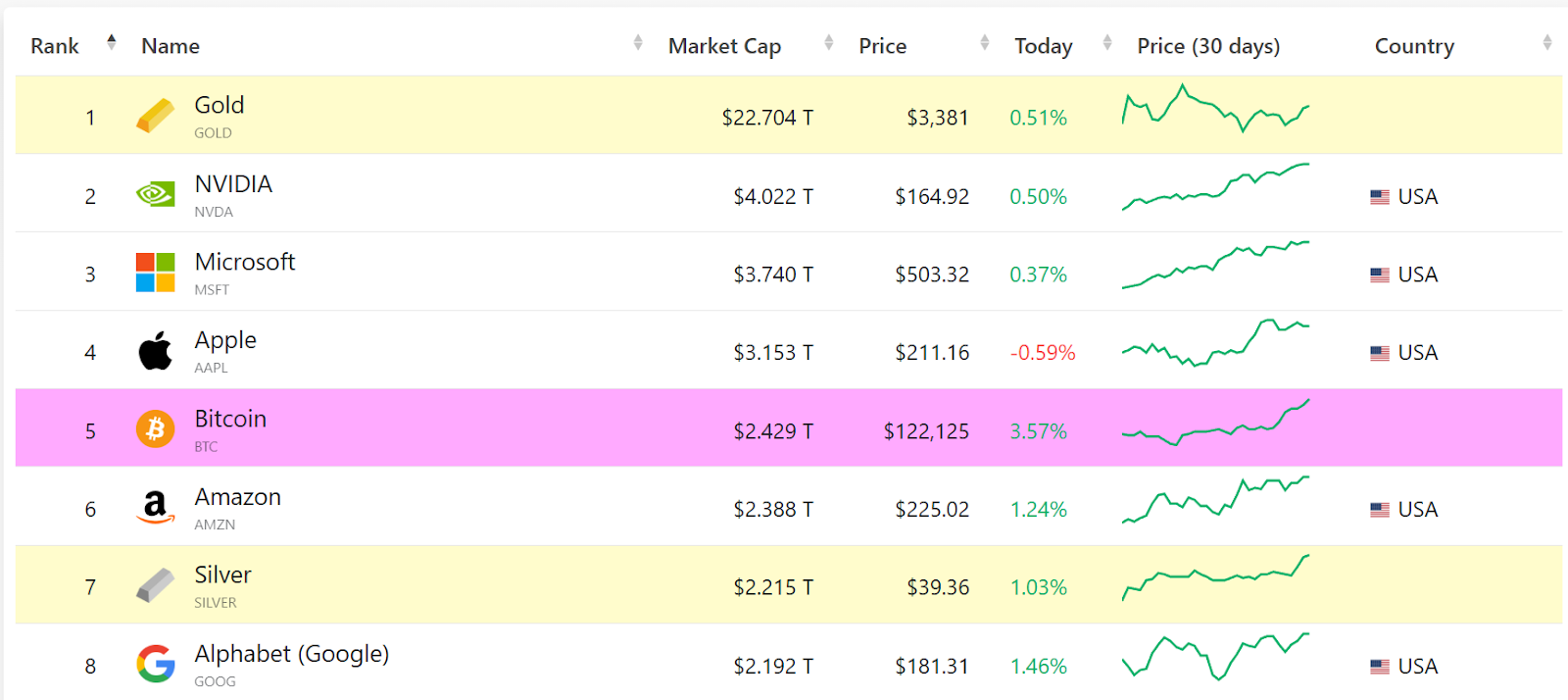

The cryptocurrency landscape witnessed a significant milestone this week as Bitcoin (BTC) flipped Amazon, surging to become the world’s fifth-largest asset by market capitalization. This remarkable feat, occurring during what’s been dubbed “Crypto Week,” underscores the growing prominence of Bitcoin within the global financial system. The event was punctuated by positive regulatory developments, further boosting investor confidence and driving the price of Bitcoin to unprecedented levels.

The Regulatory Tailwind

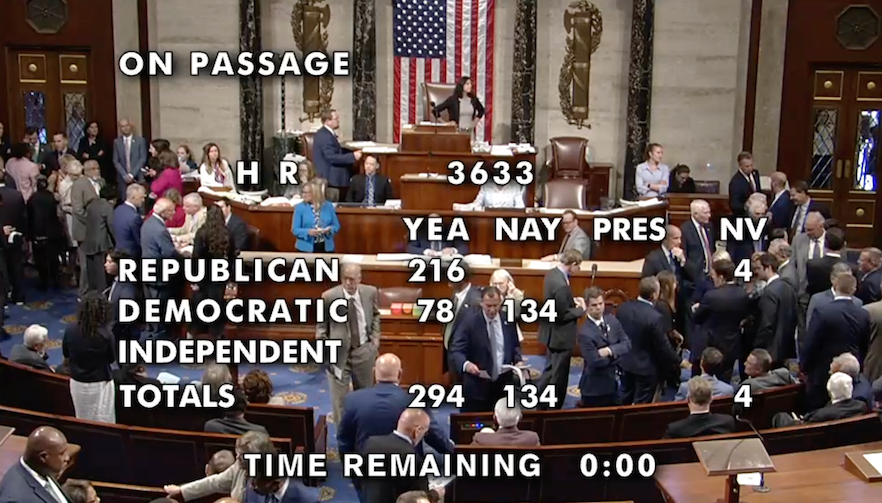

A primary catalyst for Bitcoin‘s recent success was the positive reception surrounding the US government’s “Crypto Week.” Lawmakers focused on passing several key regulatory bills aimed at providing clarity and structure for the Web3 industry. Three crucial bills were voted on, signaling a potential shift in the regulatory landscape. These included the Digital Asset Market Clarity (CLARITY) Act, the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, and the Anti-CBDC Surveillance State Act. The GENIUS Act, in particular, is seen as pivotal in legitimizing stablecoins for wider adoption.

Flipping Amazon: A Market Cap Milestone

Bitcoin‘s price experienced a significant surge, allowing it to surpass Amazon‘s $2.3 trillion market cap. This achievement places Bitcoin ahead of established tech giants, solidifying its position among the world’s most valuable assets. According to data, Bitcoin’s market capitalization reached over $2.4 trillion, surpassing other tech and financial titans like Silver and Alphabet. This monumental shift reflects the growing recognition of Bitcoin as a legitimate asset class and a potential hedge against traditional market volatility.

Institutional Interest and Future Prospects

Industry experts believe that continued institutional accumulation and the supportive macro environment could propel Bitcoin even further. The involvement of institutional players, such as BlackRock and MicroStrategy, is seen as a key driver, with the legitimacy of Bitcoin as an investment asset no longer in question. This shift highlights a growing acceptance of digital assets by major financial players and the potential for further price appreciation. One analyst even suggested a potential price exceeding $142,000 if Bitcoin were to surpass Apple’s valuation.

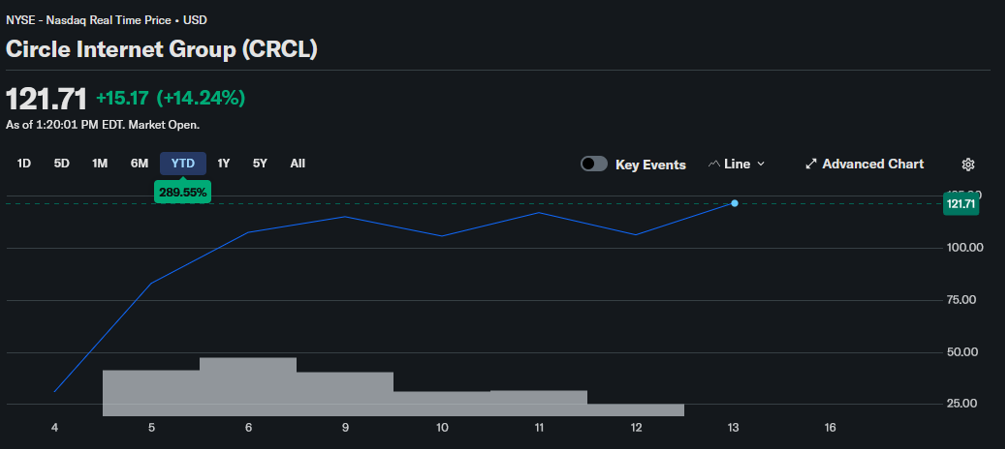

Grayscale‘s IPO and Crypto’s Maturation

Adding to the bullish sentiment, Grayscale, a prominent cryptocurrency-focused asset manager, filed for a confidential IPO. This move, which could potentially unlock new funding avenues, reflects the increasing maturity of the crypto industry and its integration with traditional financial markets. Circle’s successful IPO also points to a possible resurgence of initial public offerings from crypto companies, potentially leading to further growth.

Conclusion: Bitcoin‘s Ongoing Evolution

Bitcoin‘s ascent to the fifth-largest global asset marks a significant moment in its history. Fueled by positive regulatory developments and growing institutional interest, the cryptocurrency continues to evolve and challenge traditional financial norms. This recent surge underscores the potential of Bitcoin to reshape the global financial landscape.