Major Institutional Push: Ether Machine’s $1.5 Billion ETH Fund

The digital asset landscape is witnessing a significant influx of institutional capital, and Ethereum (ETH) is at the forefront. A new player, Ether Machine, is poised to launch what it’s calling the largest yield-bearing Ether fund specifically designed for institutional investors. This ambitious initiative, valued at over $1.5 billion, aims to provide institutional-grade exposure to the Ethereum infrastructure and its yield potential. The vehicle is a publicly traded offering that will be listed on Nasdaq under the ticker symbol “ETHM.” The founders, veterans of the crypto space with strong backgrounds in Consensys, are betting big on the future of ETH.

Why Now? Analyzing the Drivers of Institutional Interest

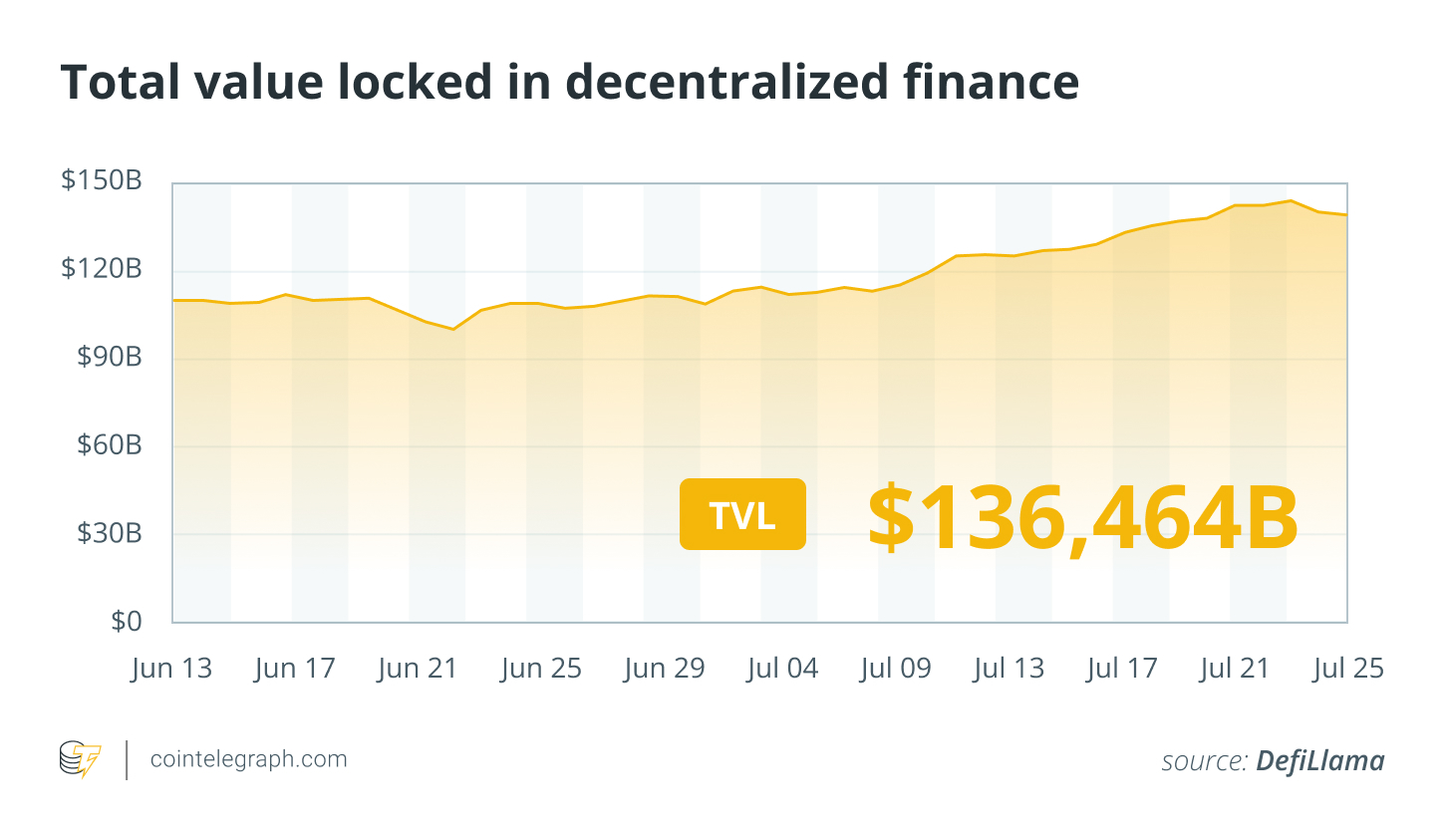

The timing of Ether Machine’s launch is crucial. Industry analysts point to a confluence of factors driving institutional interest. One significant influence may be the recent passage of the GENIUS Act, which effectively curtails the issuance of yield-bearing stablecoins in the US. Some experts suggest this could increase demand for ETH and decentralized finance (DeFi) protocols built on Ethereum. Furthermore, the ongoing maturation of the cryptocurrency market and increased regulatory clarity are contributing to a more welcoming environment for institutional players. This fund launch is a clear indication that the market perceives a real opportunity for institutional capital allocation to the Ethereum ecosystem.

The Fund’s Strategy and Potential Impact

Ether Machine plans to hold a substantial ETH position – over 400,000 ETH at launch. This significant holding will position the firm as a major player in the Ethereum ecosystem. The fund’s stated goal is to contribute to the economic security of Ethereum. This institutional commitment could have a ripple effect, potentially boosting on-chain activity and furthering the development of DeFi applications. By attracting substantial capital, Ether Machine could help to validate and strengthen the Ethereum network, leading to increased liquidity, innovation, and adoption. The team is also planning to make the fund’s structure as accessible as possible, allowing for ease of entry and exit for institutional investors.

Beyond the Fund: A Broader Market Context

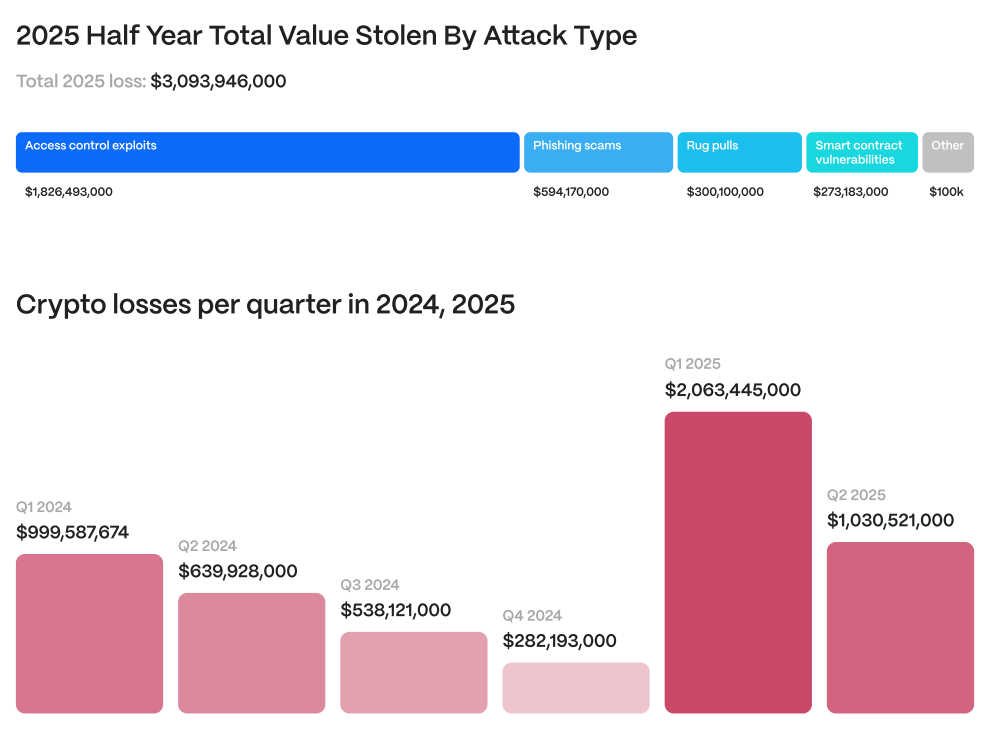

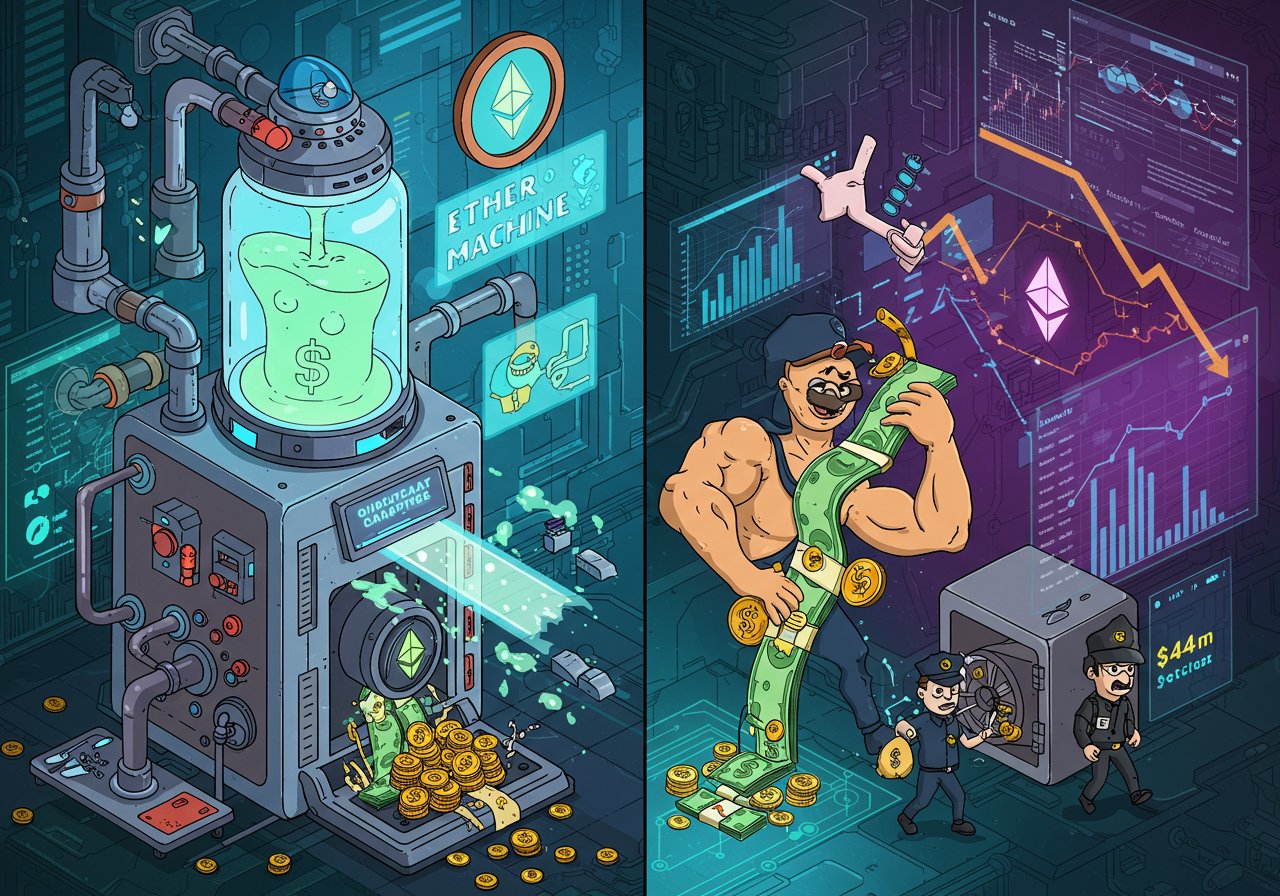

This news comes amid other noteworthy developments in the crypto space. Strategy, led by Michael Saylor, is launching a new stock offering to purchase more Bitcoin, demonstrating continued institutional interest in the digital asset space. Also, blockchain compliance tools are gaining traction as a way to reduce costs and streamline processes. Unfortunately, the broader crypto sector continues to grapple with security challenges; over $3.1 billion in crypto was lost in the first half of 2025 due to exploits and vulnerabilities. Furthermore, the Indian cryptocurrency exchange CoinDCX announced a recovery effort after a $44 million hack and is incentivizing white hat hackers to help recover funds. The success of Ether Machine and the larger market trends underscore the evolving dynamics of the cryptocurrency market. The growing institutional presence is reshaping the landscape, creating both opportunities and challenges for the entire industry.