US Treasury Eyes DeFi ID Integration: A Brave New World?

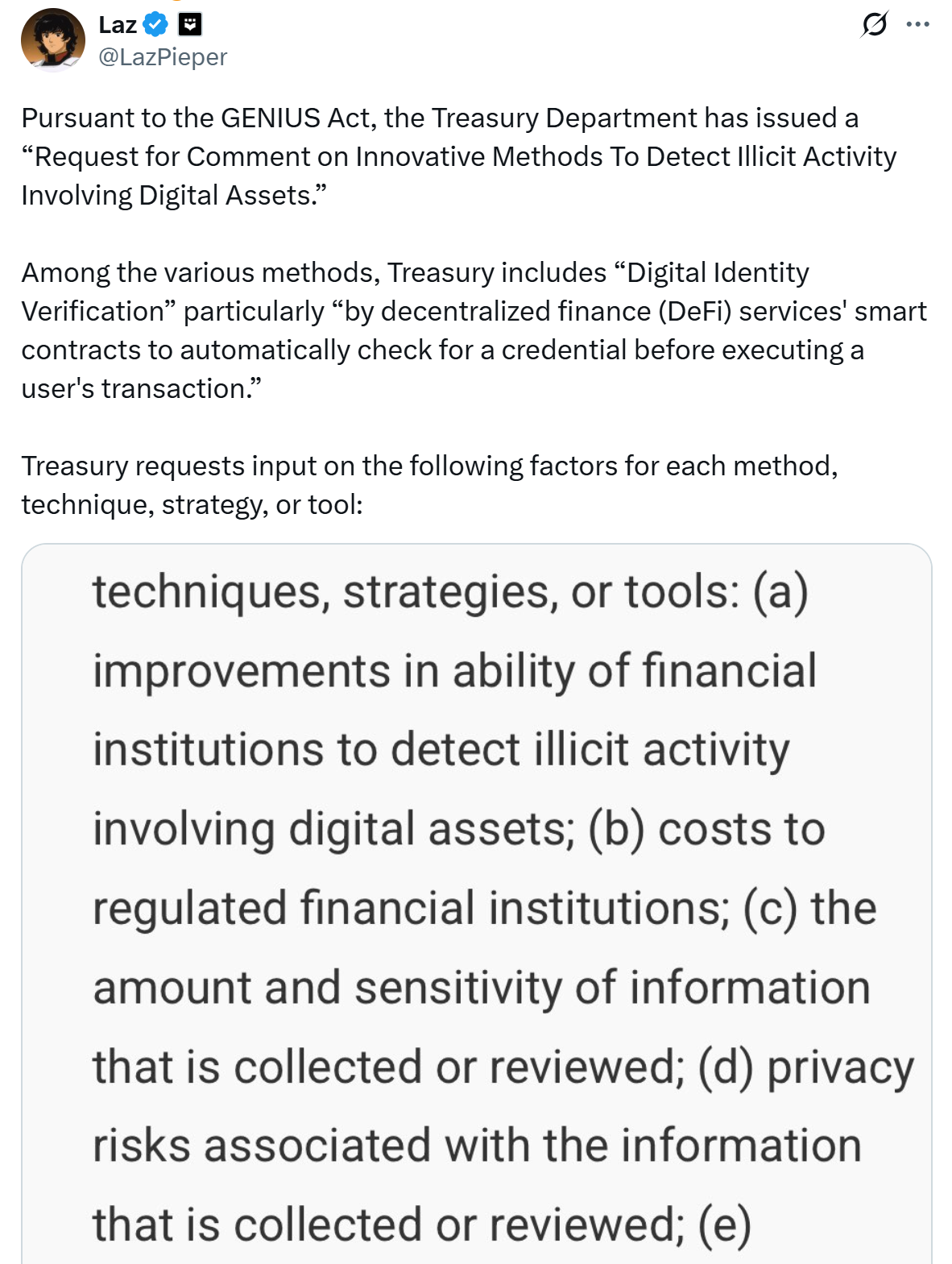

The US Treasury‘s recent exploration into embedding identity verification directly into decentralized finance (DeFi) smart contracts has ignited a heated debate. The proposal, born from the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act), aims to enhance compliance within crypto markets. However, the implications are far-reaching, sparking concerns about privacy, censorship, and the very ethos of DeFi.

The Promise of Compliance and the Allure of Control

Proponents of the initiative argue that integrating Know Your Customer (KYC) and Anti-Money Laundering (AML) checks into blockchain infrastructure could streamline regulatory compliance. This, they contend, would make it more difficult for criminals to exploit DeFi platforms for illicit activities. SmartSearch’s Chief Product Officer, Laz Fraser Mitchell, suggests that these tools could “unmask the anonymous transactions that make these networks so attractive to criminals.” This, in turn, could potentially make it easier to mitigate risks and prevent the proceeds from serious crimes from flowing through DeFi.

The Spectre of Surveillance and the Erosion of Privacy

Critics, however, are sounding the alarm, arguing that the proposal fundamentally undermines DeFi‘s core principles. Mamadou Kwidjim Toure, CEO of Ubuntu Tribe, famously likened the plan to “putting cameras in every living room.” The core issue is the potential loss of pseudonymity. Linking biometric or government IDs to blockchain wallets could make every transaction permanently traceable. This raises the specter of governments censoring transactions, blacklisting wallets, and even automating tax collection directly through smart contracts, effectively transforming permissionless infrastructure into a surveilled landscape.

Exclusion and the Digital Divide: Who Gets Left Behind?

Beyond privacy concerns, the proposed identity checks could exacerbate the existing digital divide. Billions worldwide lack formal identification. Mandating government-issued credentials could lock out entire communities, including migrants, refugees, and the unbanked, thereby limiting DeFi‘s democratic nature. This creates a stark contrast between the promise of financial freedom and the reality of exclusion.

Data Security: A High-Stakes Game

Another significant concern is the security of sensitive data. Linking biometric databases to financial activity could create catastrophic vulnerabilities. A single breach could expose both financial holdings and personal identities, making the stakes of a hack exponentially higher. The potential for mass surveillance raises serious questions about how personal data is handled.

Seeking Alternatives: Privacy-Preserving Solutions

The debate isn’t a binary choice between criminal havens and mass surveillance. Privacy-preserving tools, such as zero-knowledge proofs (ZKPs) and decentralized identity (DID) standards, offer potential middle grounds. ZKPs allow users to prove eligibility without revealing their full identity, while DIDs enable selective disclosure of verifiable credentials. As Toure suggests, “Instead of static government IDs, users hold verifiable credentials they selectively disclose.” The focus should remain on promoting safety while safeguarding fundamental rights.