Bitcoin‘s Rally: A Resurgence Above $112,000

The world of Bitcoin is abuzz as the cryptocurrency claws its way back above the $112,000 mark. This price action, occurring on Friday, has injected a surge of optimism into the market, with analysts and traders alike closely monitoring key support and resistance levels. The move is particularly noteworthy considering the anticipation surrounding the upcoming US jobs report, which is poised to influence market sentiment and potentially trigger further volatility.

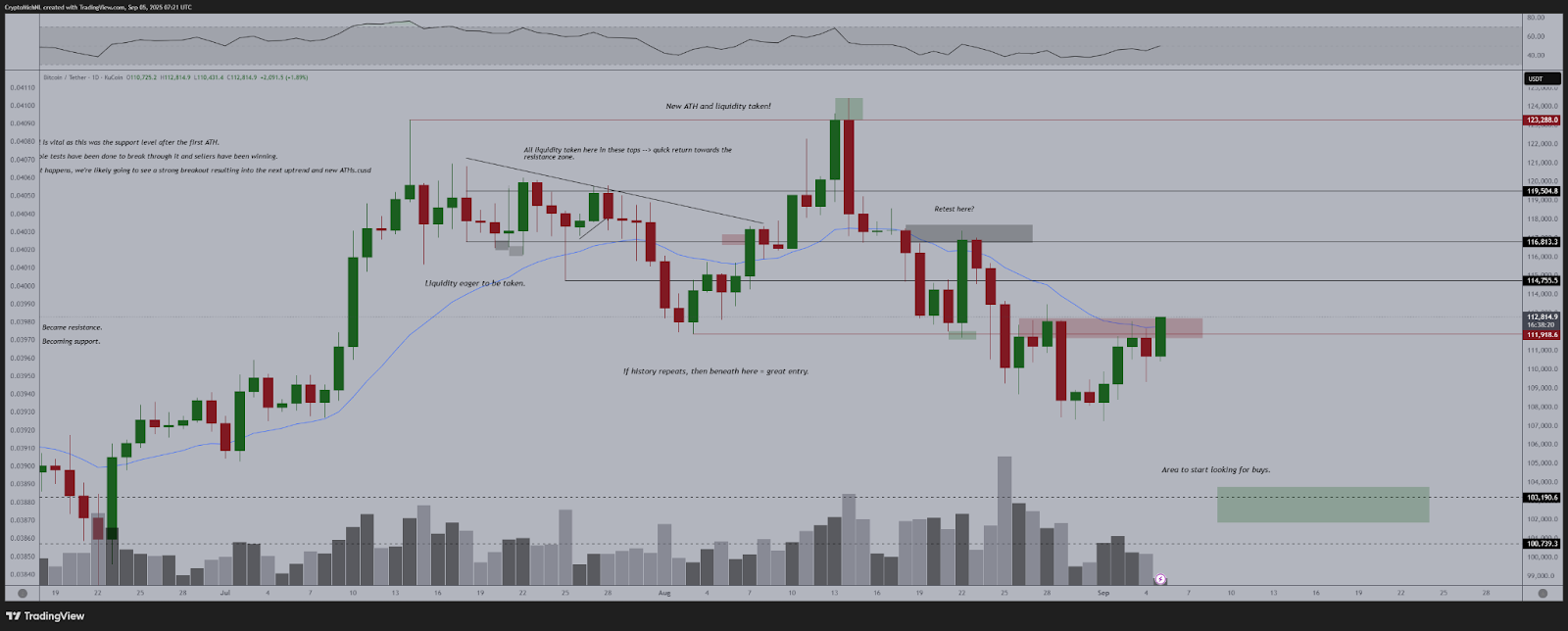

Key Resistance and Potential for a ‘Massive’ Move

The focus for Bitcoin bulls now shifts to consolidating above $112,000, a level that analysts see as a crucial indicator of sustained upward momentum. Data from sources like Cointelegraph Markets Pro and TradingView highlight the importance of flipping key resistance into support. Should Bitcoin successfully maintain its position above this threshold, it could signal a ‘massive long opportunity’, as described by MN Capital founder Michael van de Poppe. The $113,000 level is another significant hurdle, as reclaiming this area could fully confirm the breakout, according to trader Rekt Capital.

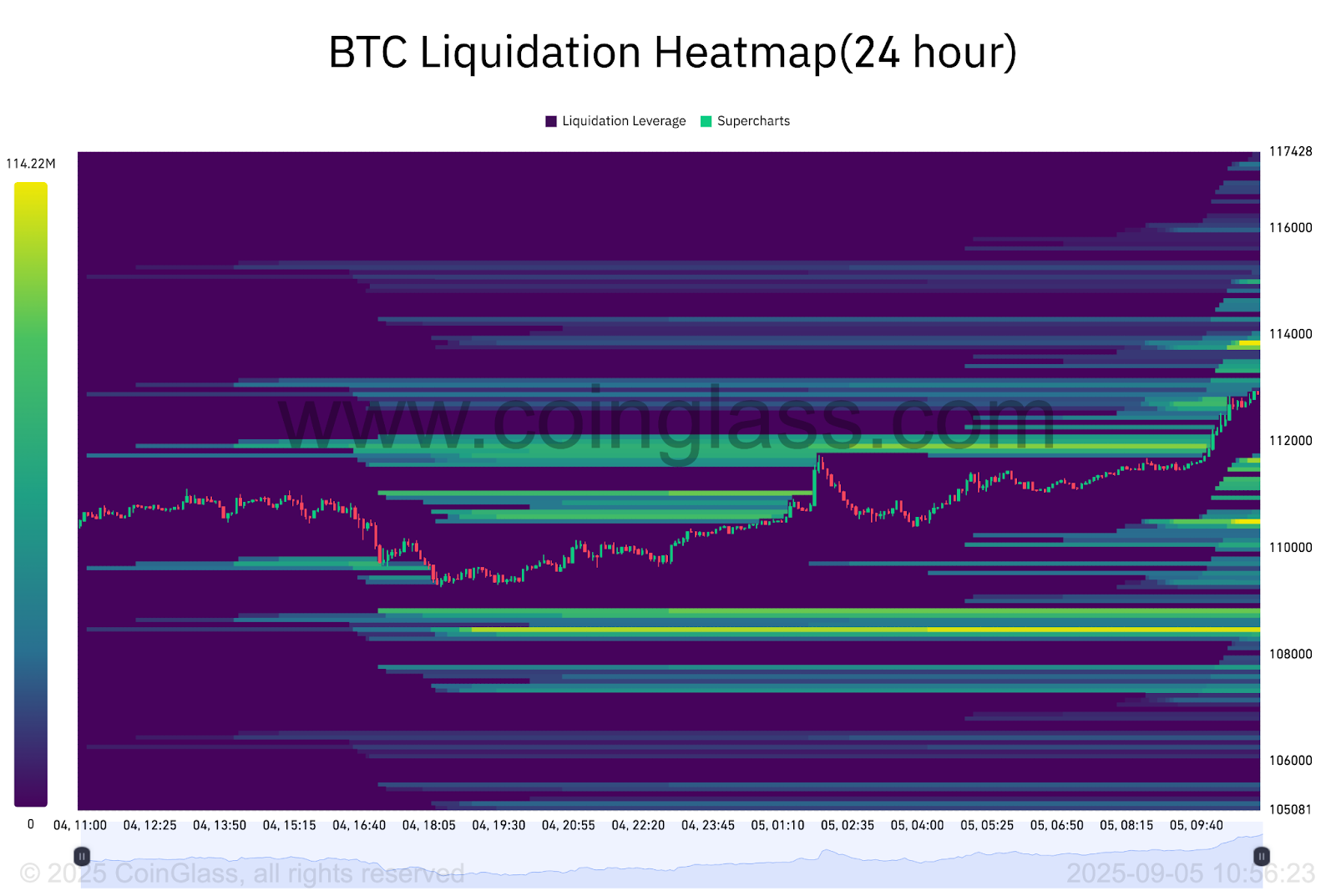

Shorts Liquidated: A Sign of Bullish Dominance?

Accompanying Bitcoin‘s price surge has been a notable liquidation of short positions. Within a single hour, a substantial $14.32 million worth of short positions were wiped out. This dynamic further fuels the bullish narrative, as highlighted by analyst Skew, who noted the rotation out of shorts into longs, particularly ahead of the crucial US jobs report. The ability of the price to ‘bounce off decent bid depth’ demonstrates the existing market demand, bolstering the confidence of buyers.

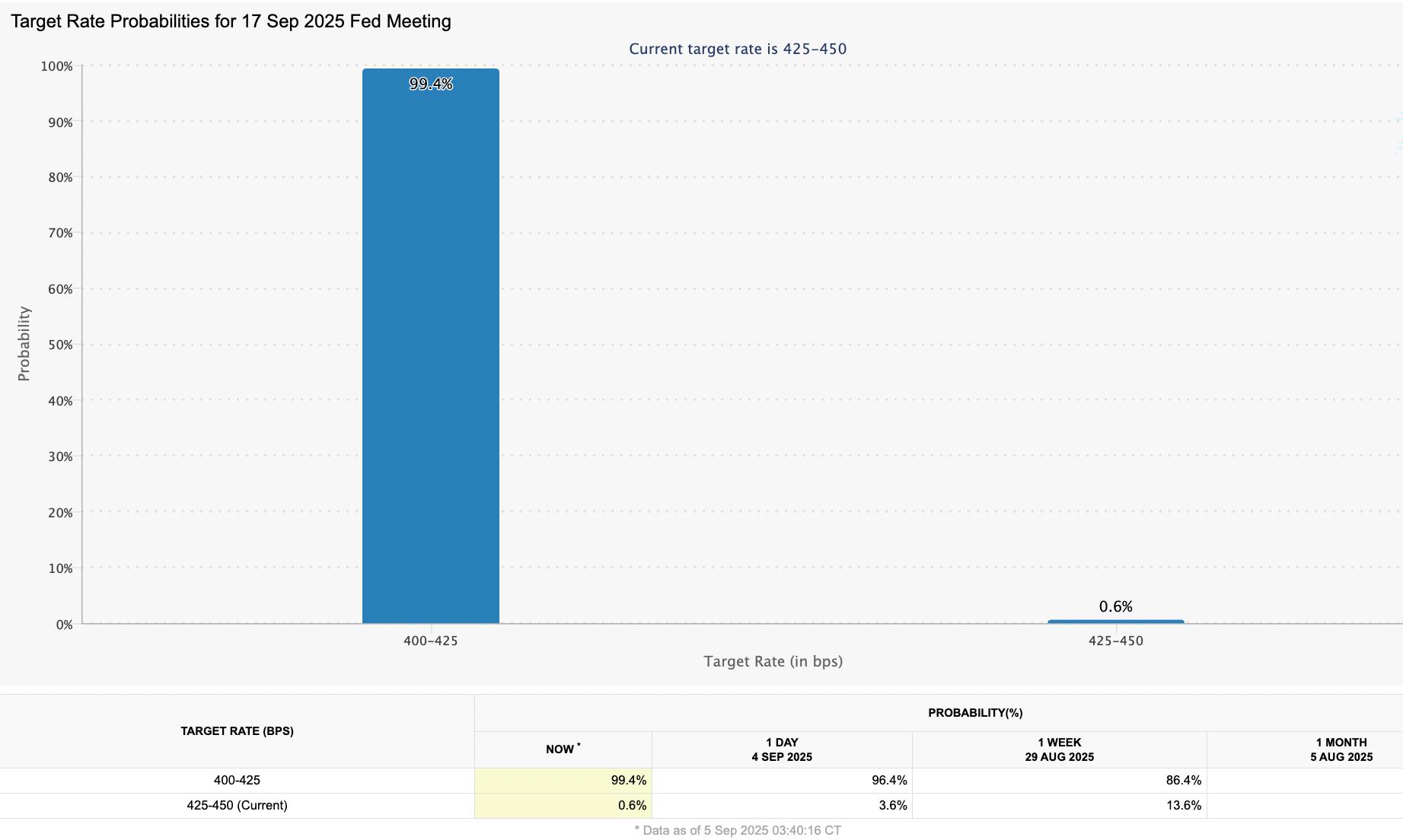

US Jobs Report and the Federal Reserve’s Influence

The impending release of the US jobs report adds a layer of complexity to the Bitcoin market. A weaker-than-expected report could accelerate expectations for Federal Reserve rate cuts. The market has already priced in a near certainty of a rate cut in September. Capital markets commentators, such as The Kobeissi Letter, are predicting a potentially ‘collapsing labor market’. Such a scenario might incentivize the Fed to cut rates, providing additional support for risk-on assets like Bitcoin.

Market Sentiment and Strategic Implications

The current market sentiment reflects a blend of cautious optimism and strategic positioning. Traders are actively adjusting their positions in anticipation of the US jobs report. The potential for rate cuts, coupled with the current price action, suggests a favorable environment for Bitcoin. However, the inherent volatility of the cryptocurrency market means that traders must remain vigilant and conduct thorough research before making investment decisions. The ability of Bitcoin to sustain its gains above $112,000 and conquer the immediate resistance levels will be pivotal in determining the short-term trajectory of the market.