The Fed‘s Rate Cut Fuels Bitcoin, But Global Landscape Remains Complex

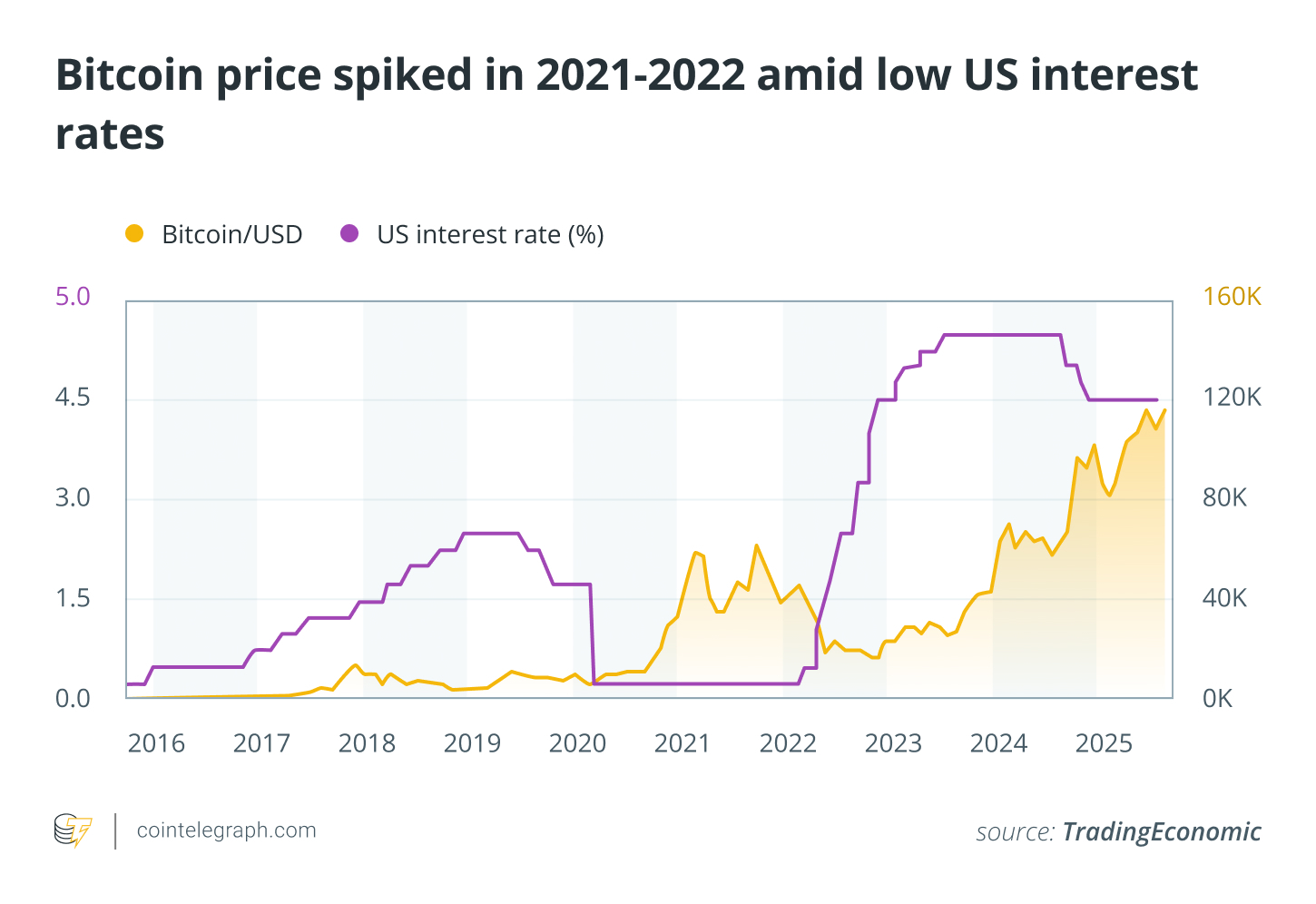

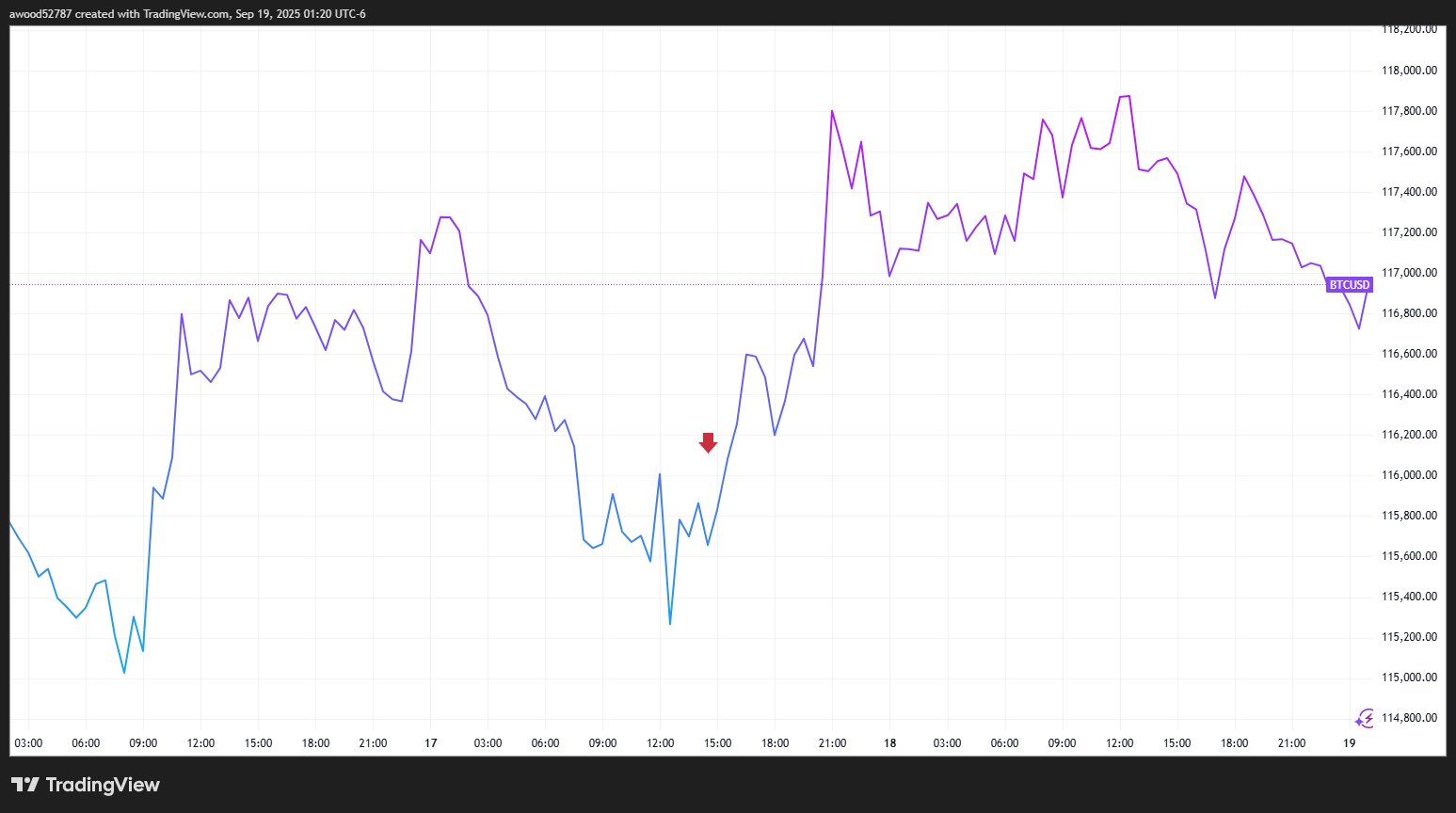

The cryptocurrency market experienced a surge in response to the US Federal Reserve’s recent interest rate cut, the first since late 2024. This decision, lowering the short-term rate, has been interpreted by many as a bullish signal for Bitcoin (BTC) and the broader crypto space. The expectation is that lower borrowing costs will infuse liquidity into the market, historically a catalyst for price appreciation. However, the global picture paints a more intricate narrative, with differing responses and emerging regulatory hurdles.

France‘s Regulatory Gambit: A Challenge to EU Crypto Harmonization

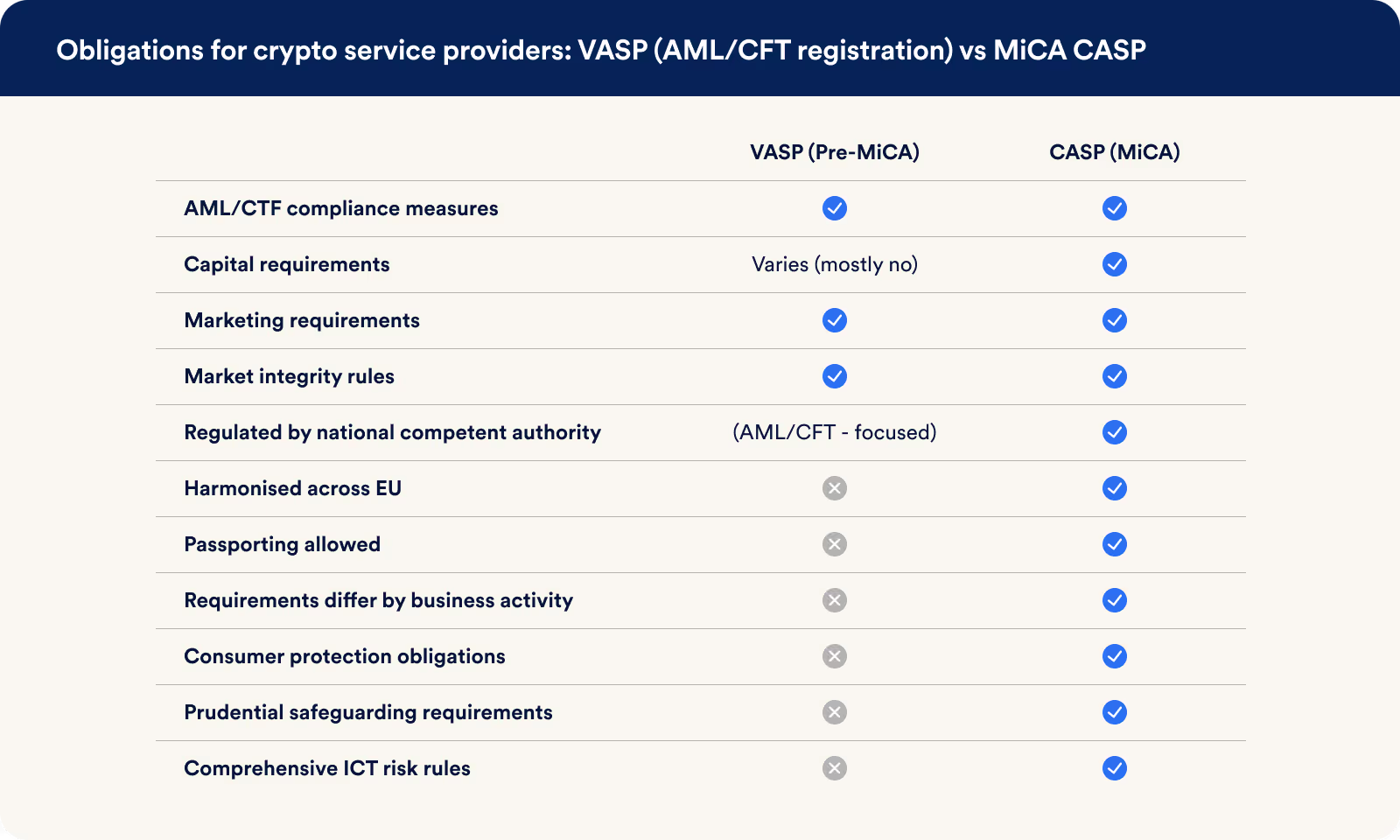

While the US embraced monetary easing, France is signaling a more hawkish stance on crypto regulation. The French Autorité des Marchés Financiers (AMF) is expressing concerns regarding the implementation of the Market in Crypto-Assets (MiCA) law, the EU’s flagship crypto legislation. Specifically, France is worried about regulatory arbitrage, where crypto companies seek licenses in jurisdictions with more lenient requirements and then operate across the EU. This could undermine the core principle of MiCA, which aims to harmonize crypto regulations across member states. The AMF’s stance raises questions about the long-term viability of the EU’s unified approach to crypto and could foreshadow increased scrutiny of companies operating under licenses issued in other member states.

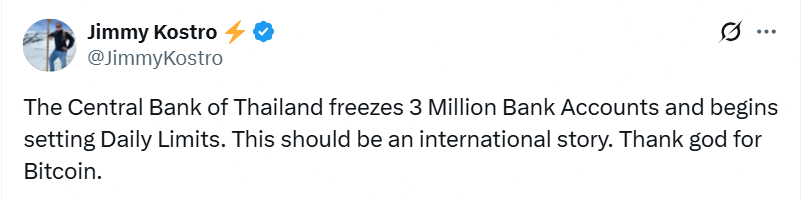

Thailand‘s Bank Account Freeze: A Parallel Narrative

Adding to the complexity, Thailand witnessed a significant disruption in its financial ecosystem. A nationwide crackdown on scams led to the freezing of millions of bank accounts, impacting both alleged wrongdoers and innocent citizens. This situation unexpectedly drew attention to Bitcoin as a potential alternative, though the use of crypto for payments remains illegal in Thailand outside a tourism-focused sandbox. The episode highlights the potential for crypto to offer resilience against government actions, yet underscores the regulatory limitations in some jurisdictions.

Australia’s Stablecoin Adjustment: A Positive Sign

In contrast to France‘s stricter approach, Australia’s Securities and Investments Commission (ASIC) is easing regulations related to stablecoin distribution. The agency has created an exemption for entities distributing stablecoins issued by Australian financial services (AFS) licensees, streamlining the process and potentially fostering innovation in the digital asset space. This move is a positive sign for the local market and reflects an effort to balance consumer protection with the development of the digital asset sector.

Pakistan Opens Doors to Crypto

Pakistan is actively courting the crypto sector through its Virtual Asset Regulatory Authority (PVARA). The authority is soliciting Expressions of Interest from major crypto companies, signaling a desire to establish a transparent and inclusive digital financial environment. With a high adoption rate globally, Pakistan’s approach has the potential to accelerate the growth of the crypto sector in the region and could become a hub.

Market Outlook

The diverse range of events, from the US Fed‘s rate cut to France‘s regulatory concerns, highlights the evolving landscape of crypto. While the Fed‘s actions may provide short-term gains, it’s crucial to remember the volatility, with the possibility of short-term pullbacks. The ongoing shifts in the regulatory and financial landscape highlight the dynamic nature of the crypto world, emphasizing the necessity for investors and industry participants to stay informed and adapt to the ever-changing environment.