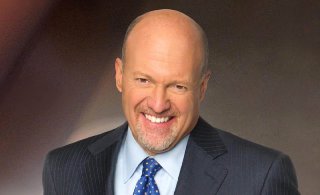

In a volatile market like today’s, it can be easy for investors to panic, but renowned financial analyst and television personality Jim Cramer has some words of advice to ease those concerns. Cramer reassures investors not to be alarmed by the recent market sell-off, emphasizing that this is part of the ebb and flow of financial markets.

Understanding Market Volatility

Cramer, the host of Mad Money on CNBC, has been through countless market fluctuations over the years, and he understands that sell-offs are inevitable. According to Cramer, the market can sometimes move unpredictably due to a variety of factors, including economic reports, geopolitical events, and changes in interest rates. He reminds investors that this is not uncommon, and that patience is often the key to navigating through turbulent times.

A Long-Term Perspective

Rather than focusing on short-term declines, Cramer advises investors to maintain a long-term perspective. “It’s critical to remember that stocks are best suited for long-term gains,” he said. “If you sell now out of fear, you could be locking in losses that could have been avoided if you had stayed the course.”

For Cramer, focusing on the fundamentals of strong, well-managed companies is essential. He urges investors to stick with stocks that have solid earnings, a clear business model, and a proven track record of growth. “Focus on quality companies,” he says, “especially those with strong cash flow and long-term growth potential.”

The Importance of Diversification

One of Cramer’s consistent pieces of advice is diversification. While market dips are stressful, they serve as an important reminder of the value of a diversified portfolio. “Don’t put all your eggs in one basket,” he advises. By spreading investments across various sectors and asset types, investors can mitigate risk and reduce the impact of any single downturn.

Looking for Opportunities

Despite the market sell-off, Cramer sees potential opportunities for investors who are willing to do their homework. He suggests looking for stocks that may have been unfairly punished in the downturn but have strong future potential. “Sometimes a market sell-off creates buying opportunities for savvy investors,” he notes.

Conclusion

While today’s market sell-off may seem alarming at first, Jim Cramer encourages investors to stay calm and stick to their investment strategy. By keeping a long-term outlook, focusing on quality stocks, diversifying portfolios, and searching for opportunities, investors can weather the storm and potentially come out stronger on the other side. As Cramer wisely puts it, “This too shall pass.”