Institutional Support for Ethena‘s Vision

The burgeoning world of decentralized finance (DeFi) has seen another significant vote of confidence, with M2 Capital, the investment arm of UAE-based M2 Holdings, committing a substantial $20 million to Ethena‘s governance token, ENA. This strategic move underscores the growing institutional interest in Ethena, a crypto-native protocol pioneering a synthetic dollar, USDe, on the Ethereum blockchain. The investment highlights the potential of protocols designed to offer yield-bearing assets and innovative financial instruments within the decentralized ecosystem.

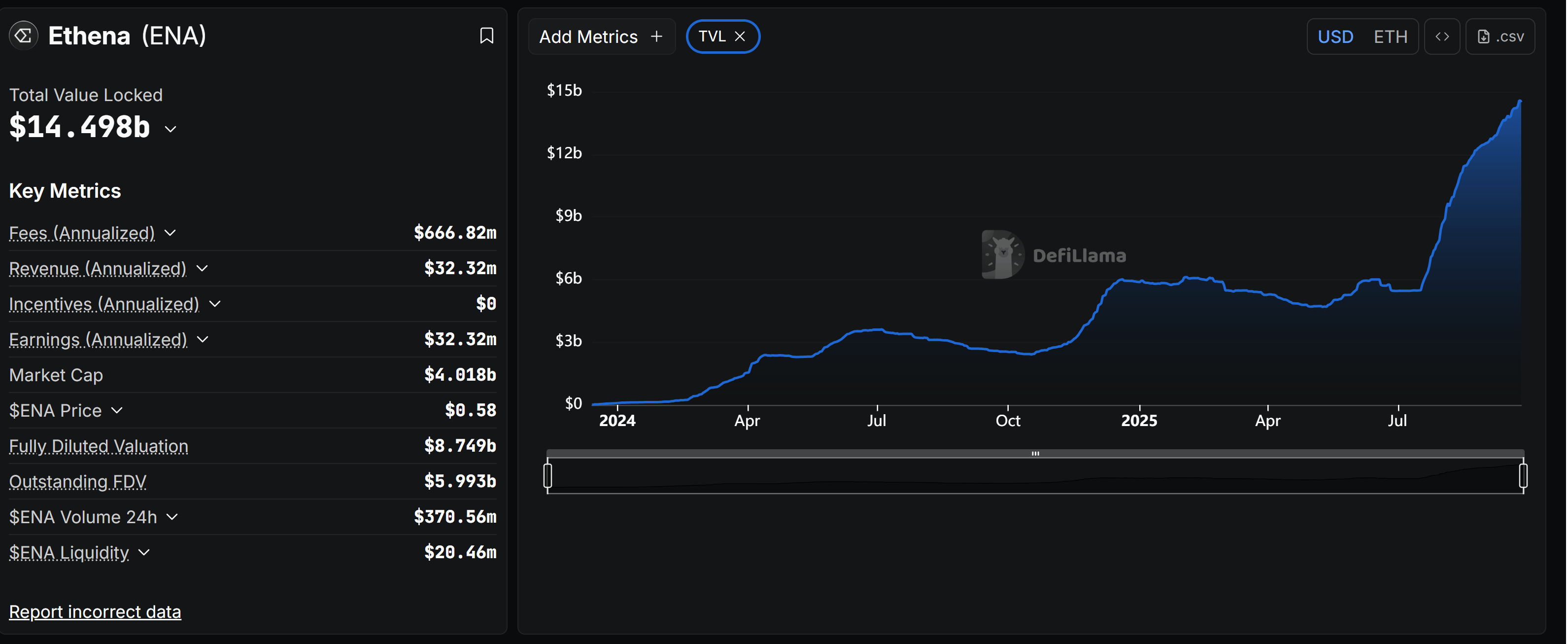

Ethena‘s Growth Trajectory and Strategic Partnerships

This influx of capital is particularly timely, given Ethena‘s impressive growth. The protocol’s total value locked (TVL) has surged, nearing $14.5 billion, demonstrating a strong user base and a robust demand for its offerings. Beyond the numbers, M2 Holdings, a conglomerate with extensive digital asset exposure, intends to integrate Ethena‘s products into client offerings through its affiliate, M2 Global Wealth Limited. This integration has the potential to significantly expand the reach and utility of Ethena‘s synthetic dollar within the institutional landscape. The announcement further solidifies Ethena‘s position within a growing list of M2’s strategic investments.

Understanding Ethena and USDe

Ethena‘s core offering revolves around its synthetic dollar, USDe, which aims to maintain price stability through a combination of crypto-backed collateral and delta-neutral hedging strategies. The protocol provides users with the opportunity to generate yield through sUSDe, a yield-bearing asset. It’s worth noting that sUSDe is currently offering an annual percentage yield (APY) of 6%, a reduction from its earlier figures. While still offering competitive returns, this shift underscores the dynamic nature of DeFi yields and the importance of constantly monitoring market conditions. The protocol’s approach, however, has gained significant traction, attracting over 811,000 users across 24 blockchain networks.

Broader Implications for DeFi and Stablecoins

This investment also highlights the increasing importance of stablecoins and yield-generating assets within the broader crypto ecosystem. The backing from M2 Capital further validates the demand for yield-generating stablecoin alternatives, especially as it comes on the heels of other significant moves in the stablecoin space. This move demonstrates the growing confidence of institutional investors in the potential of DeFi protocols like Ethena, capable of disrupting traditional financial markets.

Looking Ahead

The investment by M2 Capital is expected to further fuel Ethena‘s development and expansion, as they scale USDe. With the increasing attention of institutional investors and the ongoing growth of its user base, Ethena is well-positioned to become a major player in the synthetic dollar market. It will be interesting to see how Ethena leverages this investment to further innovate and solidify its position within the increasingly complex and competitive landscape of DeFi.