Metaplanet‘s Bitcoin Bonanza: A New Corporate Titan Emerges

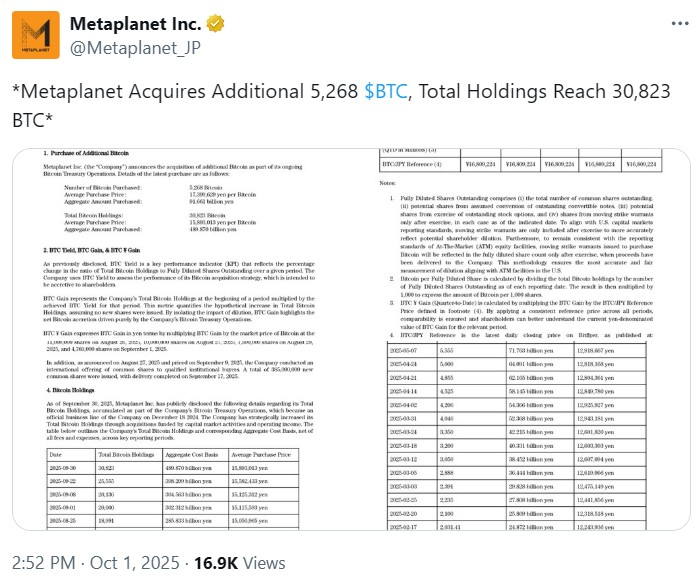

In a move that’s reverberating across the Bitcoin landscape, Japanese investment firm Metaplanet has significantly bolstered its Bitcoin holdings, catapulting itself into the ranks of the largest corporate Bitcoin holders globally. The company’s recent acquisition of 5,268 Bitcoin, valued at roughly $600 million, has not only expanded its portfolio but also elevated its position within the Bitcoin-holding hierarchy.

Climbing the Corporate Ladder: Metaplanet‘s Ascent

This latest purchase brings Metaplanet‘s total Bitcoin holdings to an impressive 30,823 BTC, solidifying its position as the fourth-largest corporate Bitcoin holder, surpassing even prominent entities like the Bitcoin Standard Treasury Company. This rapid ascent underscores Metaplanet‘s commitment to Bitcoin as a core component of its investment strategy. The aggressive accumulation strategy has clearly paid off, with the company already seeing an unrealized profit of over 7.5% on its Bitcoin holdings, a testament to the asset’s performance and Metaplanet‘s well-timed entries into the market.

Strategic Timing and Aggressive Accumulation

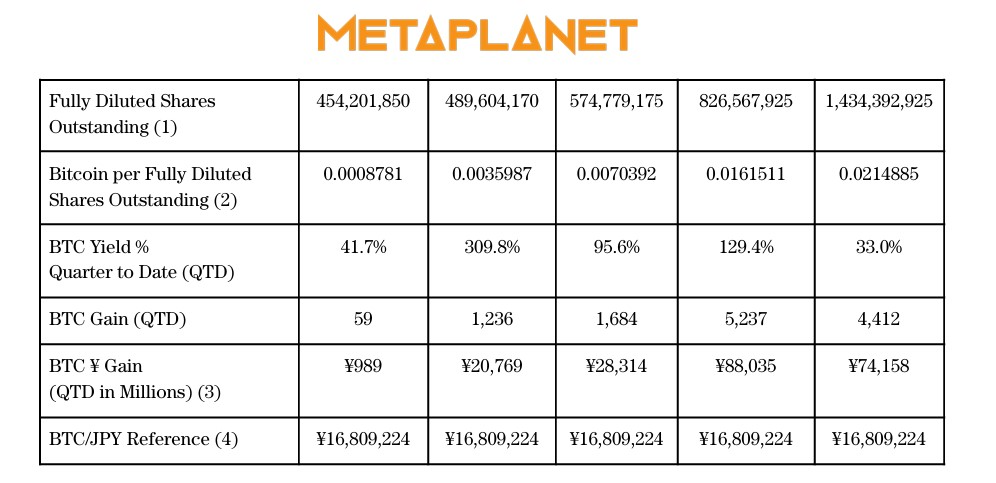

Metaplanet‘s strategy isn’t merely about accumulating Bitcoin; it’s also about timing. The company’s average purchase price for the recent tranche was approximately $116,000 per Bitcoin, and its total holdings are currently valued at $3.6 billion, acquired at an average price of around $108,000 per coin. This indicates a calculated approach, potentially leveraging market dips to maximize Bitcoin acquisition. Metaplanet‘s BTC Yield, a metric tracking the ratio of total Bitcoin holdings to fully diluted shares, soared to over 300% in late 2024, showing how quickly they accumulated Bitcoin relative to their share dilution.

The Broader Implications for Bitcoin and Beyond

Metaplanet‘s actions reflect a growing trend of institutional adoption of Bitcoin. Public companies now collectively hold over 1 million Bitcoin, representing approximately 4.7% of the asset’s total supply. This corporate interest, combined with the growing popularity of Bitcoin ETFs and governmental adoption, paints a picture of increasing mainstream acceptance. Moreover, the rise of altcoin-based treasuries, such as those holding Ether and Solana, indicates diversification within the digital asset space, with institutions exploring various blockchain technologies. This suggests a more mature and nuanced investment landscape.

Looking Ahead: What Does This Mean?

Metaplanet‘s commitment suggests a long-term bullish outlook on Bitcoin. As more institutions follow suit, the demand for Bitcoin could increase, potentially driving its price further. This could also foster increased liquidity and stability in the market. This move could also influence other firms to diversify their treasury holdings. Ultimately, Metaplanet‘s Bitcoin play is a clear signal of growing confidence in the future of digital assets and a shift in how companies approach their balance sheets.