Senate Gears Up to Examine Crypto Taxation

The world of digital assets is once again under the congressional microscope. The US Senate Finance Committee is preparing to hold a hearing on cryptocurrency taxation, a move that underscores the increasing importance of this nascent asset class within the broader financial landscape. This comes on the heels of recent guidance from the Treasury Department and the Internal Revenue Service (IRS) aimed at providing some relief to corporations navigating the complex world of crypto taxation. This simultaneous focus highlights the government’s evolving stance, which balances the need for regulatory clarity with concerns over tax burdens and market stability.

IRS Offers Interim Tax Guidance: A Welcome Reprieve?

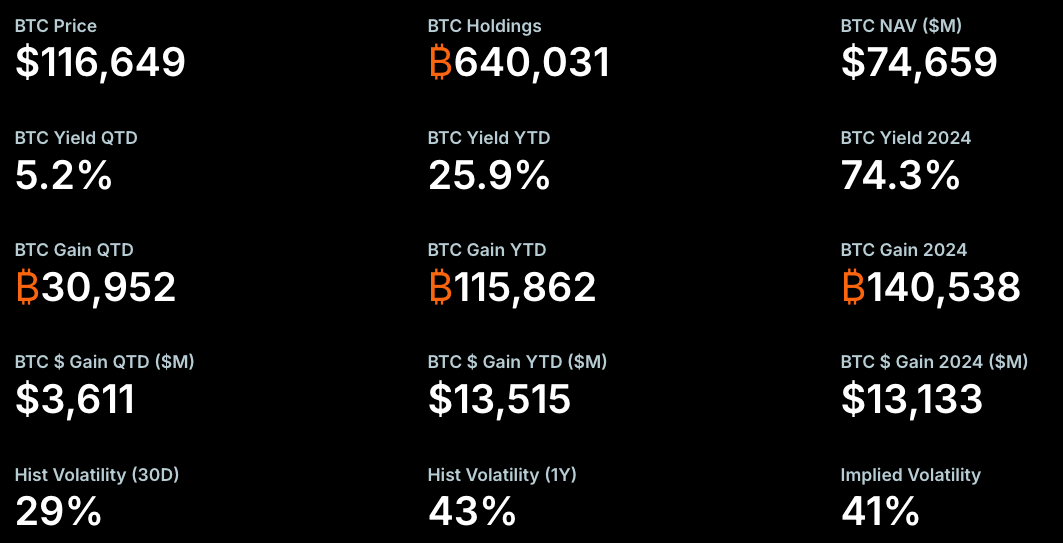

The IRS has issued interim guidance specifically addressing the application of the Corporate Alternative Minimum Tax (CAMT) to the digital asset sector. This guidance, detailed in Notice 2025-49, offers a degree of clarity and, crucially, relief for companies holding significant digital assets. The core of this relief comes in the form of allowing companies to exclude unrealized gains and losses on digital assets held as fair value assets when calculating their CAMT income. This is particularly significant for large corporate holders of Bitcoin and other cryptocurrencies.

Impact on Corporate Bitcoin Holders

This guidance has direct and tangible consequences for companies deeply invested in crypto. A prime example is MicroStrategy, led by Michael Saylor, which holds a massive amount of Bitcoin. Without this relief, companies like MicroStrategy could have faced substantial tax liabilities under CAMT. The new guidance offers a temporary reprieve, allowing these firms to manage their tax obligations more effectively while they navigate the volatile landscape of digital asset valuations.

The Senate’s Parallel Inquiry: A Broader Examination

Simultaneous to the IRS‘s guidance, the Senate Finance Committee’s hearing signals a deeper examination of crypto taxation. The hearing will delve into various aspects, potentially covering areas like the classification of digital assets, the taxation of staking rewards, and the treatment of decentralized finance (DeFi) activities. This parallel track indicates the government’s commitment to understanding and adapting to the rapidly evolving world of digital assets.

Key Players and Perspectives

The hearing will feature prominent figures within the crypto space, including representatives from Coinbase and Coin Center. Their participation ensures that the Senate receives diverse perspectives on the challenges and opportunities within the industry. The hearing is also likely to consider the recommendations of the White House Digital Asset Working Group, which advocated for clearer tax rules for digital assets, treating them as a distinct asset class, separate from securities and commodities.

Looking Ahead

The combination of the IRS guidance and the Senate hearing points to a dynamic period for crypto taxation. While the interim guidance provides short-term relief, the Senate’s deliberations will set the stage for future legislation and regulations. Investors and businesses in the digital asset sector will need to closely monitor these developments to understand the evolving tax landscape and adapt their strategies accordingly.