Bitcoin Faces Test: Analyzing the Recent Price Drop

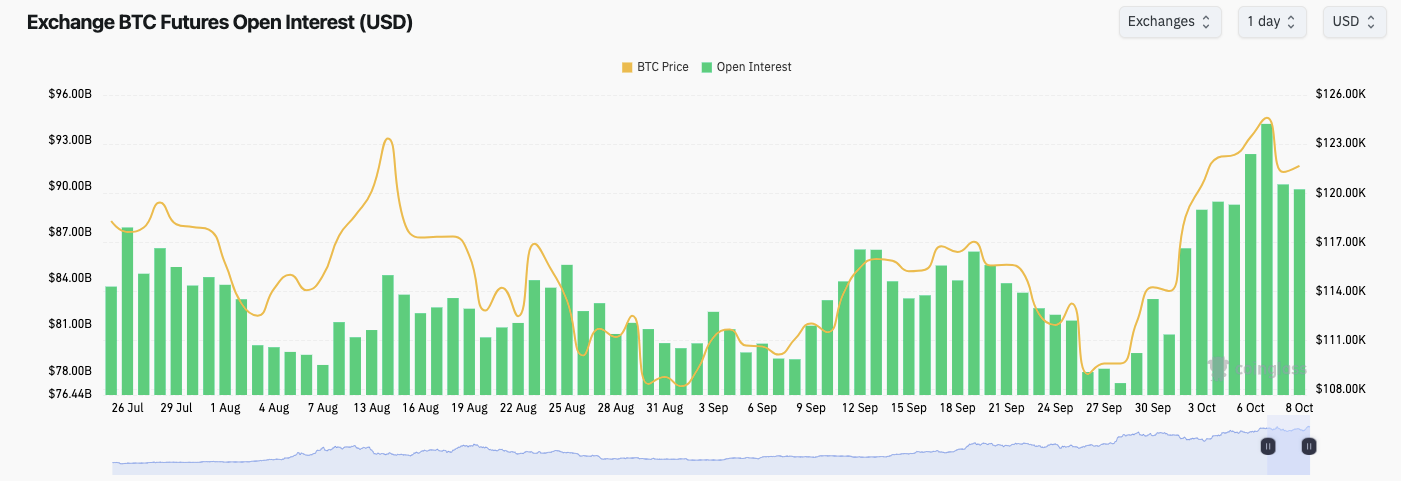

Bitcoin‘s recent surge to all-time highs has been followed by a swift correction, sparking concerns of a potential plunge, potentially reaching $114,000. The cryptocurrency market is currently navigating choppy waters, with key market participants scrutinizing the dynamics at play. The rapid shifts in price, coupled with increasing open interest in derivatives markets, suggest a period of heightened volatility. Traders are now dissecting the price action, analyzing potential support levels, and attempting to decipher the strategies of large-volume players.

‘Predatory’ Trading Tactics and Market Manipulation

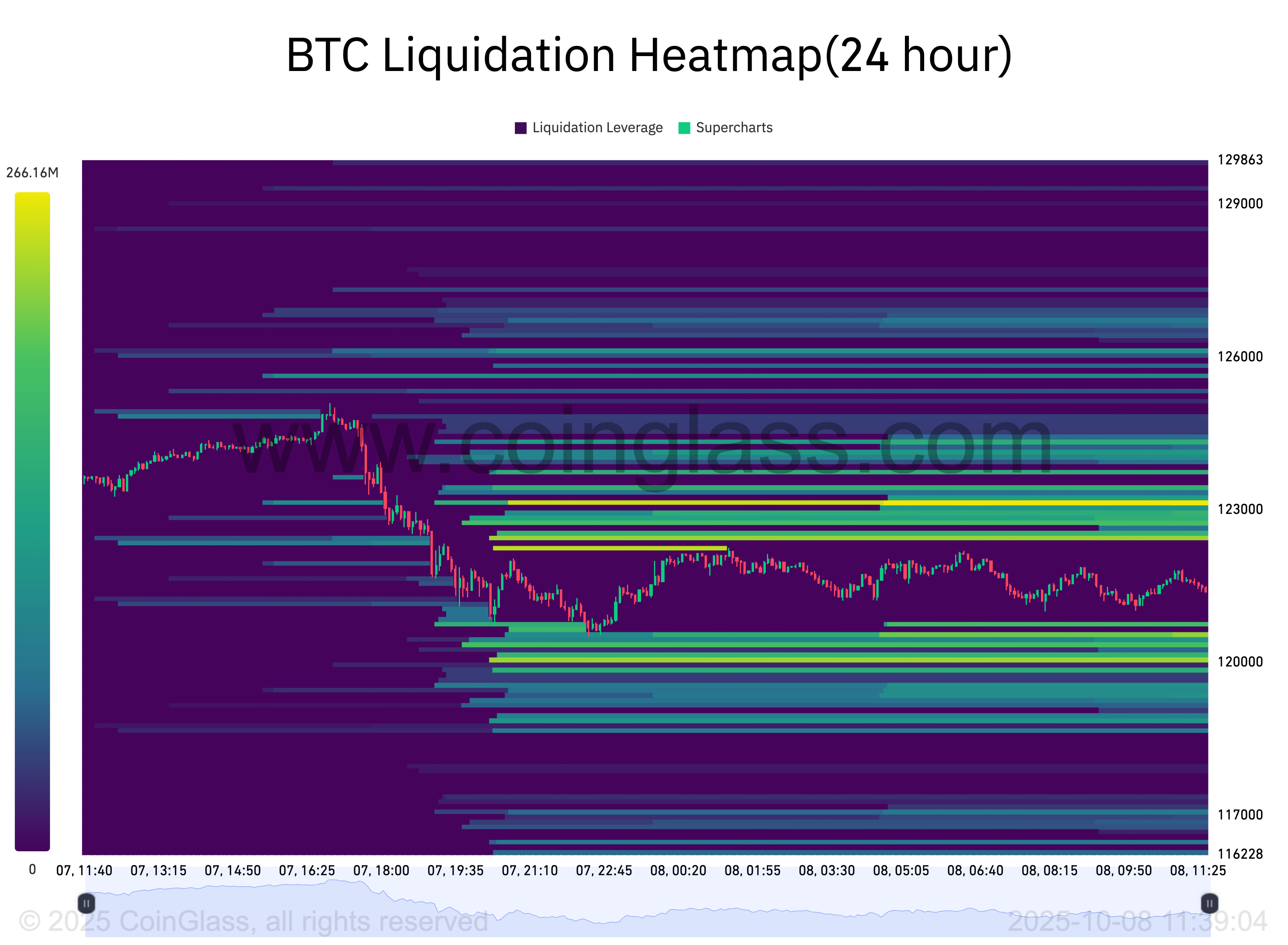

A significant factor contributing to the recent price movements is the alleged presence of ‘predatory’ trading tactics. Some analysts have pointed to market manipulation, including spoofing on order books, aimed at squeezing long positions. This involves artificially inflating or depressing prices to trigger liquidations and capitalize on market inefficiencies. This type of activity can exacerbate downward pressure, accelerating price declines and creating opportunities for strategic traders to accumulate Bitcoin at potentially lower prices. The implications of this alleged manipulation are substantial, underscoring the importance of understanding market dynamics beyond simple technical indicators.

Potential Support Levels and Key Price Zones

Analysts are closely monitoring potential support levels, with several key price zones coming into focus. A breakdown of support at $121,000 could potentially lead to a swift decline, given the lack of substantial support in that range. However, there are indications that a stronger floor might be forming around $117,000, where a significant cluster of recent buyers may be present. This area could act as a buffer against further price drops, as those buyers are likely to defend their positions. Further analysis points to the $114,000 level, which aligns with Bitcoin‘s 50-day simple moving average (SMA), and represents a key area of interest for potential dip buyers.

Volatility and the Role of Liquidity

The return of liquidity to the market adds another layer of complexity. After the initial sell-off, liquidity has begun to flow back in, with data showing increased bid-side and ask-side activity. This suggests that the market is potentially finding equilibrium, albeit within a potentially volatile range. The interplay of liquidity and trading activity is crucial for understanding Bitcoin’s short-term trajectory. The speed at which liquidity enters and exits the market can significantly impact price movements, creating opportunities for both bulls and bears.

Looking Ahead: Navigating the Bitcoin Landscape

For investors and traders alike, the current environment demands vigilance and a comprehensive understanding of market dynamics. Monitoring key support levels, analyzing open interest in derivatives, and being aware of potential manipulative tactics are essential. While the possibility of a dip to $114,000 exists, it’s critical to remember that Bitcoin’s long-term prospects remain a topic of extensive debate. The market’s response to the current volatility will shape the narrative going forward. It is recommended to conduct thorough research and due diligence before making any investment decisions.