Dogecoin‘s Resilience: A Deeper Dive into the Current Market Dynamics

The Dogecoin (DOGE) community appears to be weathering the storm after a recent market downturn. Data suggests that even amidst volatility, holders are accumulating the meme coin, potentially paving the way for a significant price surge in the coming years. This behavior warrants a deeper examination of the on-chain data, market sentiment, and technical analysis surrounding DOGE.

Accumulation Amidst Chaos

The recent price drop, which saw DOGE plunge and then recover, offered a stark reminder of the crypto market’s inherent volatility. However, rather than panic selling, on-chain metrics reveal a pattern of accumulation, particularly among short-term holders. This action suggests that investors believe in DOGE‘s long-term potential. One can infer that traders are viewing the dip as a buying opportunity, anticipating future gains.

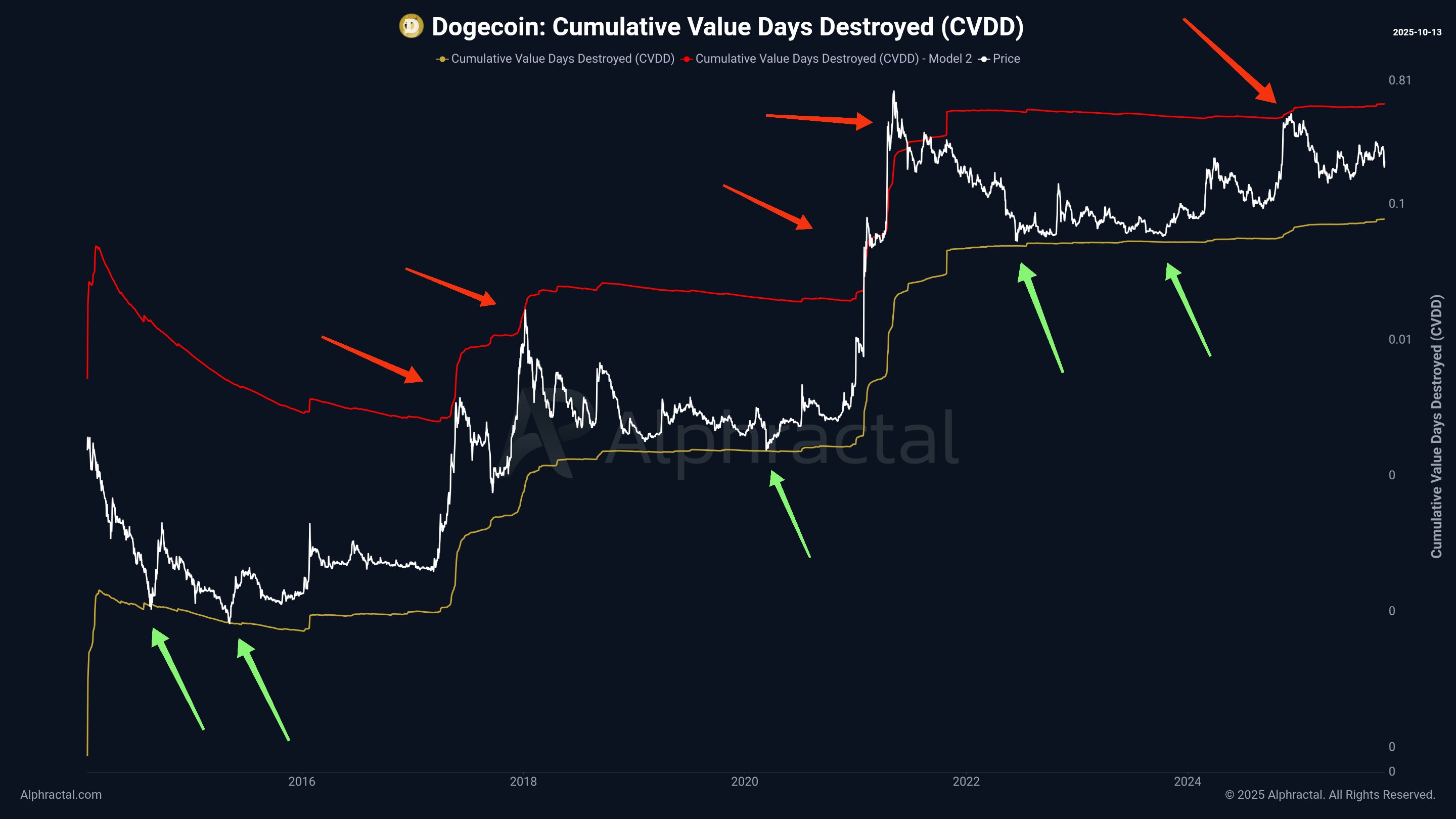

On-Chain Indicators and Cycle Analysis

Several on-chain indicators are reinforcing the bullish narrative. The ‘Hodl Waves‘ data is showing an increasing share of DOGE supply held by investors with up to six months of coin age, which indicates the inflow of new capital into the market and increased confidence. Moreover, the MVRV Z-Score remains significantly below levels observed during the 2021 euphoria. This data point suggests that the market is still in an early expansion phase, and there’s ample room for further growth. Additionally, the Cumulative Value Days Destroyed (CVDD) Alpha metric has historically pinpointed cycle peaks and bottoms for DOGE, adding a layer of credibility to the current bullish outlook. According to several analysts, we are not in an environment characterized by irrational exuberance, suggesting further upside potential for the meme coin.

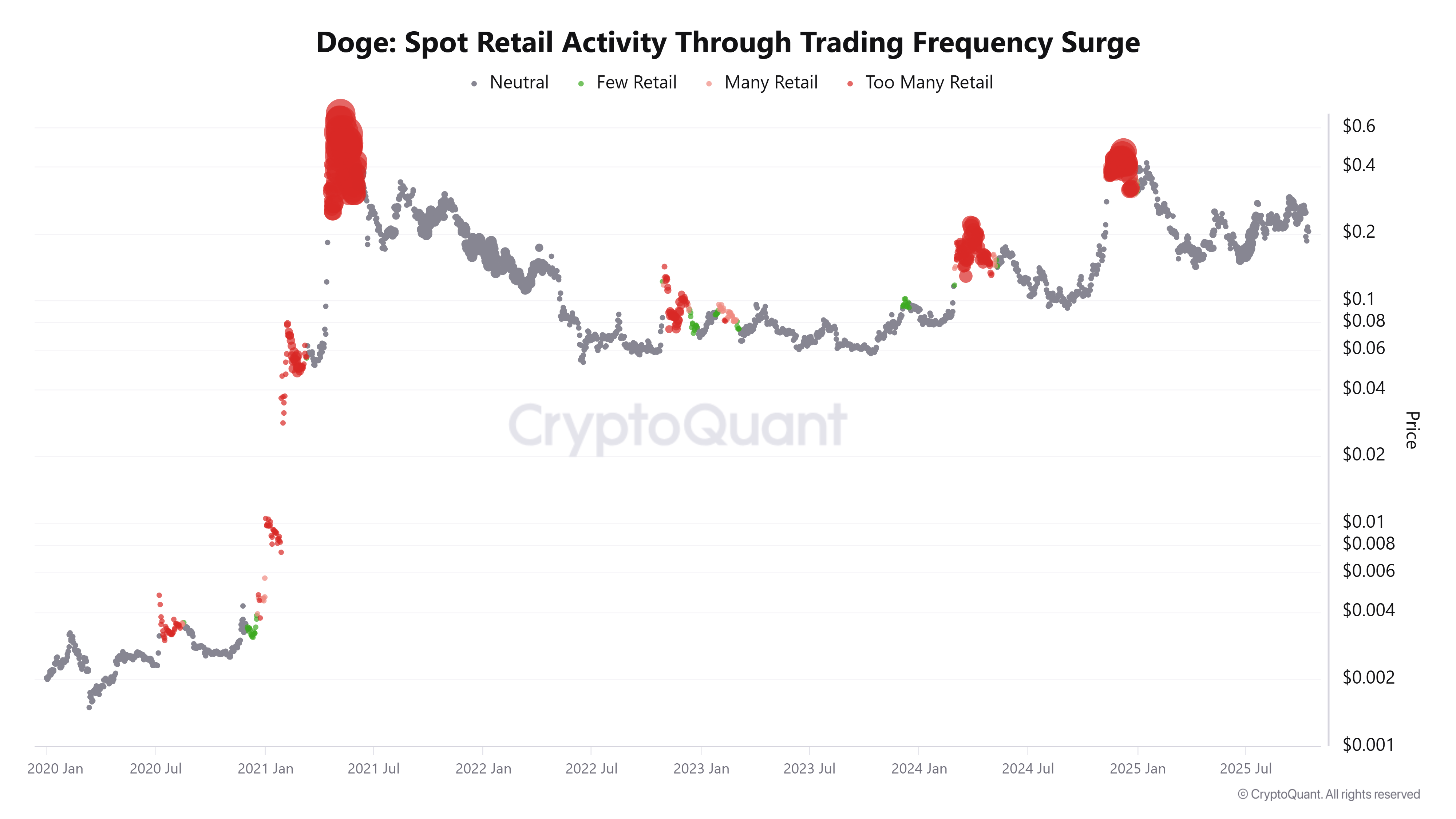

Market Sentiment and Retail Positioning

While institutional investors and whales often dictate market trends, retail participation also plays a crucial role. Data from CryptoQuant indicates that retail positioning is currently neutral. This equilibrium, where neither excessive hype nor widespread apathy prevails, can often be a precursor to substantial inflows, further supporting the bullish thesis.

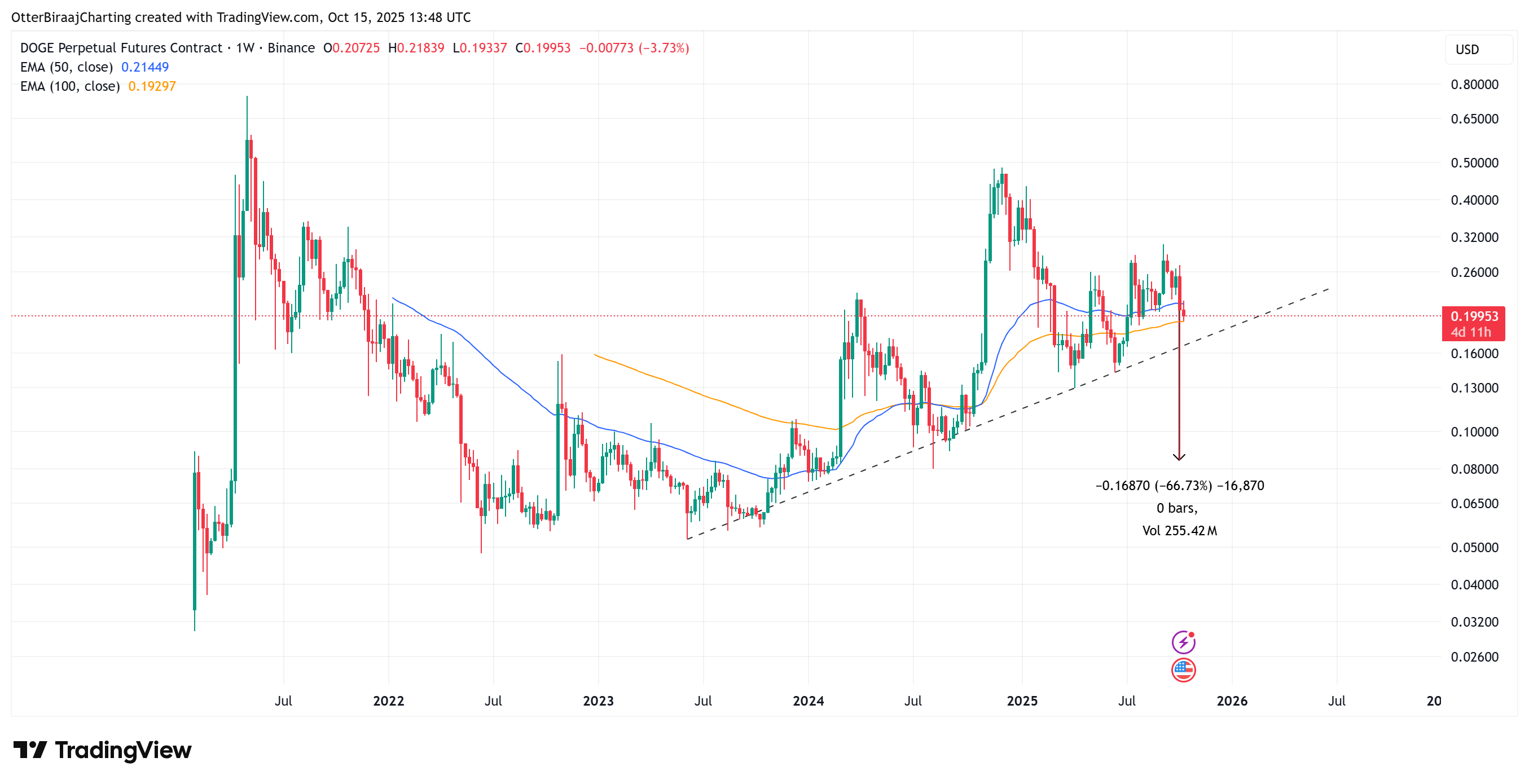

Technical Analysis and Potential Price Targets

Technical patterns are also aligning with the bullish predictions. Many analysts suggest that the current market structure mirrors the 2014-2017 bull cycle, which, if accurate, could imply a breakout rally. Such a scenario could target a price of $1.60 by early 2026. However, it is crucial to emphasize that the crypto market is inherently unpredictable, and any investment decisions should be made with caution and after conducting thorough research.

The Role of Disbelief and Market Fatigue

Interestingly, the uncertainty and market fatigue following the recent flash crash could be a bullish signal for DOGE. Historically, the beginning of significant rallies has often coincided with periods of widespread disbelief. Crypto trader EtherNasyonal pointed out that DOGE tends to begin its major runs under conditions of market fatigue.

Conclusion: A Bullish Outlook, But With Caveats

The confluence of on-chain data, technical analysis, and evolving market sentiment paints a compelling picture for DOGE. While a price target of $1.60 by 2026 seems ambitious, the data suggests that the potential for significant price appreciation exists. Investors should stay vigilant and constantly monitor the market.