Visa‘s Bold Leap into the Stablecoin Realm

In a significant development for the integration of traditional finance and the crypto space, Visa has unveiled a pilot program in the United States, facilitating fiat-funded stablecoin payouts. This initiative allows businesses to leverage the power of stablecoins, specifically those pegged to the US dollar, for sending payments directly from their accounts through Visa Direct.

Streamlining Global Payments with Stablecoins

The pilot program, announced at the Web Summit in Lisbon, focuses on enabling businesses, especially those operating internationally and those within the freelance or gig economy, to disburse funds rapidly. This move directly addresses the need for quicker and more efficient payment solutions. With the ability to send stablecoins like USDC directly to crypto wallets, Visa aims to provide “truly universal access to money in minutes, not days.”

Leveraging Visa Direct and Strategic Partnerships

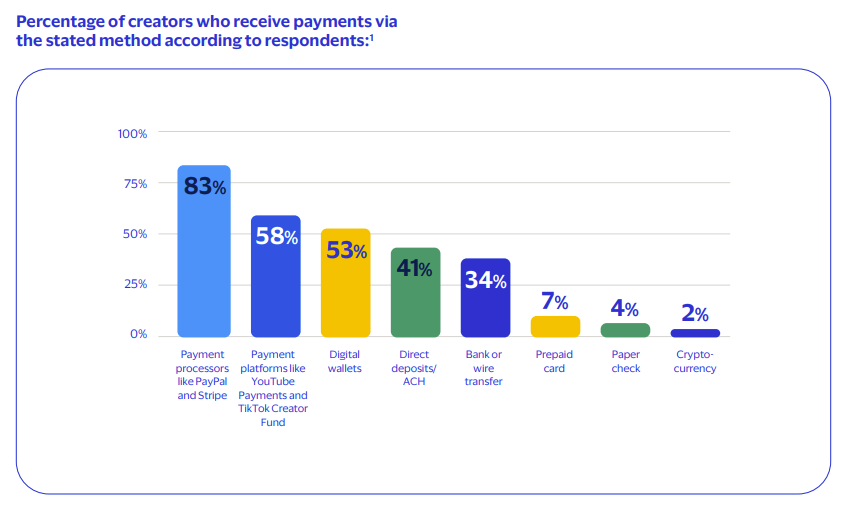

The pilot will initially involve “select partners,” with broader availability anticipated in 2026. The platform, Visa Direct, is the backbone of this operation. Visa‘s research indicates that gig workers are increasingly inclined towards digital payment methods, with 57% expressing a preference for faster access to their earnings. This highlights the growing demand for solutions that can offer speedy and versatile payment options within the creator economy.

Visa‘s Expanding Commitment to Blockchain and Stablecoins

This initiative builds on Visa’s existing efforts within the blockchain and stablecoin ecosystems. Notably, in July, Visa expanded its stablecoin settlement platform, adding Global Dollar (USDG), PayPal USD (PYUSD), and Euro Coin (EURC) across the Stellar and Avalanche blockchains. Further, in September, Visa Direct started piloting instant transfers using USDC and EURC, increasing treasury settlement speed for businesses.

The Broader Industry Landscape and Regulatory Influences

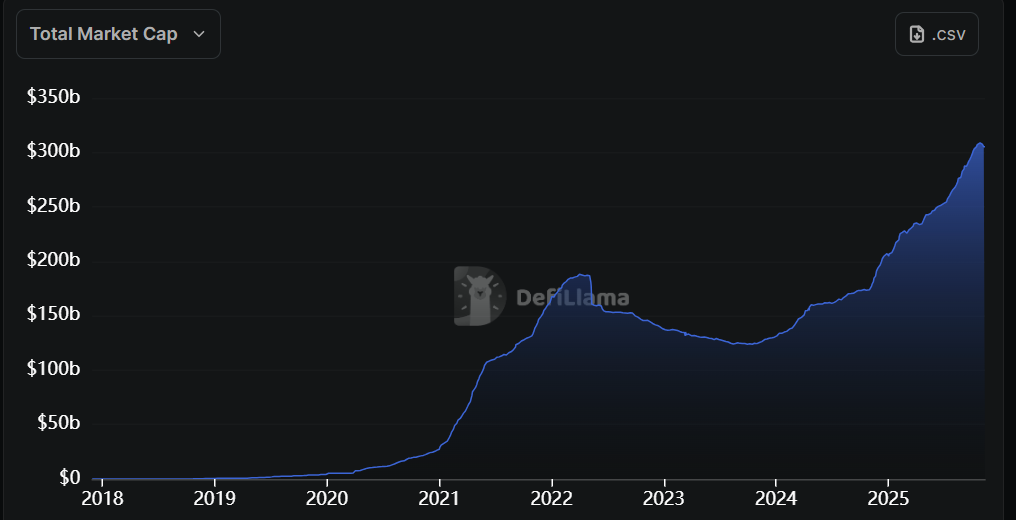

The move by Visa mirrors a wider trend within the financial sector, as payment networks and financial institutions begin to explore and implement stablecoin-based solutions. The recent passage of the GENIUS Act, which sets federal guidelines for stablecoins, has increased clarity within the US regulatory environment. Banking giants like Citigroup are also exploring stablecoin payments, while Western Union is preparing a digital asset settlement system on Solana. Even Wall Street titans, such as JPMorgan and Bank of America, are reportedly evaluating their own stablecoin ventures. The stablecoin market itself has surged, surpassing $300 billion this year.

The Future of Payments

Visa’s pilot signifies a crucial step in the convergence of traditional finance and the decentralized world. The success of this pilot has the potential to redefine how businesses make payments, offering speed, efficiency, and broader access. This is a crucial move as the market prepares for potential further expansion and institutional adoption of stablecoin technologies.

This is a significant development in the financial sector.