Market Shakeout: The Panic Sell-Off Unfolds

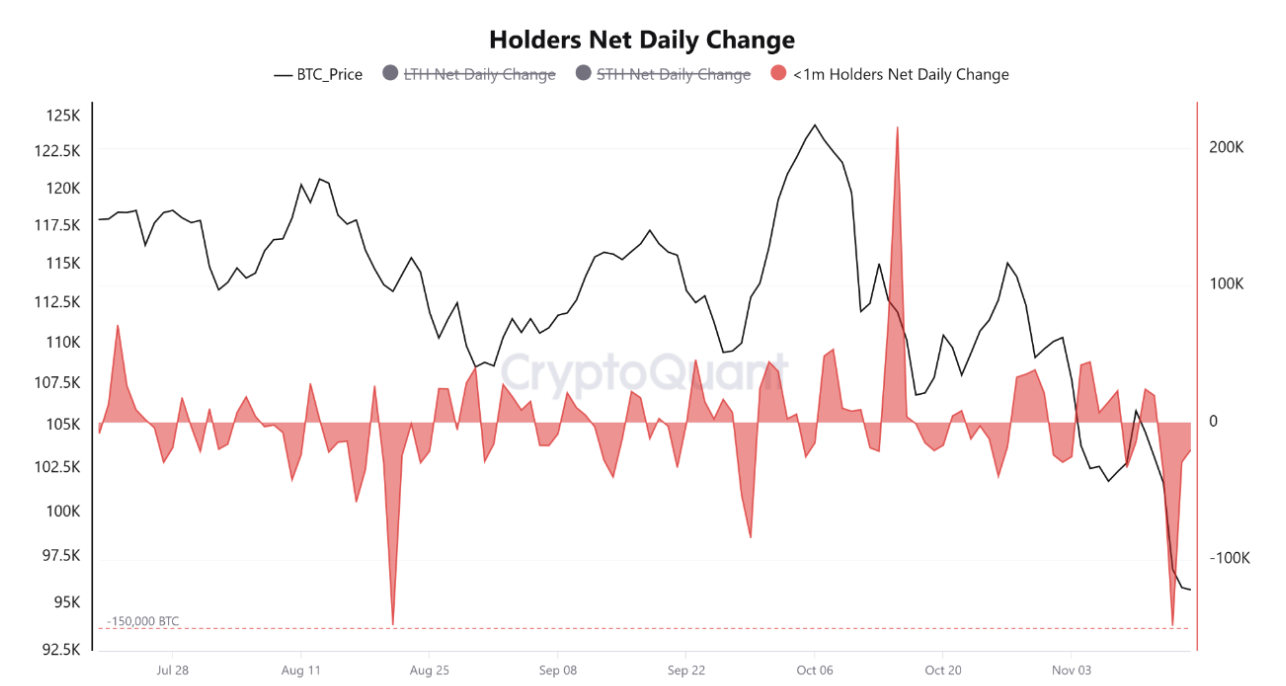

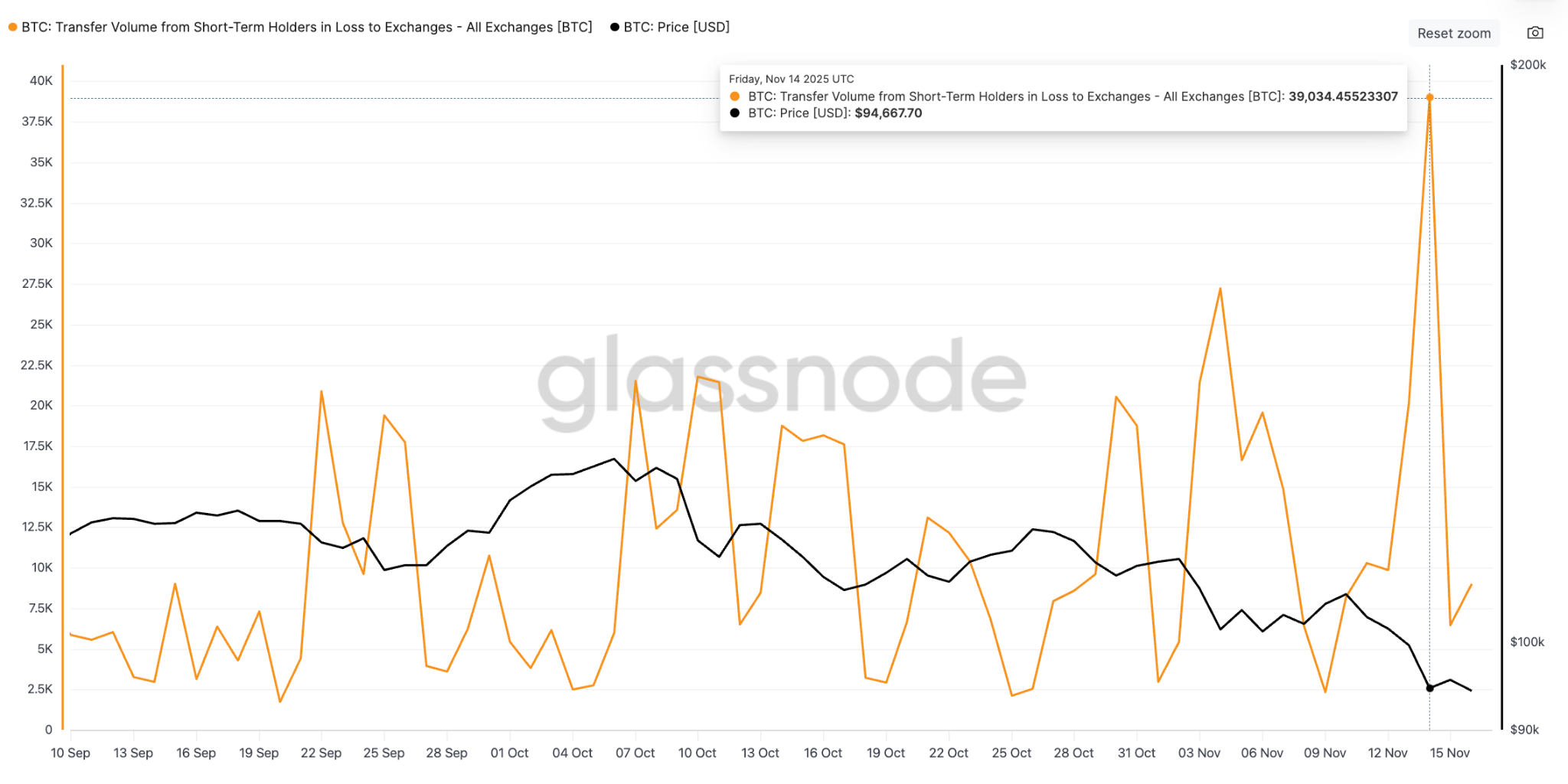

Recent on-chain data paints a concerning picture for Bitcoin, highlighting a significant wave of selling pressure from newer investors. Over 148,000 BTC were offloaded at a loss on November 14th, a stark indicator of the prevailing market sentiment. This sell-off, primarily driven by those who entered the market more recently, reveals a classic pattern of ‘weak hands’ capitulating during a period of price decline. The price had retreated significantly from its all-time highs.

Analyzing the ‘Loss Realization’

The CryptoQuant analysis revealed that these investors typically acquired their Bitcoin at prices between $102,000 and $107,000. Selling at approximately $96,853 represents a substantial realized loss. This behavior underscores a common phenomenon in volatile markets where fear overcomes rational decision-making. Investors, particularly those with less experience, often choose to cut their losses rather than risk further declines. Glassnode also contributed data, showing a significant transfer of Bitcoin from short-term holders to exchanges at a loss.

The $90,000 Threshold: A Critical Level

A consensus is emerging among analysts that Bitcoin‘s price faces further downside risk. The current price action, which has dipped below the 50-week moving average and the $100,000 psychological level, has intensified bearish sentiment. Several analysts are predicting a potential drop below $90,000. A breach of the yearly open around $93,000 could trigger further selling pressure, potentially leading to a test of lower support levels, possibly even revisiting the April lows of around $74,000.

Implications for the Broader Market

This wave of selling activity, while painful for those involved, could potentially create a more robust foundation for a future price recovery. The transfer of coins from panicked sellers to more steadfast buyers could set the stage for a stronger long-term base. The analyst at CryptoQuant, Crazzyblockk, noted that this ‘fire sale’ signifies a flushing out of impatient capital. Polymarket’s predictions show significant uncertainty in the short term, with probabilities split on price outcomes. While the immediate outlook appears bearish, the long-term prospects for Bitcoin remain a topic of debate.

Looking Ahead: Navigating the Uncertainty

The current market dynamics require careful consideration. Investors need to assess their risk tolerance and make informed decisions. While the possibility of a dip below $90,000 exists, the long-term trend remains a subject of ongoing discussion. Staying informed and exercising caution is crucial in navigating the fluctuating crypto landscape. The market awaits further signals and data, with the potential for both further declines and subsequent rebounds. Traders are watching key levels closely, anticipating potential entry points and exit strategies as the situation unfolds.