APR Airdrop Controversy: aPriori Denies Involvement

The Web3 startup aPriori is currently under fire following revelations that a single, unidentified entity managed to claim a substantial portion of its recent airdrop of APR tokens. Approximately 60% of the airdrop distribution was reportedly consolidated across a network of roughly 14,000 interconnected cryptocurrency wallets, according to data from blockchain analytics firm Bubblemaps. This pattern has ignited suspicions of a Sybil attack, a malicious strategy where an individual or group leverages multiple wallets to unfairly maximize rewards. aPriori has strongly denied any involvement from its team or the foundation, however, investor unease is palpable.

The Scale of the Suspicion

The magnitude of the wallet consolidation is a key point of concern. The coordinated activity suggests a sophisticated and potentially well-funded operation, raising questions about whether the airdrop’s security measures were sufficient. This situation echoes past airdrop exploitation incidents, reminding the crypto community of the ongoing vulnerabilities within the space. Further complicating matters, aPriori‘s initial response, as described by some, was perceived as dismissive, which hasn’t helped alleviate community concerns.

aPriori’s Response and Community Divide

In response to the controversy, aPriori has maintained its stance that it wasn’t involved in the suspicious activity. The company has suggested a potential leak of information as a possible explanation for the massive claim, which is under internal investigation. This explanation has been met with skepticism by some, with many investors expressing doubt due to the lack of concrete details provided so far. The community’s reactions are diverse, with some voicing support for the aPriori team, while others express concerns about possible fraudulent activity. Such division highlights the importance of transparency and prompt communication during crises.

The Impact on Investors

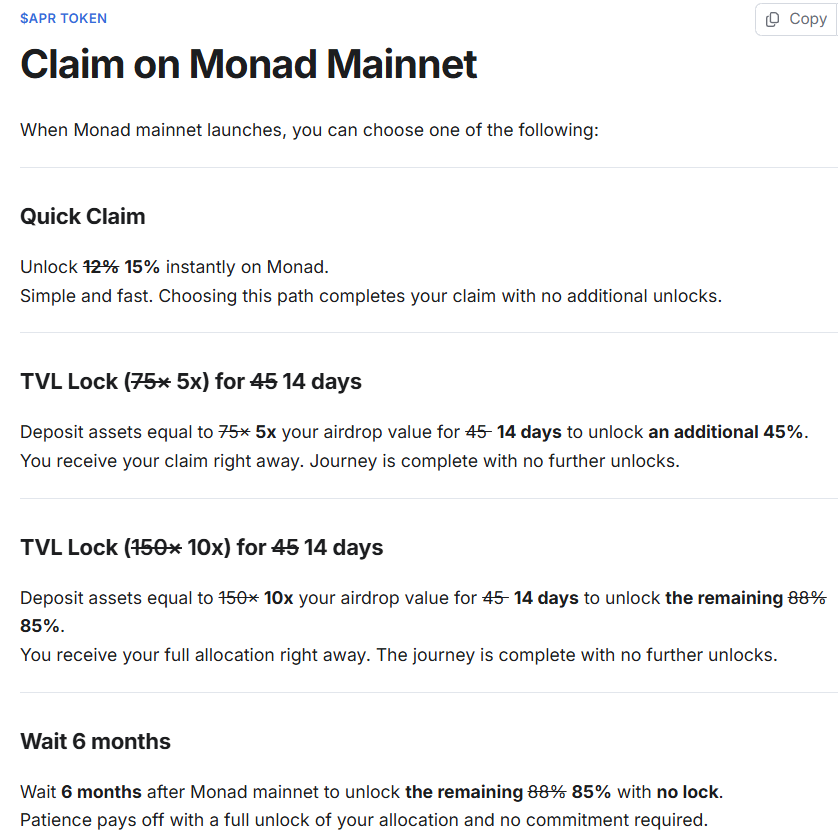

The airdrop debacle arrives at a crucial juncture for aPriori, which raised a substantial $30 million in funding in August. The recent adjustment to the airdrop criteria, prioritizing “social contribution,” and increasing the immediate unlock from 12% to 15%, may have been an effort to mitigate the damage and reward genuine users. However, the shadow of the wallet cluster looms large, potentially affecting investor confidence and the APR token‘s future valuation. Users can also deposit assets to unlock the remaining tokens, but the requirements need to be carefully considered.

The situation involving aPriori and the APR airdrop underscores the ever-present challenges in the crypto world. Investors are now left to ponder several questions: Who controls the suspicious wallets? Was a data leak actually exploited? What further steps will aPriori take to reassure its community? As the investigation unfolds, the transparency of information will be crucial for the company to retain its reputation and move forward.