MicroStrategy‘s Nasdaq 100 Survival: A Victory for Bitcoin‘s Biggest Holder

MicroStrategy, now the largest corporate holder of Bitcoin, has successfully navigated the recent rebalancing of the Nasdaq 100, a significant milestone since its addition to the index in December of last year. This event serves as a crucial test for the company’s aggressive Bitcoin acquisition strategy, and its survival suggests a continued acceptance, despite ongoing market volatility.

Bitcoin Accumulation and the Shifting Landscape

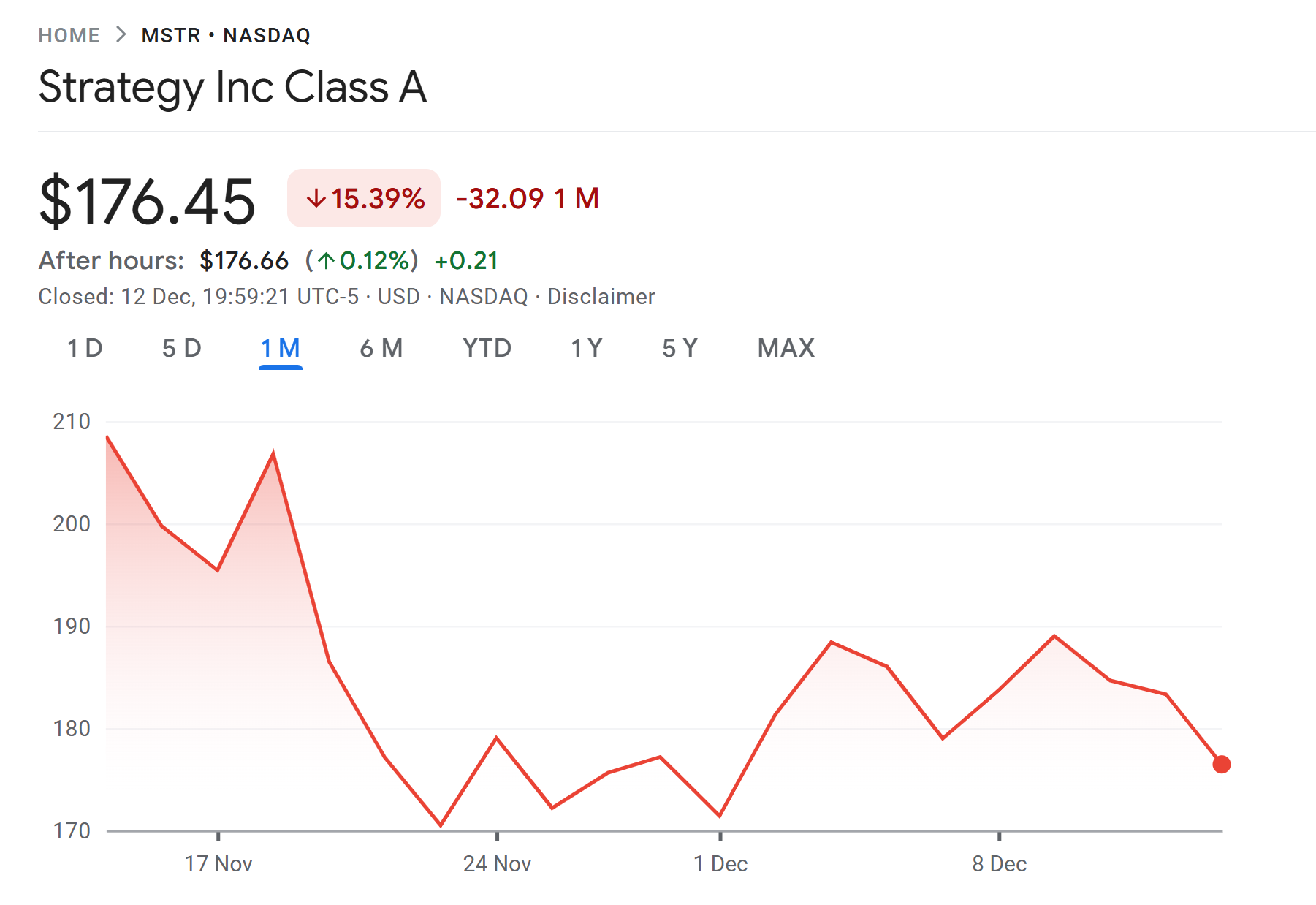

The company’s recent purchase of an additional 10,624 Bitcoin, valued at approximately $962.7 million, brings its total holdings to an impressive 660,624 BTC. This massive accumulation places MicroStrategy in a unique position within the tech-heavy index. However, the recent Nasdaq 100 adjustment saw several companies removed, highlighting the dynamic nature of the index and the constant need for companies to prove their long-term value. While MicroStrategy remains in the index, its shares experienced a dip, reflecting broader market anxieties.

Navigating Market Concerns and Institutional Adoption

MicroStrategy‘s inclusion in the Nasdaq 100 is particularly noteworthy given the debate surrounding its classification as an operating firm versus an investment vehicle. MSCI’s review of companies holding significant crypto assets has added further scrutiny. The potential exclusion of firms with over 50% of assets in crypto has been a major concern, potentially impacting MicroStrategy. JPMorgan has even warned of potential forced selling by passive funds if MSCI were to exclude the firm. However, MicroStrategy has actively defended its position, arguing that it is more than just a Bitcoin accumulator, it is an operating enterprise.

Strategic Moves and Market Perception

Recognizing the market’s concerns, MicroStrategy recently raised $1.44 billion to address anxieties surrounding its ability to manage dividend and debt obligations. This proactive move aimed to counter the negative market sentiment and the potential for short-selling. According to CEO Phong Le, the capital raise was to counter the “FUD” that the company would not be able to meet its financial obligations. Executive Chairman Michael Saylor has been actively engaging with sovereign wealth funds, bankers, and family offices, positioning Bitcoin as a form of “digital capital” and “digital gold,” further emphasizing the institutional opportunities that lie ahead.

Looking Ahead

This episode highlights the evolving relationship between traditional financial indices and the burgeoning crypto landscape. MicroStrategy‘s continued presence on the Nasdaq 100 is not just a win for the company, but a potential signal of growing acceptance of Bitcoin as a legitimate asset class within the broader investment environment. The long-term implications of this event remain to be seen, but it undoubtedly represents a key moment in the ongoing evolution of cryptocurrency’s relationship with mainstream finance.