Crypto ETPs Continue Strong Inflow Trend

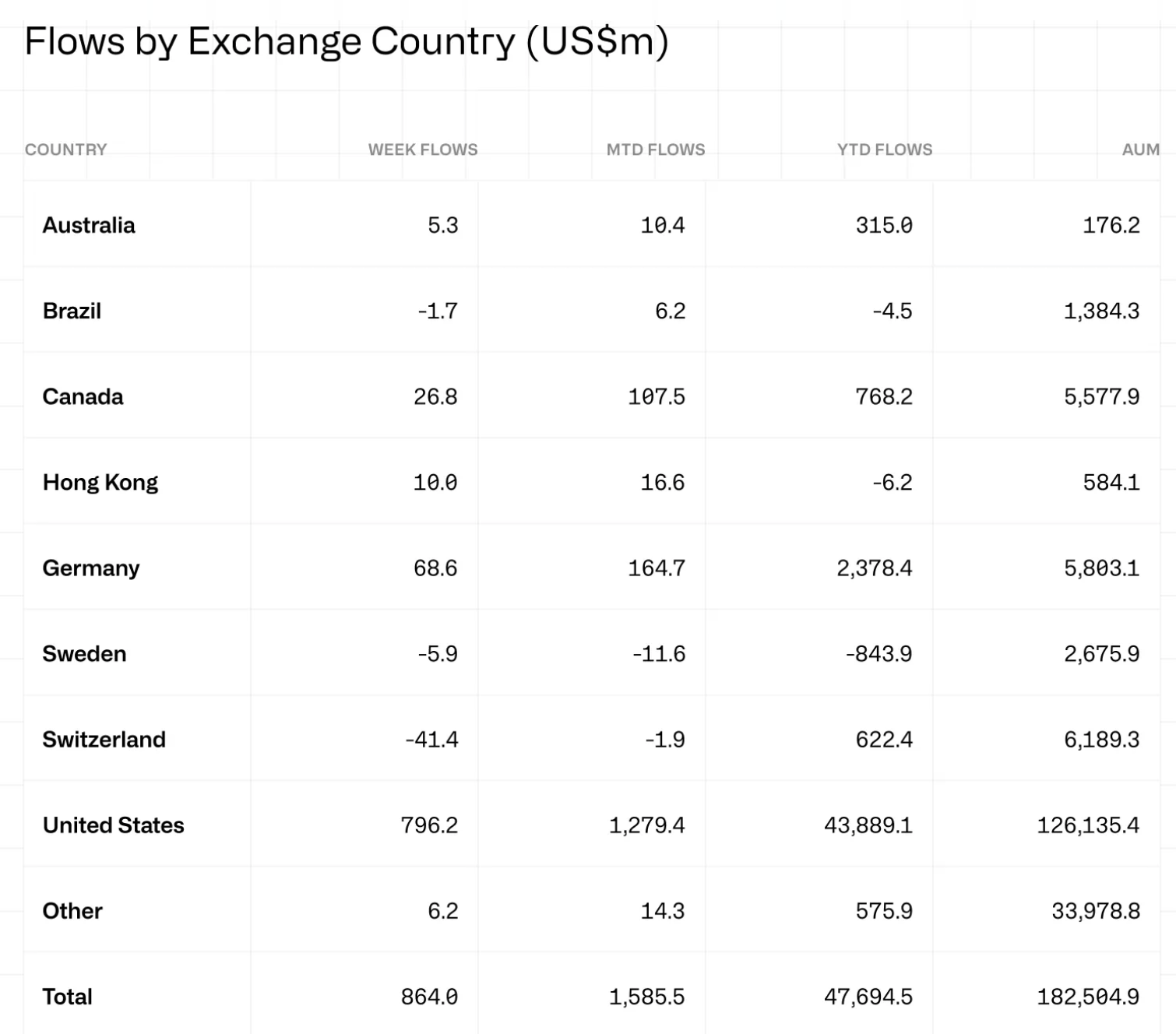

The digital asset market is showing continued signs of recovery, with crypto exchange-traded products (ETPs) witnessing their third straight week of net inflows. Data compiled by CoinShares indicates a significant influx of capital, with approximately $864 million entering the market last week. This positive trend underscores a growing appetite for exposure to digital assets through regulated investment vehicles.

United States Takes the Lead

The United States emerged as the primary driver of these inflows, accounting for roughly $796 million of the total. Germany and Canada also contributed positively, with $68.6 million and $26.8 million respectively, highlighting the global appeal of crypto ETPs. Together, these three nations represent almost 98.6% of year-to-date (YTD) inflows, demonstrating a concentrated interest in digital asset investment products within specific geographic areas.

Bitcoin and Ethereum Dominate

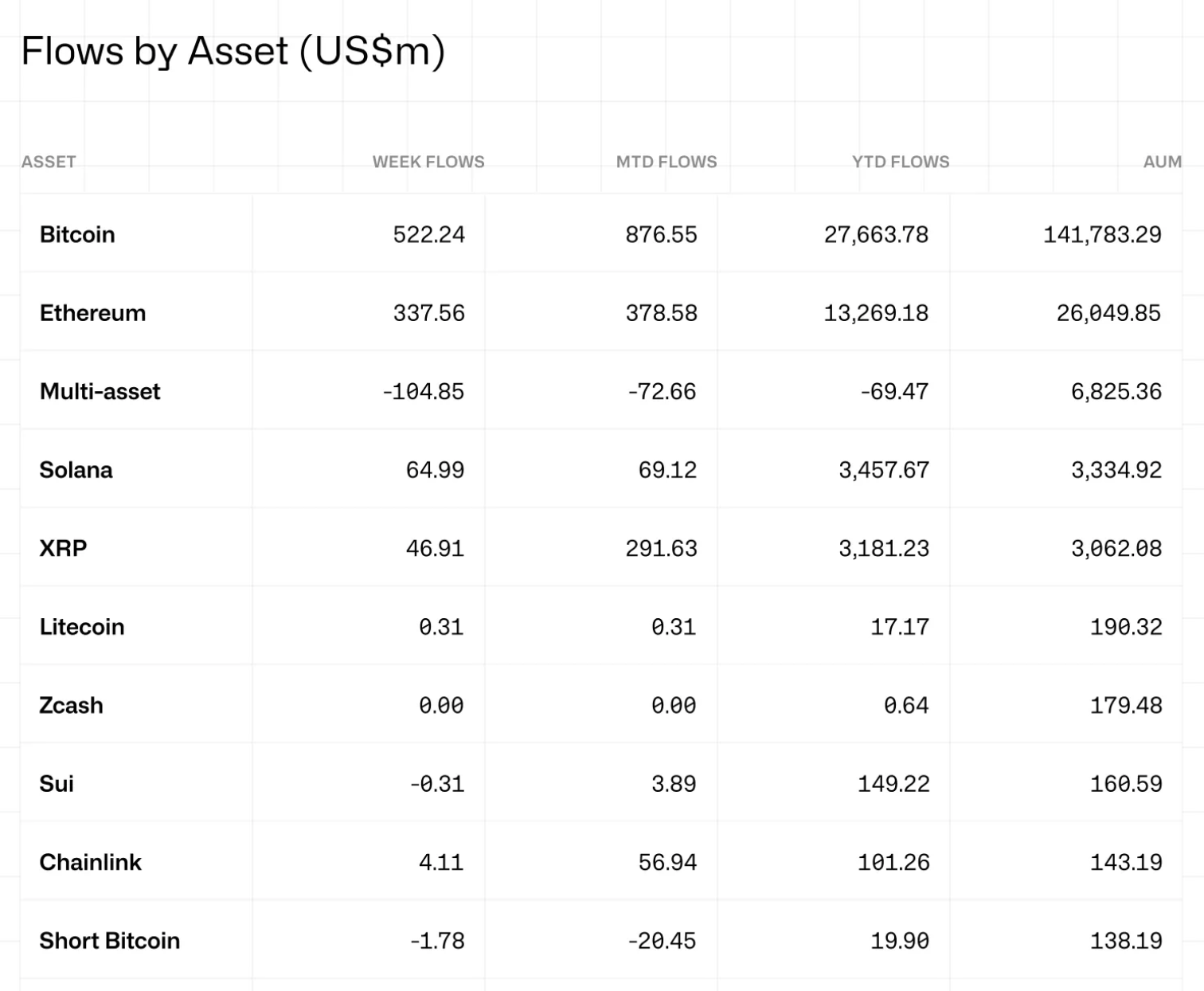

Bitcoin (BTC) investment products continue to attract substantial capital, with approximately $522 million in weekly inflows. This indicates a strong belief in the long-term value of the leading cryptocurrency. Short-Bitcoin products saw slight outflows, hinting at improving investor sentiment. Ethereum (ETH) followed closely, recording around $338 million in inflows for the week. This influx pushed its YTD inflows to a staggering $13.3 billion, a remarkable increase of 148% from 2024.

Altcoin Performance: Solana and XRP Shine

Beyond the two market leaders, Solana (SOL) and XRP (XRP) also experienced notable inflows. Solana-linked investment products attracted approximately $65 million, bringing the YTD total to roughly $3.46 billion, a significant rise from last year. XRP products added about $46.9 million during the week, with YTD inflows reaching around $3.18 billion. These figures demonstrate a wider diversification of investment strategies within the crypto space, as investors explore opportunities beyond Bitcoin and Ethereum.

Mixed Results for Smaller-Cap Assets

While larger-cap cryptocurrencies performed well, smaller-cap products saw a more mixed response. Aave (AAVE)-linked products recorded inflows, while Chainlink (LINK) also added fresh capital. Conversely, Hyperliquid (HYPE) products experienced net outflows, showcasing the varying degrees of investor interest across the altcoin spectrum.

Market Sentiment and Future Outlook

The consistent inflows over the past three weeks, coupled with the strong performance of major cryptocurrencies and rising altcoins, signal a potential shift in market sentiment. While challenges and volatility remain inherent within the digital asset market, the recent data suggests a growing confidence in the future of cryptocurrencies and the value of ETPs as investment vehicles. This trend could indicate a broader institutional and retail adoption of digital assets in the months to come.