Institutional Bitcoin Demand: A Resurgence?

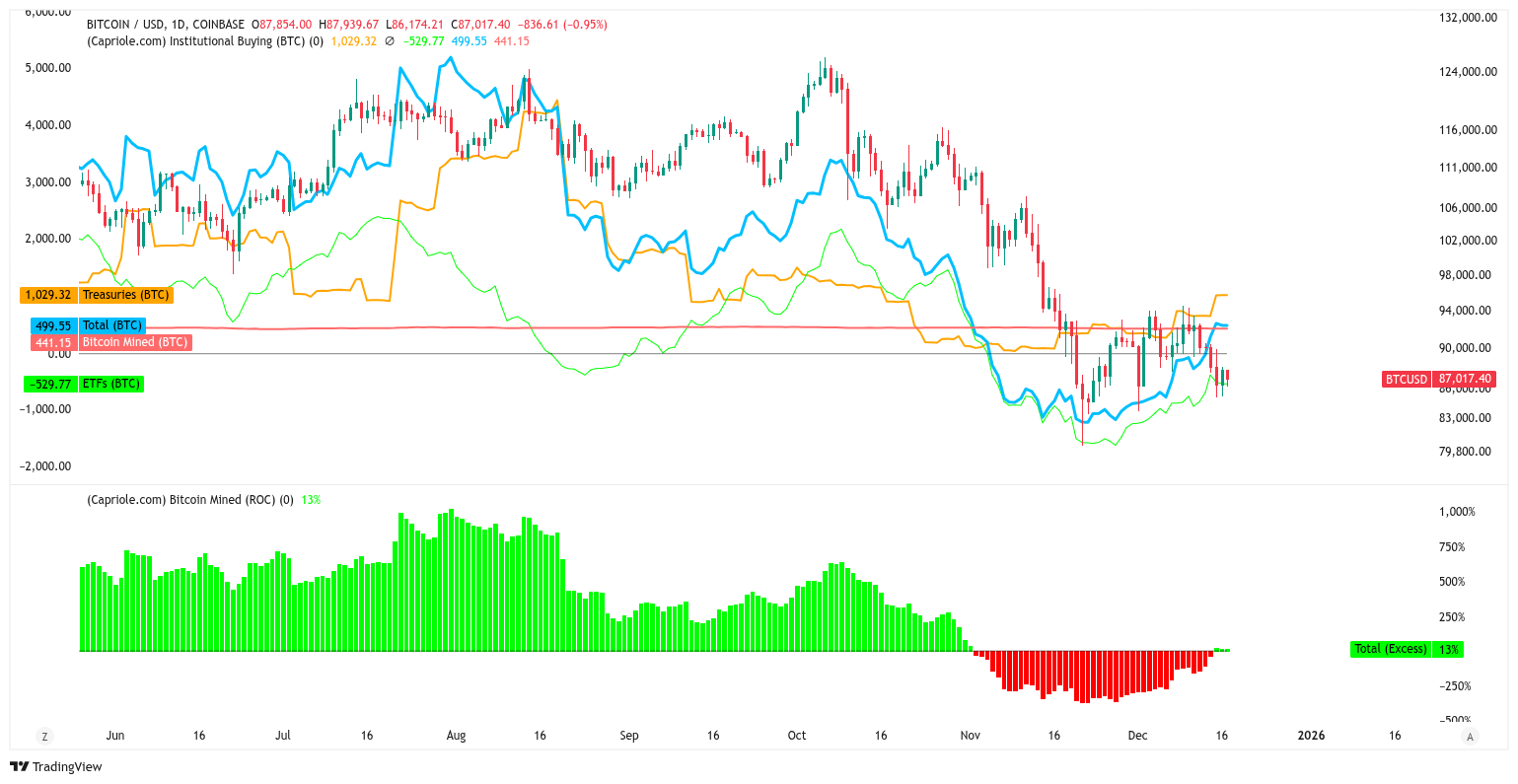

The Bitcoin market is witnessing a noteworthy development: for the first time in six weeks, institutional demand for Bitcoin is exceeding the amount of newly mined supply. This shift, revealed by data from Capriole Investments, highlights a potential turning point in the market dynamics, even amidst ongoing volatility.

The Numbers: Demand Outstrips Supply

Capriole’s analysis indicates that institutional buying now surpasses the daily Bitcoin mined supply by approximately 13%. This marks a significant change from the preceding weeks, where new supply consistently outpaced demand. This net reduction in the available Bitcoin supply from institutional purchases is a positive signal for the long-term health of the market. The last time this occurred was at the beginning of November.

ETF Outflows and Market Sentiment

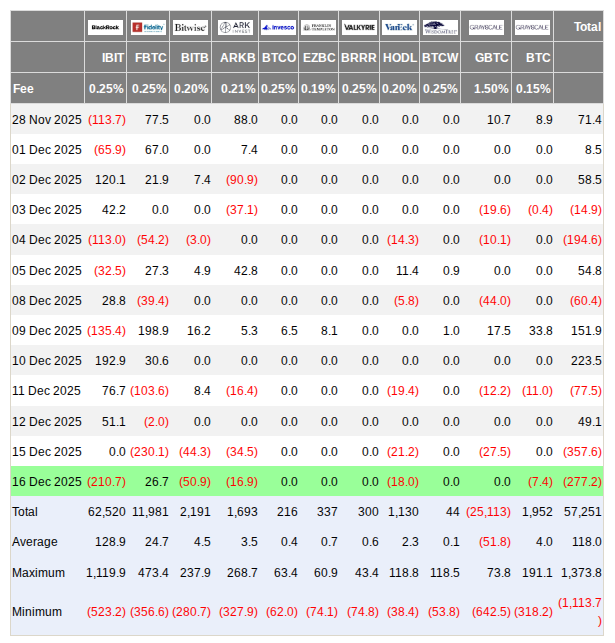

While institutional accumulation is evident, the market isn’t without its challenges. Recent data reveals substantial outflows from US spot Bitcoin exchange-traded funds (ETFs). Over the past few days, these outflows have exceeded $600 million. This divergence between institutional buying and ETF outflows underscores the complex and nuanced nature of current market sentiment. Some analysts suggest that the ETF outflows may be driven by short-term pessimism, while larger players are strategically accumulating Bitcoin, anticipating future price appreciation.

Corporate Treasuries and the “Flywheel” Effect

The report from Capriole highlights the impact of corporate Bitcoin treasuries. Charles Edwards, the founder of Capriole, pointed out that the recent period of price decline has put pressure on market participants, including businesses holding Bitcoin in their treasuries. His analysis highlights a potential “broken corporate ‘flywheel’, evidenced by record discounts to NAV among treasury companies and rising leverage.” This dynamic adds another layer of complexity to the market, and could influence the speed of the price recovery.

Long-Term Expectations vs. Short-Term Stress

CryptoQuant, a well-known on-chain analytics platform, describes the current market state as a “market in transition, where short-term pessimism contrasts with strategic accumulation.” This observation reinforces the idea that Bitcoin‘s market oscillates between immediate stress and expectations of long-term appreciation. Network fundamentals remain strong, supporting new market entries even as capital leaves investment vehicles like ETFs.

Looking Ahead

The convergence of increasing institutional demand and declining Bitcoin supply presents a compelling narrative for Bitcoin enthusiasts. While the ETF outflows and corporate treasury dynamics warrant monitoring, the overall trend suggests that institutions are once again seeing Bitcoin as a valuable asset. The market will undoubtedly continue to evolve, but the current data strongly suggests that the balance of power is shifting, and potentially setting the stage for a period of growth.