Bitcoin ETFs Reverse Course: A Look at the Inflow Surge

The cryptocurrency market witnessed a significant shift this week as spot Bitcoin exchange-traded funds (ETFs) snapped a seven-day outflow streak, recording a substantial $355 million in inflows. This reversal marks a crucial turning point, injecting optimism into the market after a period of negative sentiment. The data, sourced from SoSoValue, highlights a renewed interest in Bitcoin ETFs, driven primarily by improved global liquidity and strategic moves by major financial institutions.

Leaders of the Pack: IBIT, ARKB, and FBTC Dominate Inflows

The resurgence in Bitcoin ETF inflows was led by key players in the industry. BlackRock‘s iShares Bitcoin Trust ETF (IBIT) spearheaded the charge, attracting $143.75 million in inflows on Tuesday. Following closely were the Ark 21Shares Bitcoin ETF (ARKB) with $109.56 million and Fidelity’s Wise Origin Bitcoin Fund (FBTC) with $78.59 million. These figures underscore the dominance of these funds and their ability to attract investor capital even amid market volatility. Bitwise’s Bitcoin ETF (BITB) also contributed positively, adding $13.87 million, while smaller inflows were noted for Grayscale’s Bitcoin Trust ETF (GBTC) and VanEck’s Bitcoin ETF (HODL).

Liquidity’s Influence: A Key Driver of the Shift

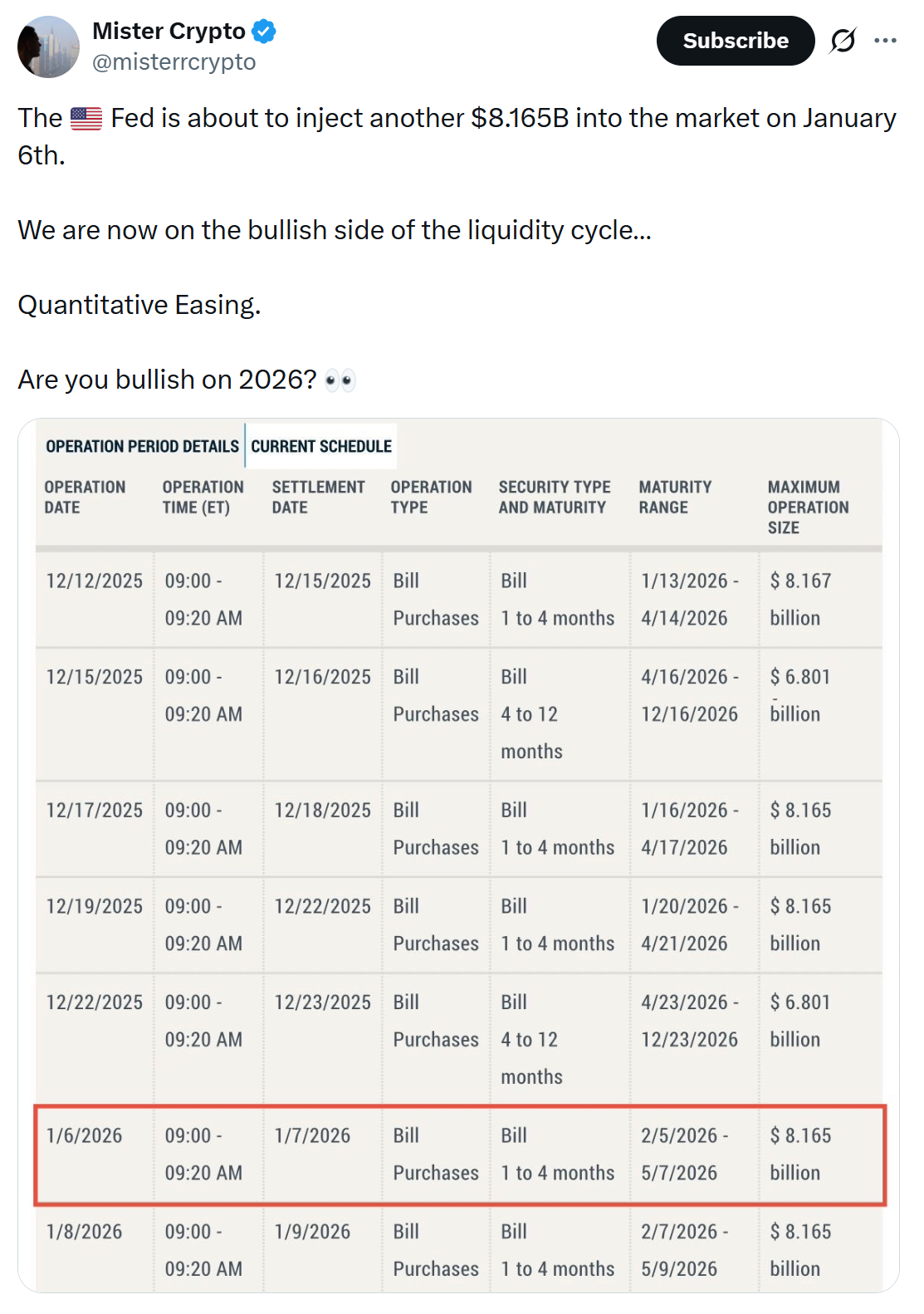

The rebound in ETF inflows coincides with improving global liquidity conditions. Several analysts and commentators are attributing the shift to rising money supply measures across major economies and forthcoming actions by the US Federal Reserve. Arthur Hayes, in a post on X, suggested that global dollar liquidity likely bottomed in November and has been gradually increasing since. This perspective is echoed by other analysts, including Mister Crypto, who noted a bullish trend in liquidity indicators. The Fed’s planned purchases of US Treasury bills, injecting billions into the market, further support the case for increased liquidity and a potentially bullish cycle. This change is vital, as December saw significant outflows, totaling $744 million, driven by falling prices and year-end liquidity constraints.

Beyond Bitcoin: Ethereum and XRP ETF Performance

The positive sentiment extended beyond Bitcoin. Spot Ether (ETH) ETFs also ended a four-day outflow streak, recording $67.8 million in net inflows on Tuesday. In addition, spot XRP (XRP) ETFs continued their inflow streak for a remarkable 30 consecutive days, with an additional $15 million in inflows. These simultaneous positive movements across major cryptocurrencies reflect a broader market recovery and increased investor confidence.

The Road Ahead: Implications and Outlook

The recent surge in Bitcoin ETF inflows is a positive sign for the cryptocurrency market. As liquidity conditions continue to improve and major players like BlackRock and Fidelity continue to attract investment, the long-term outlook for Bitcoin and other cryptocurrencies appears increasingly optimistic. Investors should remain vigilant, however, as market volatility is inherent to crypto and unforeseen events could alter the trajectory. The combination of improved liquidity, institutional interest, and positive ETF performance suggests a possible resurgence of bullish momentum within the digital asset space.