Navigating the Crypto Landscape: OKX‘s 2026 Vision

The cryptocurrency industry is undergoing a significant transformation. As regulations tighten and institutional interest grows, major exchanges are recalibrating their strategies. OKX, under the guidance of Global Managing Partner Haider Rafique, is positioning itself to be at the forefront of this evolution. The core focus for OKX, and many other exchanges, revolves around a few key pillars: securing licenses, embracing stablecoins, and capitalizing on the rise of tokenized assets.

The Quest for Regulatory Clarity and Global Footprints

A primary objective for OKX is to solidify its presence in regulated markets. Rafique highlights the importance of obtaining the necessary licenses to operate legally and securely. OKX’s strategy involves building robust infrastructure and obtaining the appropriate regulatory approvals in key regions. This proactive approach will allow OKX to offer a wider array of services and products, particularly derivatives, in more jurisdictions. Other major exchanges, such as Coinbase, Bybit, and Binance, are following suit, recognizing that compliance is paramount for sustainable growth and long-term viability. The race is on to be the most licensed exchange, a testament to the industry’s maturation.

Stablecoins: The New Foundation of Crypto Yield

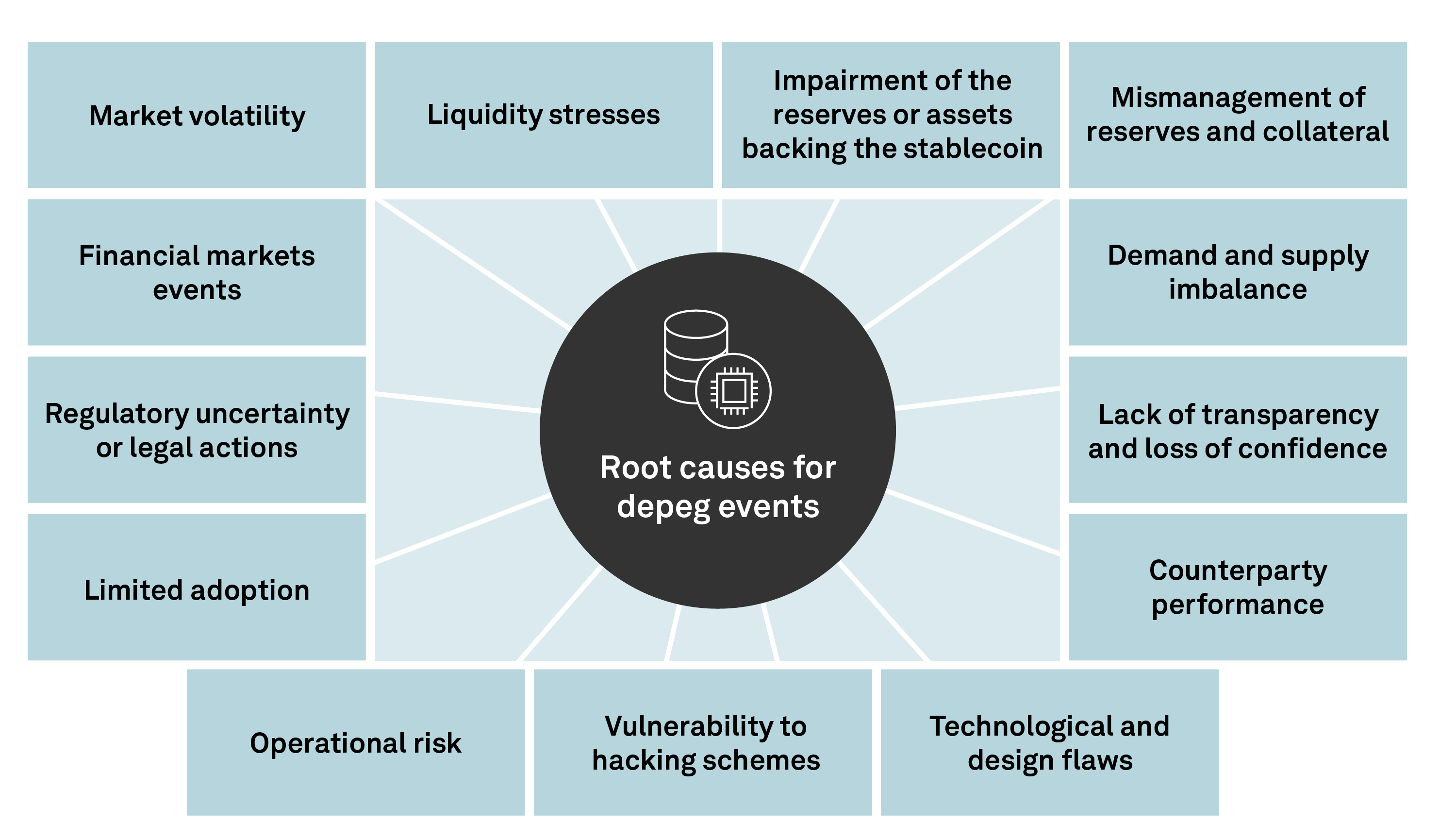

Stablecoins are poised to play an even more significant role in the future of crypto exchanges. OKX sees stablecoins as more than just a means of exchange; they are viewed as evolving into yield-bearing financial products. Rafique observes that traditional savings options are often rendered unfavorable due to high inflation. Stablecoins, in contrast, offer users the opportunity to earn yields without the restrictive lock-up periods associated with conventional savings accounts. These developments reflect a broader trend towards integrating stablecoins into the core financial structures of these platforms.

Tokenization: Bridging the Gap to Traditional Finance

Real-world asset (RWA) tokenization is another key area of focus for OKX. The potential of tokenizing commodities, stocks, and other assets is substantial, and Rafique believes that exchanges are the ideal platforms to facilitate this process. The transition of traditional assets onto blockchain platforms is expected to attract significant investment, further blending crypto with traditional finance. As younger generations, familiar with crypto, start seeing assets they already engage with through their exchange, the user base is expected to continue to increase.

A Prudent View on Bitcoin‘s Trajectory

Underpinning OKX‘s strategic direction is a pragmatic outlook on Bitcoin. Rafique acknowledges that the asset’s price is increasingly influenced by macroeconomic factors. The exchange is building its services with a measured approach to market volatility, shying away from extreme bullish predictions. This measured approach reflects a commitment to protecting its users and providing a stable environment for trading and investment. He anticipates Bitcoin to be a core macro asset that drives spot, derivatives, and RWA flows across the newly licensed markets.

The Road Ahead: Building for the Future

In conclusion, OKX‘s strategic focus for 2026 highlights the evolving landscape of the cryptocurrency industry. By prioritizing regulatory compliance, embracing stablecoins, and exploring tokenization, OKX is positioning itself for sustained growth. This approach underscores a shift away from speculative ventures and towards a more mature and robust ecosystem, with a focus on delivering secure, compliant, and user-friendly products and services to a global audience.