Mantra‘s Hard Lessons: A Restructuring Amidst Market Turmoil

The blockchain project Mantra, a prominent player in the Real World Assets (RWA) space, is undergoing a significant restructuring, marked by staff reductions and a strategic refocus. This shift follows a challenging period for the company, largely driven by the dramatic collapse of its native OM token and the broader, unforgiving pressures of the cryptocurrency market. The announcement, spearheaded by CEO John Patrick Mullin, signals a necessary adaptation to navigate the current financial climate and recalibrate the company’s trajectory.

The OM Token‘s Precipitous Plunge

At the heart of Mantra’s difficulties lies the performance of its OM token. After reaching an all-time high of $8.99 in early 2025, the token experienced a devastating decline, plummeting to just $0.59 by mid-April. This steep drop, a loss of approximately 99% of its value, has significantly impacted Mantra’s financial stability. The company has cited aggressive leverage policies on centralized exchanges as a contributing factor to the crash, highlighting the systemic risks that can arise from such practices within the crypto ecosystem.

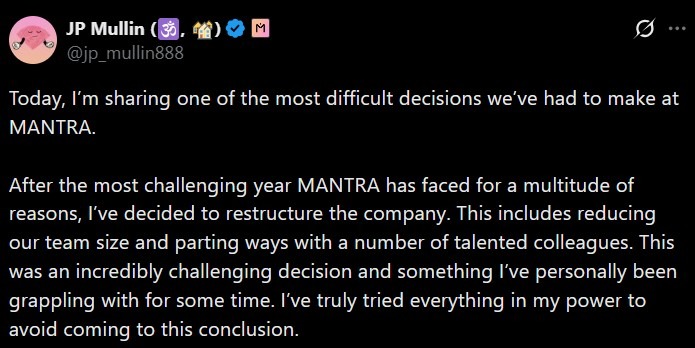

Restructuring and Strategic Realignment

Responding to the market pressures, Mantra is taking decisive action to streamline its operations and enhance capital efficiency. This involves a workforce reduction across various departments, a move acknowledged by Mullin as difficult, especially for those directly affected. The restructuring reflects a commitment to focusing resources on core execution and adapting to near-term market conditions. Mullin’s open admission of accountability underscores the seriousness with which the company is approaching these challenges.

Lingering Exchange Disputes and the Path Forward

Adding another layer of complexity to Mantra‘s situation is the strained relationship with the cryptocurrency exchange OKX. A dispute over token migration information led Mullin to advise OM holders to withdraw their tokens from the exchange. While OKX contested these claims, the episode highlights the intricate dynamics and potential pitfalls within the crypto landscape. The restructuring aims to fortify the project, placing a strong emphasis on strategic adjustments, and operational optimization. This includes the implementation of governance and transparency measures, and efforts to reduce token supply.

What Lies Ahead for Mantra?

Mantra‘s path forward is now decidedly narrower. The company will likely need to re-establish investor confidence and demonstrate a clear vision for its future within the evolving RWA sector. The success of this restructuring will depend on Mantra‘s ability to adapt, innovate, and navigate the volatile crypto environment. The decisions, while tough, demonstrate a commitment to long-term sustainability and a strategic refocus on their core objectives.