Regulatory Storm Gathers Over Polymarket

Polymarket, a prominent crypto-based prediction market, is facing a growing wave of restrictions across Europe. Hungary and Portugal have recently joined the list of countries blocking access to the platform, highlighting the intensifying regulatory pressure on prediction markets and sparking debate over their classification within existing legal frameworks. These actions add to an already extensive list of nations that have moved to curb Polymarket‘s operations.

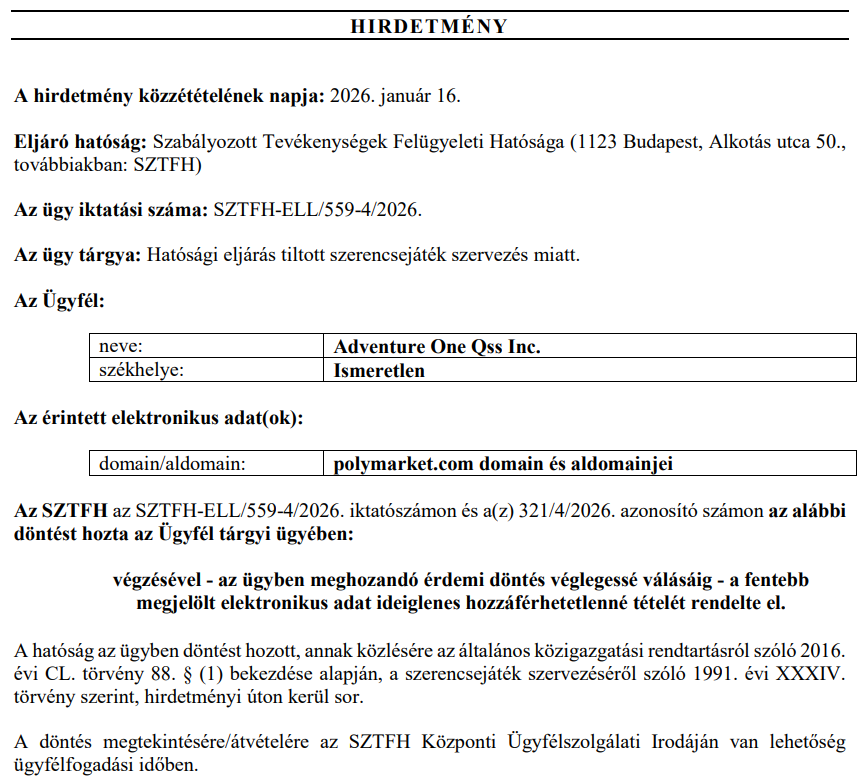

Hungary and Portugal‘s Actions: A Deeper Dive

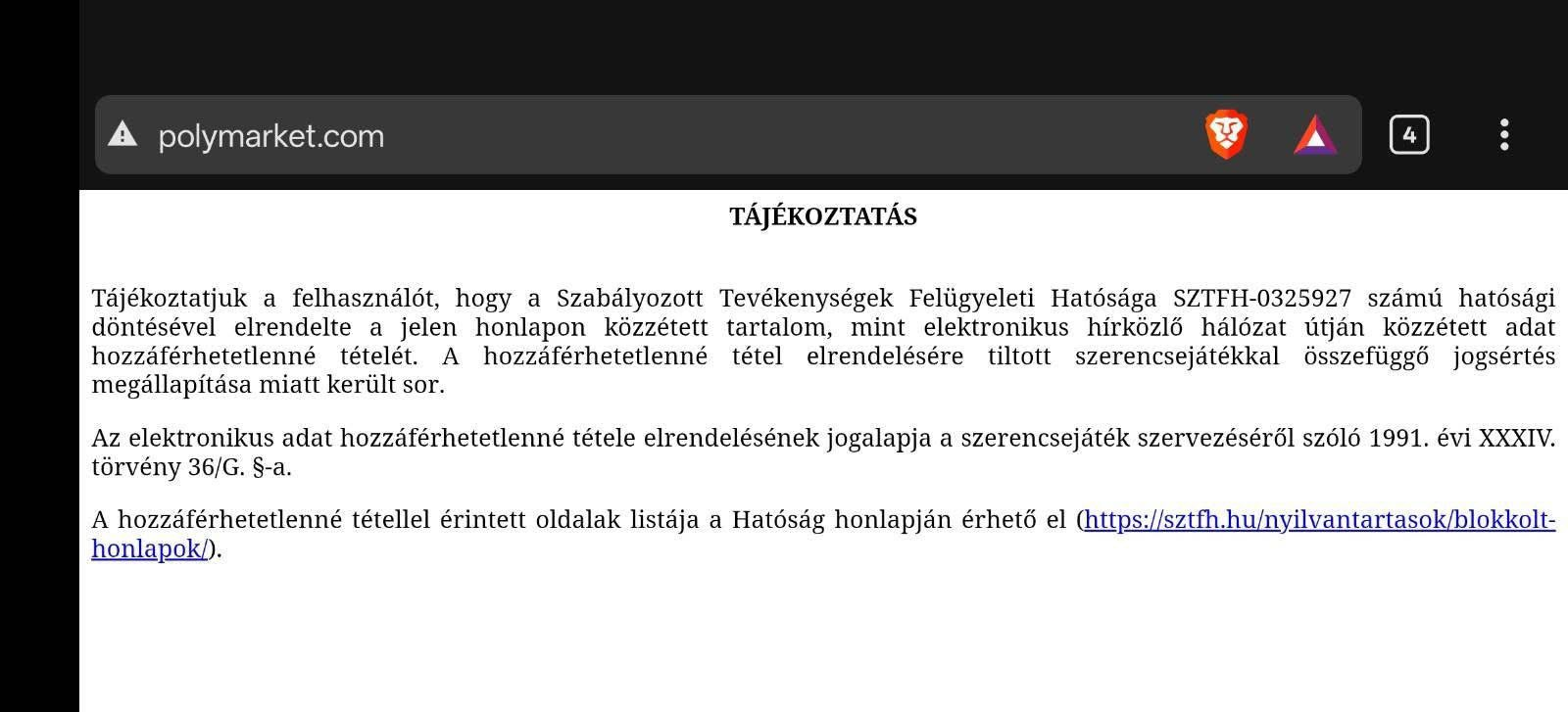

Hungary’s regulatory body, Szabályozott Tevékenységek Felügyeleti Hatósága, has taken the unprecedented step of temporarily blocking Polymarket’s domain and subdomains. The stated reason for this move is the alleged “forbidden organization of gambling activities.” Access to the platform from Hungarian IP addresses is now met with a warning message from the country’s regulator. Meanwhile, Portugal‘s Gaming Regulation and Inspection Service (SRIJ) has mandated Polymarket to cease operations within the country, although the platform’s accessibility remains in a state of flux.

The Growing List of Restrictions and the Gambling Debate

The actions taken by Hungary and Portugal are just the latest in a series of regulatory crackdowns targeting Polymarket. The platform has already encountered restrictions or outright bans in numerous other countries, including Ukraine, France, Belgium, Poland, Singapore, and Switzerland. The core of these regulatory concerns revolves around whether these prediction markets fall under the purview of financial regulations or gambling legislation. Supporters of these platforms often argue they function more like financial markets, while regulators in numerous jurisdictions are clearly siding with the latter.

Insider Trading Concerns and Their Impact

The regulatory scrutiny is further amplified by concerns over potential insider trading. A controversial bet made on Polymarket, tied to the removal of Venezuela’s president, has brought the platform into the spotlight. Following a substantial payout from a contract predicting the removal of Nicolas Maduro, questions were raised about the possibility of insider knowledge being used to influence the prediction market. These events have contributed to increased pressure and calls for greater oversight.

Implications for the Future

The ongoing regulatory crackdown on Polymarket and similar prediction market platforms has far-reaching implications. It signals a potential shift in how regulators approach the intersection of crypto and prediction markets. The restrictions could significantly impact the accessibility and usability of these platforms for European users, and the debate over their classification as financial products or gambling services is likely to continue. The rapid growth of trading volume in prediction markets, even amidst regulatory challenges, showcases the sector’s appeal, however, and the actions taken by authorities will be closely monitored.

The Broader Ecosystem

The growing regulatory challenges facing Polymarket also shed light on the broader ecosystem of prediction markets and the future of trading within these innovative platforms. While regulatory bodies and lawmakers take a stricter approach, platforms like Kalshi, a competitor to Polymarket, are stepping up to fill the void, potentially creating new market dynamics. As the landscape evolves, the industry will have to make a choice – to comply with existing gambling frameworks or push for regulatory recognition that aligns with financial market classifications.