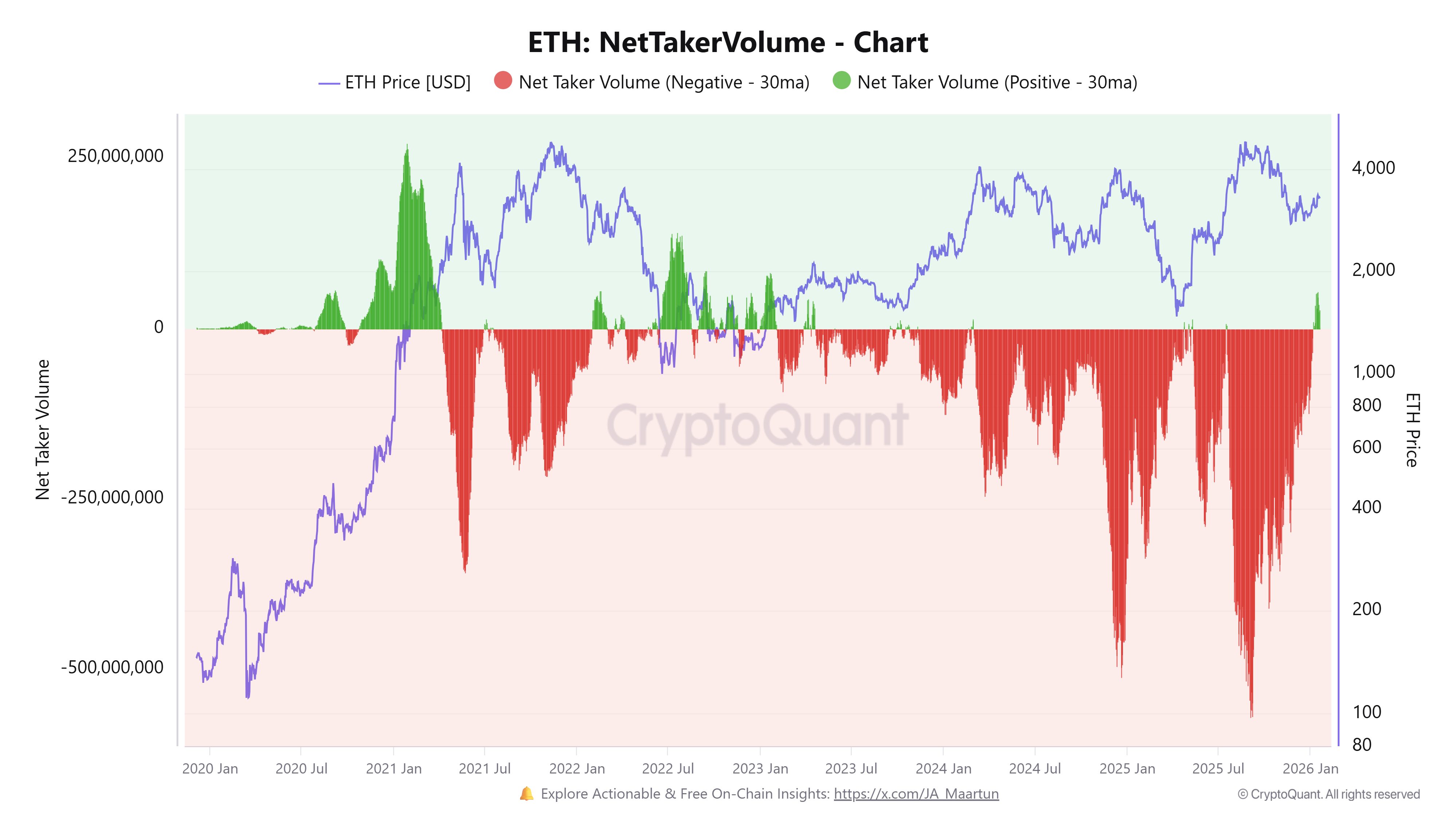

A Turning Tide for Ethereum: Net Taker Volume Shifts

For the first time in nearly three years, a key metric is flashing a bullish signal for Ethereum (ETH). After enduring a prolonged period of seller dominance, the cryptocurrency’s net taker volume has surged into positive territory, igniting speculation about a potential price rally and signaling a change in the market’s sentiment.

This shift in net taker volume, which tracks whether traders are aggressively buying at market prices or selling into bids, suggests a fundamental change in the futures market. The recent data indicates that traders are now more confident about the long-term prospects of ETH, driving significant buying pressure.

Understanding the Significance of Net Taker Volume

The positive net taker volume, which reached approximately $390 million since January 6th, represents the largest buy-side imbalance since January 2023. Historically, similar instances of strong positive flips in this metric have coincided with the bottoming of price ranges or the early stages of uptrends. This makes it a crucial indicator for gauging the health and direction of ETH.

This positive trend doesn’t necessarily guarantee an immediate price surge. However, it strongly suggests a shift in the underlying market dynamics. The data suggests leveraged participants are positioning themselves for a continuation of the uptrend, anticipating further price appreciation. The current price action is currently supported by available liquidity despite a negative cumulative volume delta (CVD). This divergence implies that while short-term profit-taking may be underway, larger players are absorbing the selling pressure, keeping ETH stable above the $3,000 support level.

Technical Analysis and Market Outlook

Technically, ETH has reverted to its five-month point of control, hovering between $3,050 and $3,140. As long as daily closes remain above $3,000, the broader uptrend remains intact. A break below this support level would signal a more bearish outlook. Furthermore, significant net long positions exist near $3,100, which, along with a large liquidity cluster below $3,000, suggests that the price may fluctuate within this range as the market rebalances.

Key Takeaways:

- Ethereum‘s net taker volume has turned positive after years of sell-side pressure.

- The current buy-side dominance is the strongest since January 2023.

- Historically, similar positive trends preceded multi-week price expansions.

- Large participants appear to be absorbing selling pressure near $3,000.

As always, investors should perform their own thorough research and consider the inherent risks involved in cryptocurrency trading. This analysis provides insights into a current market trend, but should not be interpreted as financial advice.