Metaplanet‘s Strategic Shift: A Deep Dive

Japanese Bitcoin treasury company, Metaplanet, is making waves in the crypto space. The firm recently revised its outlook, painting a picture of substantial growth in 2026. This positive forecast arrives despite a significant Bitcoin write-down, signaling a nuanced approach to navigating market volatility. This strategic shift warrants a closer look at the company’s financial maneuvers and the underlying implications for its future.

The Write-Down‘s Impact

A crucial element of Metaplanet‘s recent announcements is the substantial non-cash Bitcoin write-down, exceeding $670 million. This accounting adjustment reflects the fluctuation of Bitcoin‘s value at the end of the fiscal year. While this write-down appears significant, it’s crucial to understand its nature. As a non-cash adjustment, it doesn’t directly impact the company’s operational cash flow. This means that while it affects reported earnings, it doesn’t necessarily reflect a loss in the practical sense of spent or lost cash. Instead, it adjusts the valuation of the company’s Bitcoin holdings to align with prevailing market prices.

2025: A Year of Mixed Signals

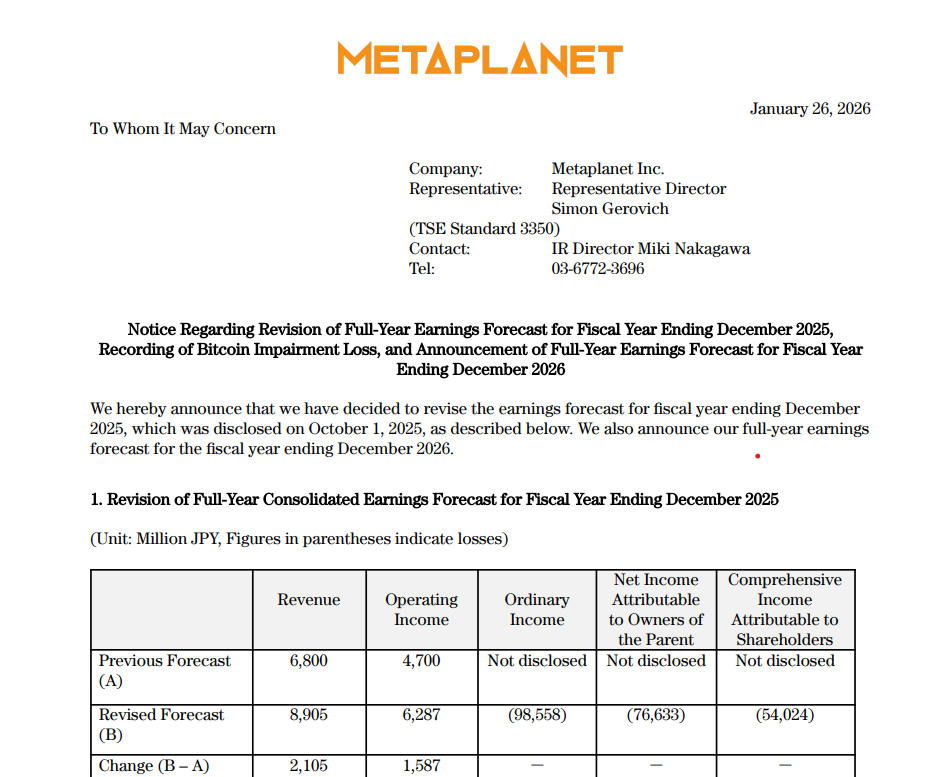

For 2025, Metaplanet projects a mixed financial picture. While revenue is expected to reach approximately $58 million, and operating income is estimated at around $40 million, the Bitcoin write-down is projected to result in considerable ordinary and net losses. This presents a complex situation. Underlying operational performance is robust, with the Bitcoin income generation business showing promising growth. However, the accounting impact of Bitcoin price fluctuations overshadows these positive developments in the reported financial figures for the year.

Looking Ahead to 2026: A Vision of Growth

Metaplanet‘s optimism shines through its 2026 projections. The company forecasts a near doubling of sales, expecting revenue to reach approximately $103 million and operating income to be around $73 million. This optimistic outlook is largely predicated on the continued success of its Bitcoin income generation business. The company’s strategy seems to be twofold: leveraging its existing Bitcoin holdings while actively growing its treasury. This approach reveals a belief in the long-term potential of Bitcoin, even amidst short-term market volatility.

Key Takeaways and Considerations

Metaplanet‘s actions offer several key takeaways for those invested in the crypto space. The firm’s willingness to embrace Bitcoin as a core asset, alongside its active strategies to generate income from its holdings, indicates a forward-thinking investment philosophy. The substantial Bitcoin holdings and the projected growth in its income generation business position Metaplanet as a key player in the evolving landscape of corporate Bitcoin adoption. While the write-down serves as a stark reminder of the market’s inherent volatility, Metaplanet‘s response demonstrates a resilient approach to navigating these challenges and building for the future.

- The non-cash write-down emphasizes the importance of understanding the accounting intricacies of crypto investments.

- The company’s growth projections for 2026 highlight the potential for long-term gains despite short-term market fluctuations.

- Metaplanet’s actions reveal a well-developed, long-term approach to Bitcoin investment, which considers Bitcoin as a critical element within its financial model.

The company’s strategic decisions reflect a proactive approach to managing its Bitcoin holdings, aiming to create value in the long term.