Bitcoin Borrowing: A Shift Towards Strategic Long-Term Planning

A recent report from Xapo Bank, a Gibraltar-based institution, illuminates a significant trend in the evolving landscape of Bitcoin-backed lending. The bank’s 2025 Digital Wealth Report indicates a move away from short-term liquidity solutions towards a more strategic approach to financial planning among its clientele. This shift suggests a growing maturity within the Bitcoin ecosystem, as long-term holders increasingly leverage their holdings without necessarily selling them.

From Liquidity to Long-Term Wealth Management

The core finding of the report centers on the extended duration of Bitcoin-backed loans. In 2025, 52% of the loans issued by Xapo carried a 365-day term. Importantly, many of these loans remained open, even as new loan creation slowed later in the year. This suggests that borrowers are utilizing these loans not just for immediate cash needs but as part of a broader financial strategy. Xapo, catering primarily to high-net-worth individuals, observes a pattern where clients are using their Bitcoin as collateral to access capital while retaining their exposure to the digital asset. This behavior underscores the confidence these individuals have in Bitcoin‘s long-term potential.

Confidence in Bitcoin‘s Future Fuels New Strategies

The report highlights that these long-term Bitcoin holders are comfortable taking some profit while simultaneously preserving their underlying conviction. This is a significant development, demonstrating a level of financial sophistication and confidence that has grown within the Bitcoin community. Xapo‘s CEO, Seamus Rocca, notes that this represents “disciplined, private-bank-style financial behaviour,” highlighting the productive use of Bitcoin as capital.

Geographic Concentration of Activity

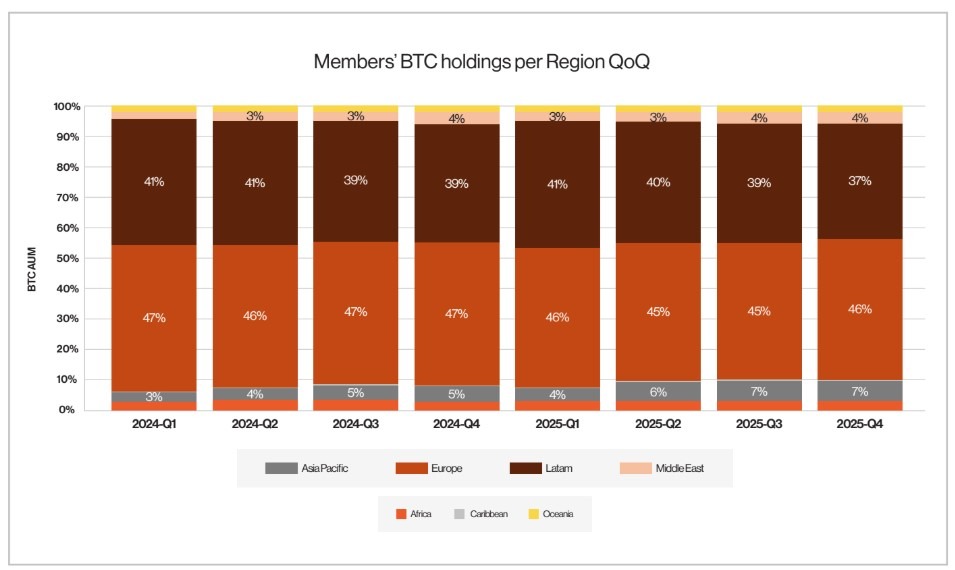

The report also provides interesting regional insights. Europe and Latin America account for a substantial 85% of the total loan volume, with 56% and 29% respectively. This geographical concentration could be attributed to various factors, including regulatory environments, economic conditions, and the adoption rate of Bitcoin in different regions. Further analysis of these regional trends could provide valuable insights into the global adoption patterns of Bitcoin-backed lending products.

Implications for the Broader Crypto Ecosystem

The findings from Xapo offer a valuable lens through which to view the evolution of Bitcoin‘s role in the broader financial landscape. The shift towards long-term strategies indicates a maturing ecosystem, where Bitcoin is being integrated into established financial planning tools. This trend suggests that regulated banking rails are becoming a more significant component of the broader cryptocurrency market. As more institutions offer similar services, and as Bitcoin adoption continues to grow, it is reasonable to expect that this trend of strategic Bitcoin-backed borrowing will continue and evolve.