CIRO Steps into Crypto: Formalizing Custody Standards

The Canadian Investment Regulatory Organization (CIRO) has taken a significant step in the evolution of crypto regulation, formalizing its interim framework for the custody of crypto and tokenized assets. This move, announced recently, provides much-needed clarity for investment dealers operating in the burgeoning digital asset space. While permanent, crypto-specific rules are still in development, this framework establishes immediate standards for safeguarding client holdings, a critical aspect of fostering investor trust and market stability.

Key Components of the Interim Framework

The CIRO framework outlines several key aspects of crypto custody. It sets forth supervisory expectations for investment dealers operating crypto trading platforms. This includes stipulations on custody limits, segregation standards for client assets, reporting obligations, and a tiered system for third-party crypto custodians. These measures are designed to provide a secure environment for investors and promote responsible market practices. The framework is enforced through the binding terms and conditions of CIRO membership, allowing for swift implementation and adaptation to the rapidly evolving crypto landscape.

A Tiered Approach to Custody and Capital

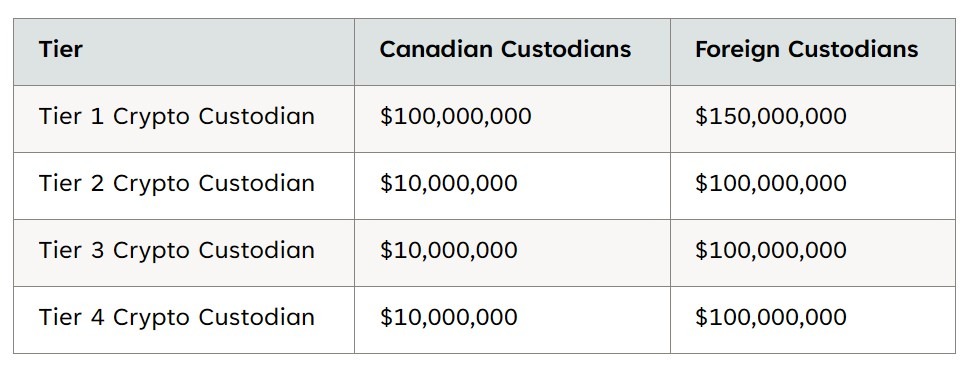

A notable feature of the framework is its tiered approach to custody. This model links capital requirements, insurance, governance practices, and technology assurance to the proportion of client assets a custodian is permitted to hold. This nuanced approach allows for varying levels of risk management depending on the custodian’s capabilities and the scale of their operations. Here’s a breakdown of the tiers:

- Tier 1 and Tier 2 Custodians: These custodians can hold up to 100% of a dealer’s crypto assets, requiring higher capital thresholds and more rigorous assurance standards, including external cybersecurity reviews.

- Tier 3 Custodians: Permitted to hold up to 75% of a dealer’s crypto assets.

- Tier 4 Custodians: Limited to holding up to 40% of a dealer’s crypto assets.

- Internal Custody: Dealers maintaining internal custody are limited to holding 20% of client crypto assets.

CIRO has also set minimum capital requirements for custodians, scaling these requirements based on risk and jurisdiction. Higher requirements apply to foreign companies, reflecting the complexities associated with cross-border enforcement and potential insolvency scenarios.

Broader Implications and Future Developments

This interim framework is a crucial step in Canada‘s broader strategy for crypto regulation. CIRO‘s proactive measures, like this custody framework, demonstrate a commitment to investor protection and market integrity. The organization aims to respond quickly to emerging risks without being locked into rigid, permanent rules. As the crypto market matures, elements of this framework are expected to inform the development of more permanent rules or harmonized regulatory instruments. This phased and cautious approach, mirroring the Bank of Canada‘s stance on fiat-backed stablecoins, reflects the country’s commitment to careful oversight of the digital asset market.

Looking Ahead

This recent development in Canada‘s crypto landscape signifies a move towards greater regulatory clarity and investor confidence. The ongoing evolution of crypto regulations, with CIRO leading the charge, will be instrumental in shaping the future of digital assets in Canada and beyond. As the market continues to evolve, these frameworks will likely be further refined and adapted to address emerging risks and opportunities.