MicroStrategy Doubles Down on Bitcoin, Adding $90 Million to Holdings

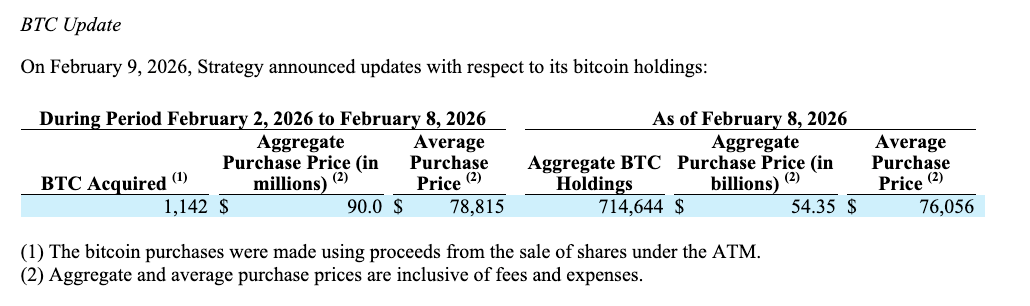

In a move that underscores their unwavering faith in Bitcoin, MicroStrategy, under the leadership of Michael Saylor, has made another significant investment in the cryptocurrency. According to recent filings, the company purchased approximately $90 million worth of Bitcoin (BTC) last week. This latest acquisition, comprising 1,142 BTC, was executed at an average price of roughly $78,815 per coin.

Timing and Context of the Purchase

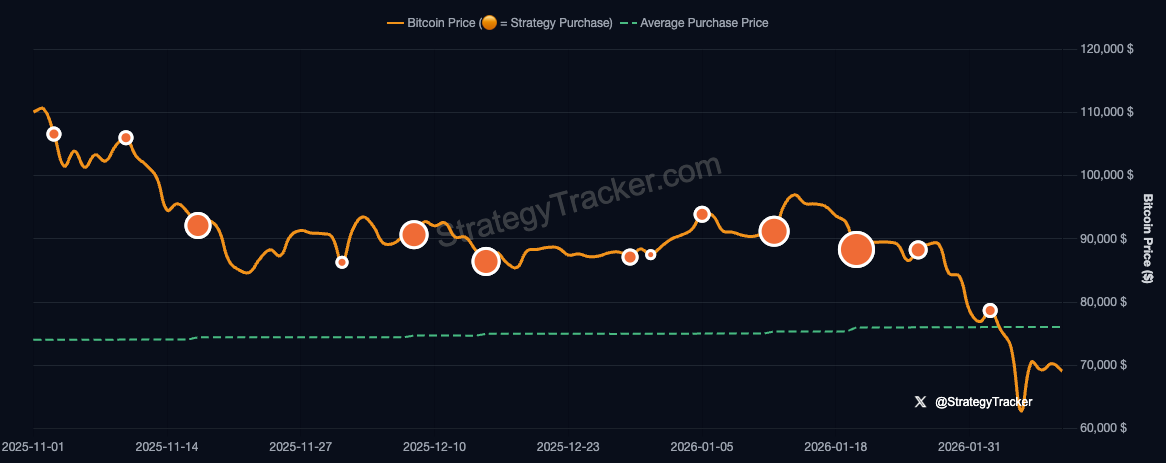

The timing of this purchase is particularly noteworthy. While Bitcoin experienced a brief dip below $60,000 recently, the market has since stabilized, yet still remained below MicroStrategy‘s average acquisition price for a significant duration. This dynamic has raised eyebrows among market observers, as the purchase was made despite the price trading below their existing cost basis. The situation mirrors a similar scenario in 2022 when Bitcoin dipped below $30,000, yet MicroStrategy continued, albeit at a slower pace, to accumulate more Bitcoin.

Impact on MicroStrategy‘s Bitcoin Holdings

This latest purchase brings MicroStrategy’s total Bitcoin holdings to an impressive 714,644 BTC, acquired at an approximate total cost of $54.35 billion. The average price per coin for the company is now around $76,056. This substantial accumulation reinforces MicroStrategy‘s position as one of the largest public holders of Bitcoin globally and demonstrates a commitment to a long-term investment strategy that is independent of short-term market fluctuations.

Market Reaction and Strategic Implications

The decision to buy more Bitcoin at a price slightly above prevailing market rates suggests a belief in the asset’s underlying value and long-term potential. While some analysts had anticipated MicroStrategy potentially avoiding purchases below its average cost basis, the company chose to continue its aggressive accumulation strategy. This move signals a strong conviction in the future value of Bitcoin. Moreover, the decision to proceed with the purchase, despite the prevailing market conditions, also carries with it potential reputational implications.

Shareholder Perspective and Market Volatility

MicroStrategy‘s stock performance has mirrored Bitcoin‘s volatility to a certain extent. Share prices briefly dipped before rebounding following the company’s recent announcements. This price volatility underscores the inherent risks associated with investing in a company whose fortunes are so closely tied to a single digital asset.

Ultimately, MicroStrategy‘s latest Bitcoin purchase reinforces its unwavering commitment to Bitcoin, despite the inherent market risks. Their strategy underscores a belief in Bitcoin‘s long-term potential, regardless of short-term price fluctuations.