Bitcoin’s Brief Stumble: A Technical Correction or More?

After a week of strong gains, Bitcoin (BTC) took a brief tumble on May 12, falling below $103,000 after hitting an intraday high of $105,819. The sudden correction caught some by surprise, especially given the positive news surrounding a potential US-China trade deal. While the market is abuzz with interpretations, experts are analyzing the factors behind this price dip and the potential implications for Bitcoin’s future trajectory.

Profit Taking and De-risking: A Leading Theory

Many analysts believe the price correction is a result of profit taking and de-risking ahead of the crucial May 13 Consumer Price Index (CPI) inflation report. The market has been anticipating this report, and its impact on monetary policy could influence Bitcoin’s direction. This view is supported by the uptick in selling observed in perpetual futures markets and spot markets, particularly near the $106,000 resistance level. The fact that Bitcoin failed to break and hold above $104,000 after the trade deal news suggests some traders may have closed their profitable long positions, choosing to wait for clearer signals from the CPI print.

On-Chain Data: A Mixed Bag

On-chain data provides mixed signals about the current market sentiment. While Glassnode’s data suggests sustained strength in new demand for Bitcoin, with “First-Time Buyers RSI” holding at 100 all week, the momentum buyers remain weak, and profit takers are on the rise. If new inflows slow down, a lack of follow-through could lead to further consolidation.

Bitcoin’s Growing Adoption: A Long-Term Narrative

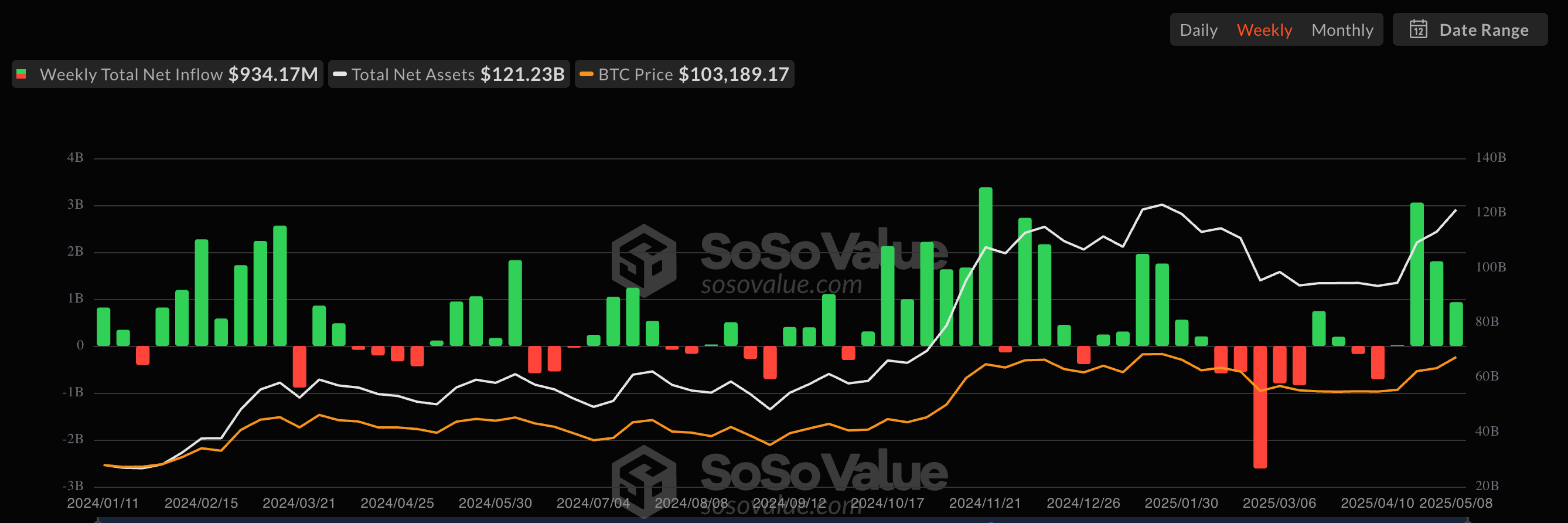

Despite the recent price correction, Bitcoin’s adoption within traditional finance continues to accelerate. Companies like Strategy continue to increase their Bitcoin holdings, and spot Bitcoin ETF inflows have been steadily rising in recent weeks. This growing adoption suggests a strong foundation for Bitcoin’s long-term growth, even amidst short-term price fluctuations.

Looking Ahead

The current price action is likely a short-term technical correction, influenced by the CPI print and profit-taking strategies. However, the underlying fundamentals remain bullish, suggesting that this dip could be temporary. The market will likely react to the CPI data, potentially influencing the direction of both spot and futures markets. As always, it is crucial for investors to conduct their own research and consider their risk tolerance before making any investment decisions.

“The current market action seems to be driven by a mix of profit-taking, de-risking, and caution ahead of the CPI print. However, the long-term trends in Bitcoin adoption remain positive, which should provide support for the market in the coming months.” – Crypto analyst, Sarah Johnson