Coinbase‘s 2026 Outlook: A Cautiously Optimistic View

Coinbase Institutional has released a comprehensive outlook, painting a picture of a potentially transformative year for the cryptocurrency market: 2026. The report, spanning 70 pages, highlights key factors that could drive significant changes, shifting the narrative from volatile speculation to institutional integration and regulatory maturity.

The Regulatory Tailwind

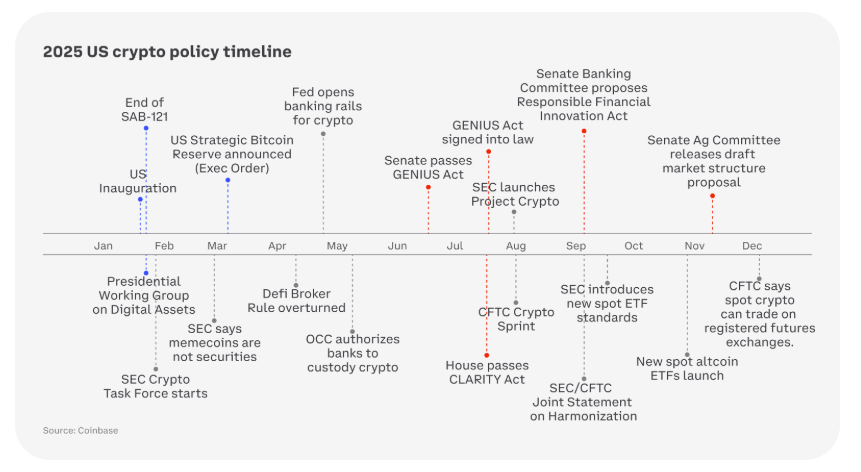

A central theme of the Coinbase report revolves around the expected clarity in global regulatory frameworks. The potential for stronger policy guardrails is seen as a catalyst, fostering innovation and supporting long-term market maturation. This shift contrasts sharply with previous retail-driven boom-and-bust cycles, with the emphasis now on deeper participation from traditional financial players.

Specifically, the report highlights the United States’ progress on stablecoin legislation and broader crypto market structure bills as critical. Initiatives like the GENIUS Act are expected to shape everything from risk management and compliance to institutional portfolio strategies. The evolution of US crypto policy is flagged as a key driver for the anticipated transformations in 2026.

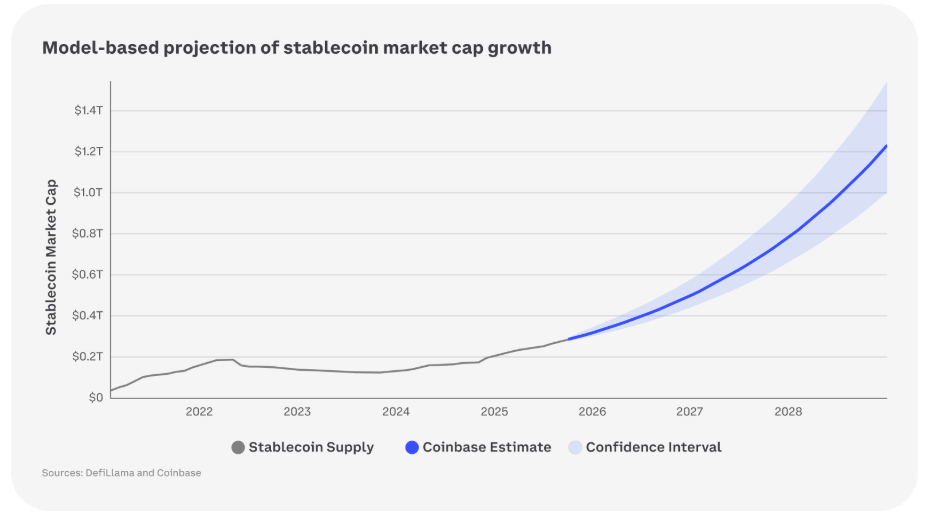

Stablecoins: The Projected Growth Engine

Stablecoins are another area of significant focus. Coinbase Institutional projects substantial expansion in the coming years. Their model forecasts a market size of approximately $1.2 trillion by 2028, fueled by increased utilization in payments, settlements, payroll processing, and cross-border remittances. This forecast underscores stablecoins‘ importance as one of crypto’s most established use cases and their potential to become a mainstream financial instrument.

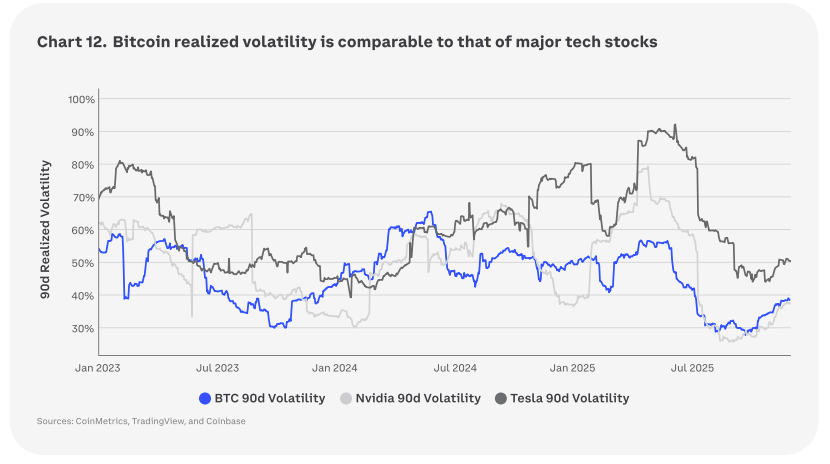

Bitcoin‘s Evolving Volatility

The report also analyzes Bitcoin‘s evolving volatility profile. Rather than an extreme outlier, Bitcoin‘s volatility is increasingly resembling that of high-growth technology stocks. This shift is notable, as Bitcoin’s 90-day historical volatility decreased to around 35% to 40% by the end of 2025, down from above 60% in mid-2024. This moderation occurred despite significant market structural changes, including the introduction of spot Bitcoin ETFs.

Macroeconomic Considerations

Coinbase Institutional adopts a “cautiously optimistic” macroeconomic outlook. While acknowledging potential uneven economic growth, the report points to the US economy’s resilience. However, persistent inflation risks and the timing of interest rate cuts remain crucial variables that could influence market dynamics heading into 2026.

The Bigger Picture

Overall, Coinbase Institutional’s report suggests that 2026 could be a pivotal year for digital assets. The confluence of regulatory advancements, stablecoin expansion, and Bitcoin‘s evolving characteristics points towards increased institutional integration and a maturing market. While uncertainties remain, the outlook signals a potentially more stable and integrated future for the crypto ecosystem.