ECB Doubles Down on Cash Amidst Digital Currency Push

The European Central Bank (ECB) is walking a tightrope. While actively developing a digital euro, it’s simultaneously reiterating its commitment to the continued use of physical cash. This seemingly contradictory stance highlights the complex interplay between traditional finance and the burgeoning world of digital currencies, particularly stablecoins and central bank digital currencies (CBDCs).

Cash: A Cornerstone of the Financial System

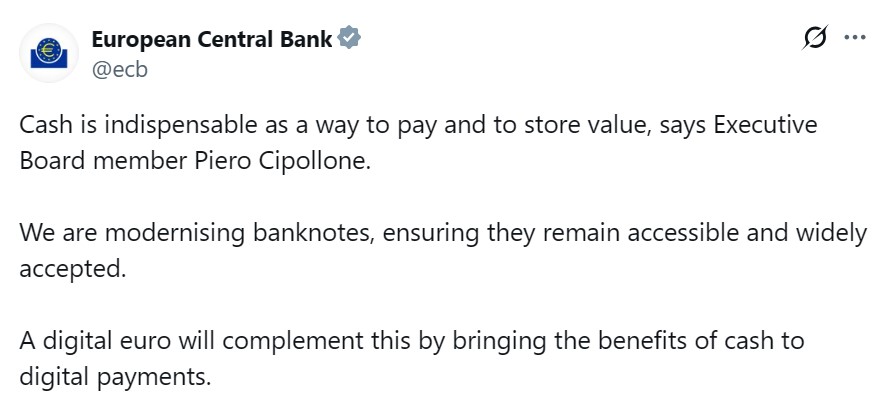

ECB Executive Board member Piero Cipollone recently emphasized that euro banknotes and coins will remain vital components of the European financial ecosystem, even with the advancement of the digital euro project. This position underscores the ECB‘s understanding of the enduring importance of cash, particularly in times of crisis when digital infrastructure might be compromised. Cipollone’s statement suggests a strategy aimed at providing consumers with a choice of payment options, encompassing cash, digital euros, and potentially other digital payment solutions.

The Digital Euro: A Complement, Not a Replacement

The ECB‘s vision for the digital euro is not one of replacing cash but of complementing it. The goal is to offer a secure, regulated digital alternative to privately issued stablecoins, mitigating the potential risks associated with unregulated digital currencies. The ECB believes a digital euro could fortify Europe’s payment autonomy and provide a stable foundation for financial innovation. This is particularly relevant in a financial landscape where stablecoins are increasingly used for cross-border transactions and everyday purchases.

Addressing the Stablecoin Challenge

The ECB‘s proactive approach is, in part, a response to the growing influence of stablecoins. These digital currencies, often pegged to the value of a fiat currency like the US dollar, pose a challenge to the dominance of central banks. The ECB is keen to ensure that euro-pegged stablecoins, alongside the digital euro, play a significant role in the future of payments within the Eurozone. ECB advisor Jürgen Schaaf has even called for global coordination in regulating stablecoins to combat the potential dominance of the US dollar in this space.

Consumer Preferences and Future Landscape

Recent ECB studies indicate that consumer interest in the digital euro is still relatively low. However, the ECB believes that the digital euro, combined with cash, can offer a flexible and reliable payment infrastructure catering to diverse payment preferences. The ultimate aim is to offer a payment ecosystem that offers security, accessibility, and choice for all users, whether they prefer traditional cash, digital euros, or potentially other innovative payment methods. As the financial world evolves, the ECB‘s strategic balancing act will be a key factor in shaping the future of money in Europe.