Genesis Lawsuit: Unpacking the Allegations Against DCG

The unfolding legal battle between bankrupt crypto lender Genesis and its parent company, Digital Currency Group (DCG), has taken a dramatic turn. Newly unsealed court documents, filed in Delaware, paint a troubling picture of alleged financial mismanagement, disregarded warnings, and a culture of deception orchestrated by DCG executives.

The ‘Alter Ego’ and Internal Concerns

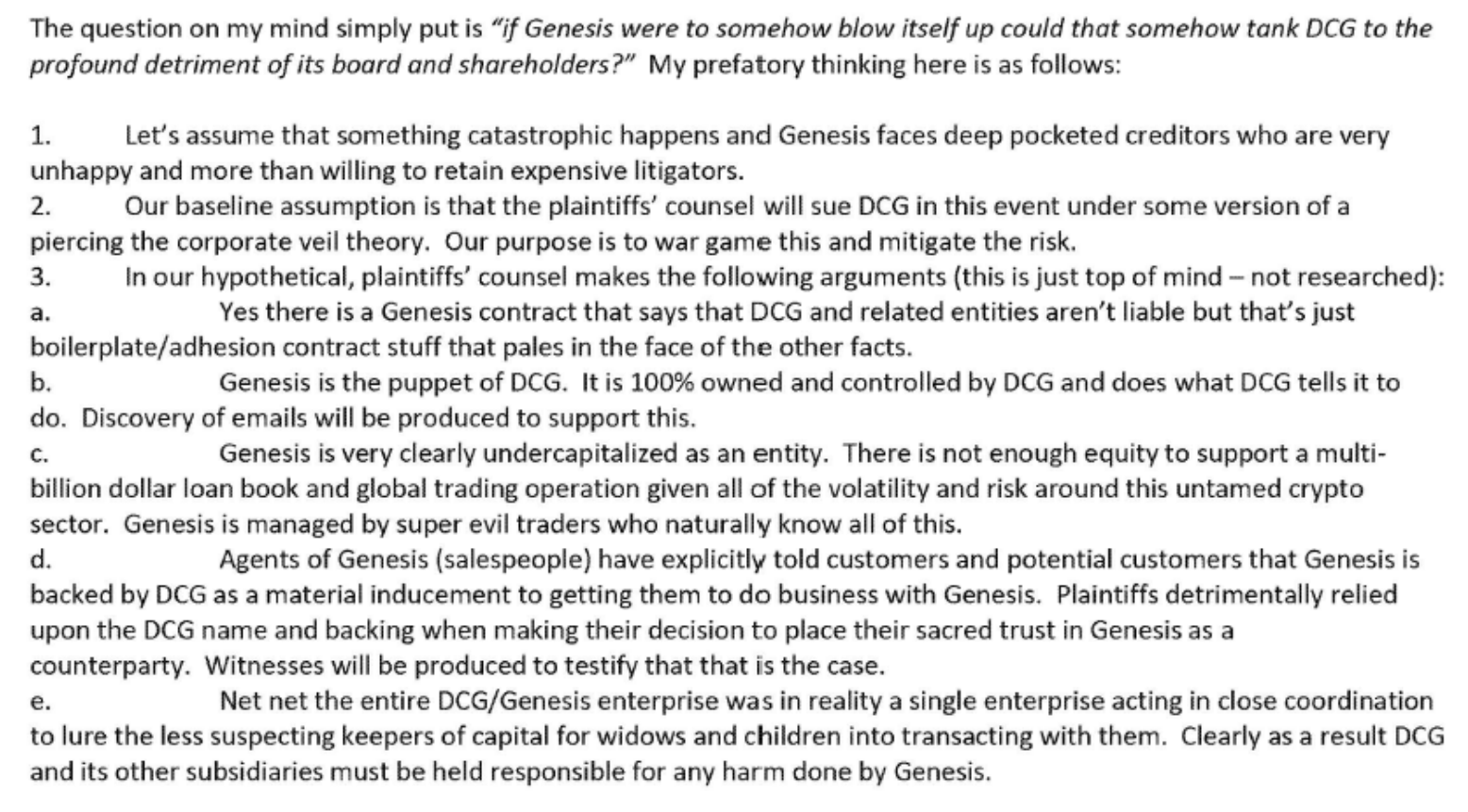

Central to the Genesis lawsuit is the accusation that DCG acted as Genesis‘s “alter ego,” essentially controlling the firm to its own benefit and to the detriment of creditors. The filing highlights internal communications, including a confidential memo, where DCG‘s CFO, Michael Kraines, acknowledged the inherent risks and prepared for potential legal challenges. This “war-gaming exercise,” conducted before Genesis‘s collapse, mirrors the very claims now at the heart of the lawsuit. This proactive approach suggests a deep awareness of the impending financial storm.

Ignored Warnings and a ‘Blind’ Genesis

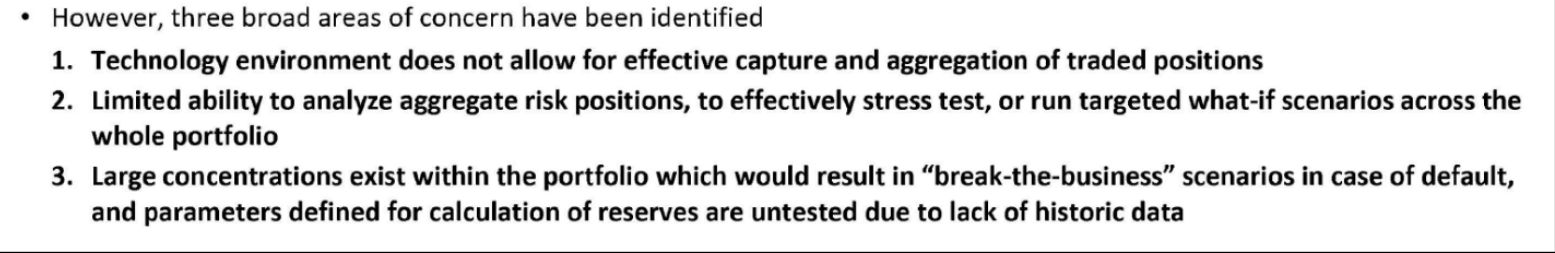

The complaint further alleges that DCG ignored serious warnings issued by third-party risk consultants. These warnings, dating back to 2020, flagged “significant deficiencies and material weaknesses” in Genesis‘s financial controls. Internal documents reveal DCG‘s admission that Genesis was operating “blindly” as its loan book ballooned. The delay in establishing a “contagion” risk committee, nine months after board approval, further underscores the alleged negligence.

A Toxic Workplace and Public Deception

The lawsuit also describes a toxic work environment where Genesis employees were expected to prioritize DCG‘s interests. Internal communications reveal a culture of “submission,” where staff allegedly served DCG‘s aims at the expense of good governance. Allegations of public deception are also prominent, with claims that Genesis staff were instructed to recite scripted messages to downplay the crisis following the collapse of Three Arrows Capital (3AC). The complaint alleges that DCG executives, including Barry Silbert, retweeted posts designed to minimize the severity of the situation.

Controversial Transactions and Seeking Recovery

The lawsuit focuses on several controversial transactions, including a June 2022 promissory note and a September 2022 “roundtrip” deal, which Genesis alleges were attempts to conceal insolvency. Genesis is seeking to recover over $3.3 billion from DCG, Barry Silbert, and other insiders. The Genesis Litigation Oversight Committee’s statement, “These are not merely technical disputes over intercompany accounting,” emphasizes the perceived deliberate nature of the alleged scheme.

What Lies Ahead

The Genesis lawsuit against DCG promises to be a pivotal case in the crypto industry. The outcome could have far-reaching implications for corporate governance and the responsibilities of parent companies towards their subsidiaries. As the legal proceedings continue, it remains to be seen whether these allegations will be proven. However, the detailed communications unearthed in the filings provide a disturbing glimpse into the alleged inner workings of DCG and its relationship with Genesis.