Gold‘s Renaissance and Bitcoin‘s Echo

A recent report from Deutsche Bank has sparked considerable interest in the financial world, drawing intriguing parallels between the resurgence of gold and the ongoing momentum of Bitcoin. The report highlights the significant increase in gold accumulation by global central banks, a trend that may have profound implications for the future of Bitcoin and the broader crypto landscape.

Gold‘s Resurgence: A Reflection of the Past

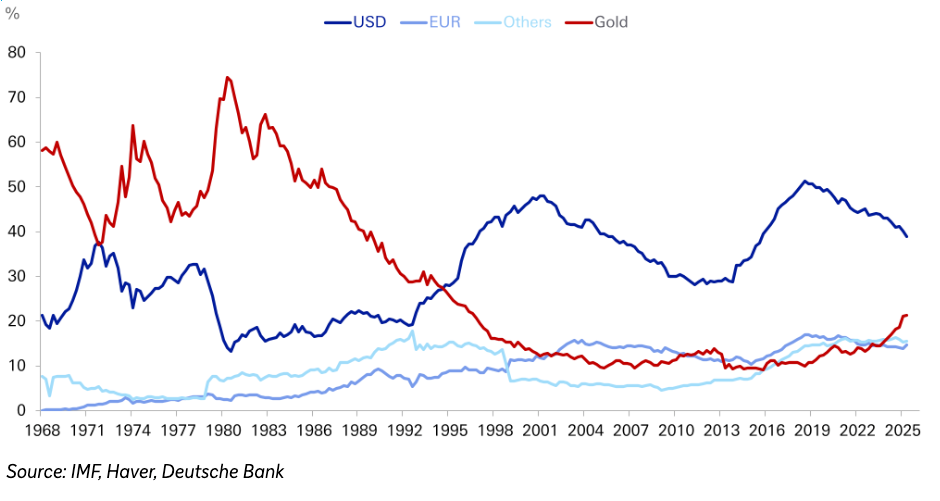

Deutsche Bank strategists observed that gold’s share in central bank reserves reached 24% in the second quarter of the year, the highest since the 1990s. This renewed appetite for gold echoes the behavior seen in the 20th century, marking a notable shift in global finance. The report emphasizes that official demand for gold is currently running at twice the pace of the 2011-2021 average. This accelerated accumulation, coupled with gold recently surpassing its inflation-adjusted all-time highs from 1980, paints a compelling picture of gold‘s resurgence as a safe-haven asset.

Bitcoin’s Parallel Journey: Volatility and Diversification

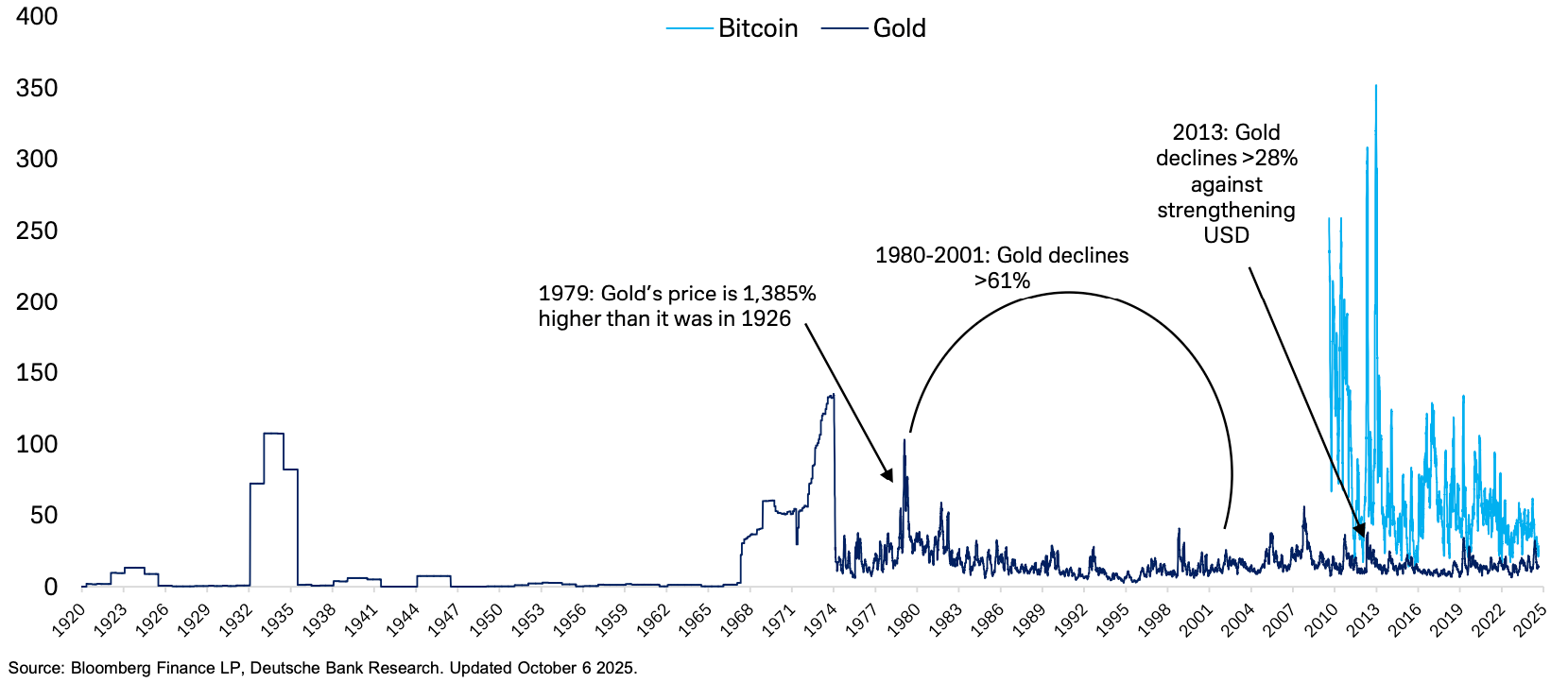

Deutsche Bank’s macro strategist, Marion Laboure, pointed out a set of striking similarities between gold and Bitcoin, potentially making Bitcoin an attractive store of value. Both assets have demonstrated high volatility and periods of underperformance throughout their respective histories. Notably, both gold and Bitcoin exhibit low correlation with traditional assets, presenting notable diversification benefits for investors and central banks alike. Laboure suggests, the factors underpinning both assets’ appeal share many of the same dynamics, creating a fascinating parallel between the two.

Bitcoin as a Reserve Asset: Challenges and Opportunities

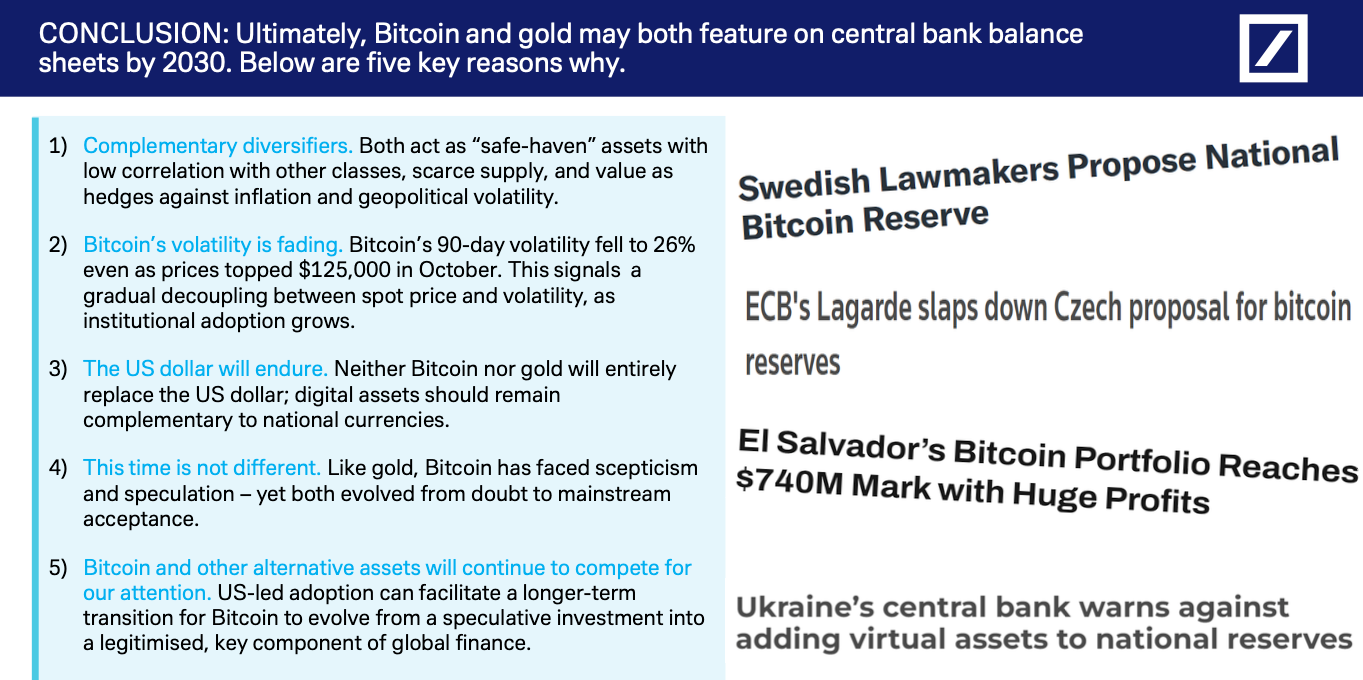

Laboure acknowledges the challenges associated with Bitcoin, citing high volatility and the lack of backing as counterarguments against its adoption as a reserve asset. However, she also notes that Bitcoin’s volatility has fallen to historic lows. Other concerns, including limited usability, perceived risk, speculative nature, cyber vulnerabilities, and liquidity constraints, are considered. Despite these concerns, Laboure’s prediction that both Bitcoin and gold may feature on central bank balance sheets by 2030 is a bold one, driven by their shared characteristics as safe-haven assets.

Implications and the Future

The Deutsche Bank report arrives amid increasing institutional adoption of Bitcoin and interest from certain governments in holding Bitcoin as part of their strategic reserves. While volatility remains a hurdle for many central bankers, the report suggests that Bitcoin’s evolution and growing acceptance could potentially reshape the landscape of central bank reserves. The report’s insights prompt critical thinking about the evolving role of digital assets and the broader economic environment. The future is unwritten, but the convergence of gold’s historical significance and Bitcoin’s innovative potential presents a compelling narrative for the coming years.