Ripple‘s Transformation: A New Era of Institutional Interest

Ripple‘s recent $500 million fundraising round, culminating in a staggering $40 billion valuation, marks a significant turning point for the company. Once embroiled in a lengthy legal battle with the US Securities and Exchange Commission (SEC), Ripple is now attracting serious attention from Wall Street giants. This shift signals not just a change in fortune, but a strategic pivot towards a more comprehensive crypto-native settlement stack.

The Institutional Stampede: Who’s Investing?

The latest funding round attracted an unusually heavy institutional roster, including Citadel Securities, Fortress Investment Group, and funds connected to prominent players like Galaxy Digital, Pantera Capital, and Brevan Howard. This influx of capital demonstrates a growing acceptance of Ripple, and the wider crypto ecosystem, by mainstream financial institutions. This is a crucial step towards further adoption and legitimization of digital assets.

Downside Protection: A Sweetener for Investors

Bloomberg reported that Ripple‘s success in securing this heavy investment can be attributed to attractive deal terms. These terms offer significant downside protections for participating funds. Investors can sell their shares back to Ripple after three or four years with a guaranteed annualized return of approximately 10%. If Ripple goes public within that timeframe, this option is no longer available. However, Ripple retains the right to repurchase the shares, offering investors an even higher return of roughly 25%.

Beyond Cross-Border Payments: Expanding the Crypto Arsenal

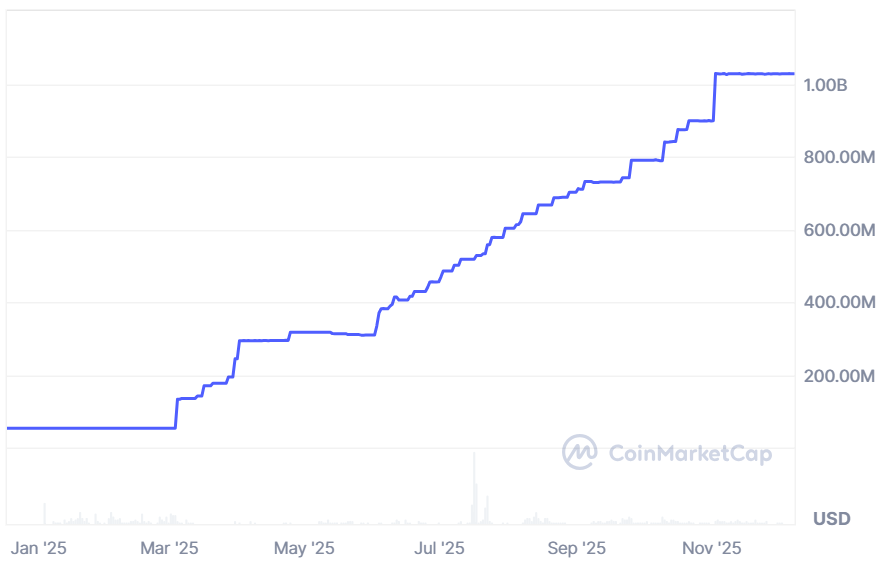

Ripple is no longer solely focused on cross-border payments. The company is strategically repositioning itself, expanding its focus and services. This includes a major push into the stablecoin market with Ripple USD (RLUSD), which has already surpassed a $1 billion market capitalization.

Additionally, Ripple acquired non-bank prime broker Hidden Road (now Ripple Prime) and treasury-management company GTreasury, highlighting the company’s efforts to build a complete institutional infrastructure stack.

XRP‘s Central Role: A Lingering Question

Despite Ripple‘s diversification, some institutional investors still see their investment as a bet on XRP. Bloomberg reported that some involved funds estimate that approximately 90% of Ripple‘s net asset value is linked to XRP, even though Ripple repeatedly emphasizes its independence from the token. This dichotomy underscores the ongoing debate surrounding XRP‘s regulatory status and its long-term role within the Ripple ecosystem.

Conclusion: The Future of Ripple

Ripple‘s transformation is undeniable. By attracting significant investment from Wall Street, expanding its services, and strategically positioning itself in the market, Ripple is charting a new course. While the path ahead might have challenges, the company’s evolution is undoubtedly fascinating and demonstrates the rapid evolution of the crypto landscape.