Stripe Expands into Stablecoin Territory

In a significant move, Stripe, a global payments platform, has unveiled stablecoin-based accounts for its clients in over 100 countries. This expansion, announced on May 7th, positions Stripe at the forefront of the burgeoning stablecoin market, catering to the growing demand for alternative financial solutions in developing economies.

The new feature enables Stripe clients to “send, receive, and hold US-dollar stablecoin account balances, similar to how a traditional fiat bank account works.” The platform currently supports two stablecoins: Circle’s USDC (USDC) and Bridge’s USDB (USDB), with the latter being acquired by Stripe in October 2024. This integration allows for seamless transactions and value storage in a more stable and accessible format.

Stablecoins: A Lifeline for Developing Economies?

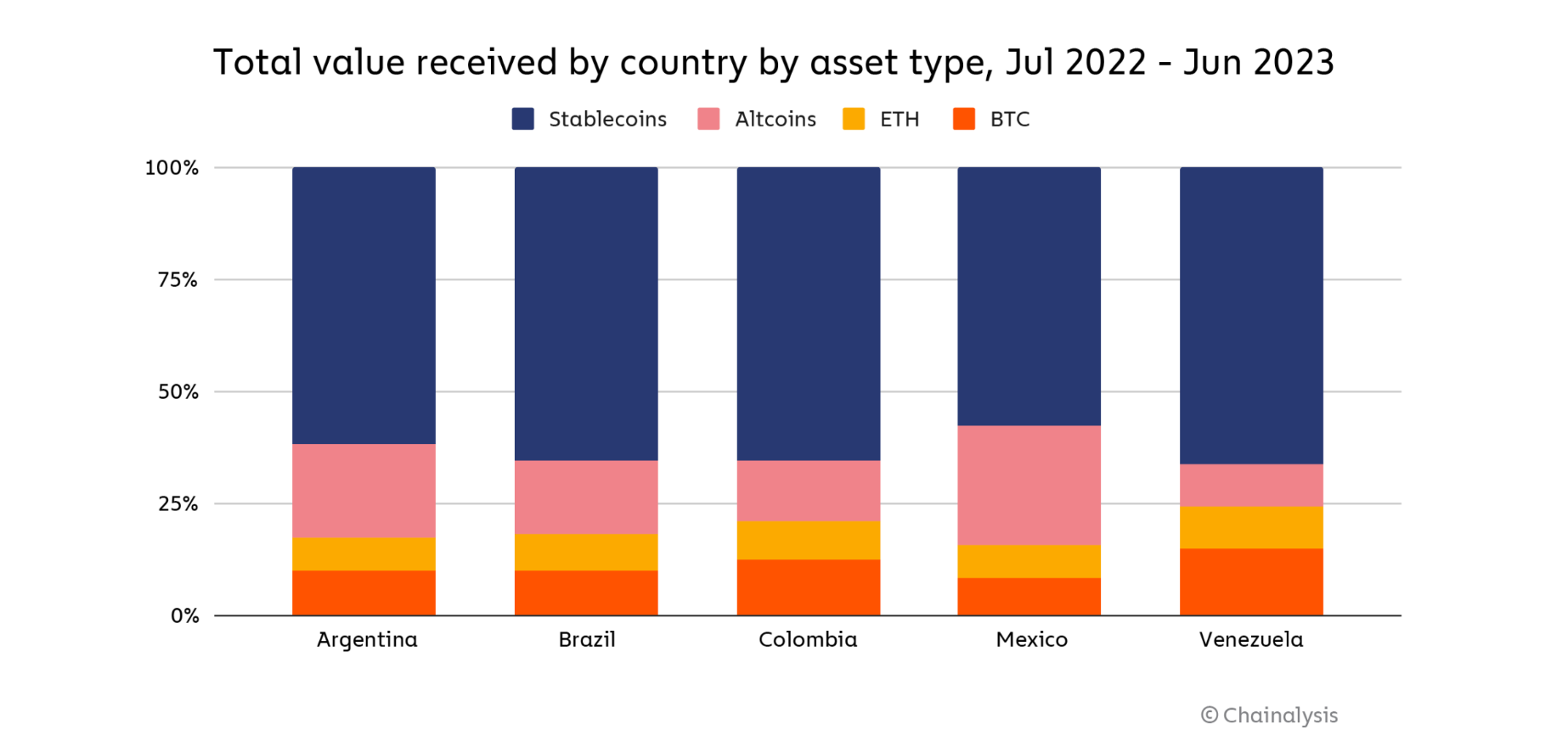

Stripe‘s move comes at a crucial juncture for the stablecoin landscape. As developing economies grapple with high inflation, capital controls, and a lack of robust financial infrastructure, stablecoins are increasingly recognized as a viable alternative. The stability of these tokens pegged to the US dollar offers a refuge from volatile local currencies and provides access to a global financial network.

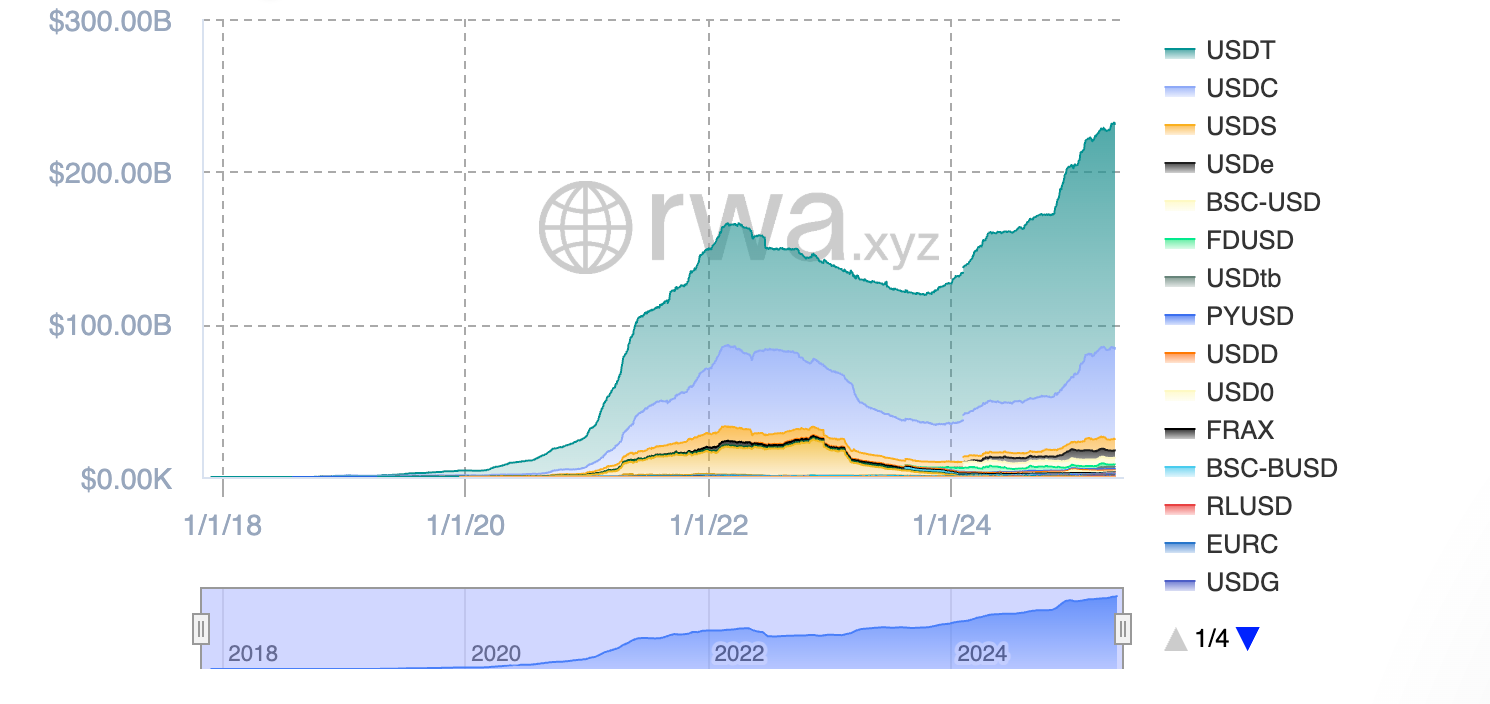

This demand is driving the global stablecoin market cap beyond $231 billion and continues to grow, especially in regions like Latin America. The adoption of stablecoins in these areas is fueled by their potential to bridge the gap in financial inclusion, offering a secure and efficient way to transact and store value.

Stripe‘s Previous Foray into Stablecoin Payments

This latest expansion follows Stripe‘s earlier integration of USD stablecoin payments in October 2024. The initial rollout, which encompassed 70 countries, saw a surge in demand for the stablecoin payment option, highlighting the growing preference for these digital currencies.

Implications and Perspectives

Stripe‘s move signifies a pivotal shift towards a more inclusive financial system. By embracing stablecoins, the platform is tapping into a global market seeking alternatives to traditional banking systems. The expansion is likely to further fuel the adoption of stablecoins and solidify their position as a viable option for individuals and businesses in developing economies.

However, it’s important to acknowledge that the use of stablecoins is not without its challenges. Regulatory uncertainty, potential volatility, and the need for enhanced security measures are issues that require careful consideration. As stablecoins continue to gain traction, the financial landscape is poised for significant transformation, and Stripe‘s foray into this space is a testament to the evolving dynamics of the global economy.