Telegram Wallet Integrates Tokenized Equities via xStocks

The world of traditional finance is inching closer to the realm of cryptocurrency, and Telegram is leading the charge. Wallet in Telegram, a crypto wallet application within the popular messaging platform, is partnering with Kraken, a US-based crypto exchange, and Backed, a tokenization platform, to introduce tokenized stocks and ETFs (exchange-traded funds) via xStocks. This integration marks a significant step toward bridging the gap between traditional financial instruments and the crypto ecosystem, bringing assets like Strategy (MSTR) and Nvidia (NVDA) to Telegram users.

Early Rollout and Expansion Plans

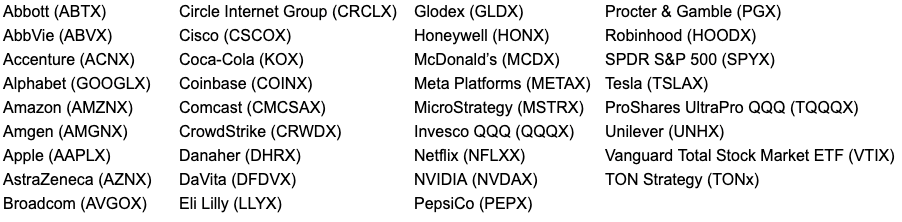

The initial rollout, slated for October, will begin in a limited number of markets. The focus, according to Wallet in Telegram, is on carefully testing adoption and ensuring a positive user experience while adhering to regulatory compliance. Initially, 35 tokenized stocks, including Circle (CRCLX), Coinbase (COINX), Robinhood (HOODX), and TON Strategy (TONx), will be available. The project aims to expand the offering to over 60 tokenized US stocks and ETFs by the end of 2025. These tokenized assets are fully collateralized 1:1 with the underlying asset, providing a degree of security and transparency for users.

Focus on Emerging Markets

The integration of xStocks within Wallet in Telegram will prioritize emerging markets during its initial launch. This strategic decision aligns with Backed‘s focus on developing economies. While the specific countries targeted for the initial rollout have not been officially disclosed, the choice suggests a desire to tap into regions with growing crypto adoption and potential for increased access to global investment opportunities. This approach reflects a broader trend of integrating traditional financial assets into blockchain-based platforms, especially in regions where access to conventional financial services may be limited.

Compliance and Transparency: Key Differentiators

The xStocks offering is designed to comply with regulatory standards. These tokenized equities are issued under a compliant prospectus with detailed investor disclosures, differentiating them from some other tokenized equity offerings. This transparency, combined with the 1:1 collateralization, aims to provide investors with a higher degree of confidence and security. As regulatory scrutiny of crypto-related products intensifies, the emphasis on compliance becomes increasingly vital for long-term sustainability.

Bitcoin‘s Role in the Ecosystem

While Bitcoin ETFs are not part of this specific offering, Bitcoin itself remains available for purchase as a crypto asset within the custodial Crypto Wallet. This further underscores the growing acceptance of crypto, alongside the expanding integration of tokenized assets into user-friendly platforms. This project comes shortly after Telegram founder Pavel Durov revealed his early Bitcoin investments, adding a layer of legitimacy and alignment with the crypto world. The focus on both Bitcoin and now tokenized equities suggests a comprehensive strategy to serve the evolving needs of a crypto-savvy audience.