Voltage: Pioneering USD-Settled Lightning Credit Lines

In a significant move to bridge the gap between traditional finance and the burgeoning Bitcoin ecosystem, Bitcoin infrastructure company Voltage has unveiled Voltage Credit, a groundbreaking revolving credit line designed specifically for businesses leveraging the Lightning Network. This innovative product allows companies to send instant payments via Lightning while settling their credit obligations in US dollars, thereby offering a seamless and flexible financial solution.

Instant Payments, Traditional Repayment: A Paradigm Shift

At the core of Voltage Credit is the ability to provide instant payment finality, a hallmark of the Lightning Network. Businesses can now benefit from the speed and efficiency of Lightning transactions, which bypass the delays inherent in traditional banking systems. Simultaneously, they can repay their credit lines in USD from a standard bank account, providing familiarity and ease of use. This unique combination targets chief financial officers and treasurers seeking the agility of instant payments without the necessity of holding Bitcoin on their balance sheets, addressing a key barrier to entry for many businesses.

The Advantage Over Existing Solutions

While other payment platforms have explored faster payment solutions or offered working capital options, Voltage Credit distinguishes itself by integrating a revolving credit facility directly into the Lightning payment flow. CEO Graham Krizek noted the difference between Voltage‘s approach and that of companies like Stripe and Block. Voltage allows businesses to originate credit and immediately use it for Lightning and stablecoin transactions, eliminating pre-funding requirements. This contrasts with existing models where Lightning and credit are often separate workflows. Furthermore, Voltage‘s credit lines are underwritten based on payment flows rather than requiring static Bitcoin collateral, making the process more accessible.

Key Features and Advantages

- Instant Payment Finality: Leveraging the speed of the Lightning Network.

- USD Settlement: Simplifying repayment through traditional banking channels.

- Underwriting Based on Payment Flows: Reducing reliance on Bitcoin collateral.

- Targeted at CFOs and Treasurers: Meeting the needs of financial decision-makers.

Scaling for Institutional Adoption

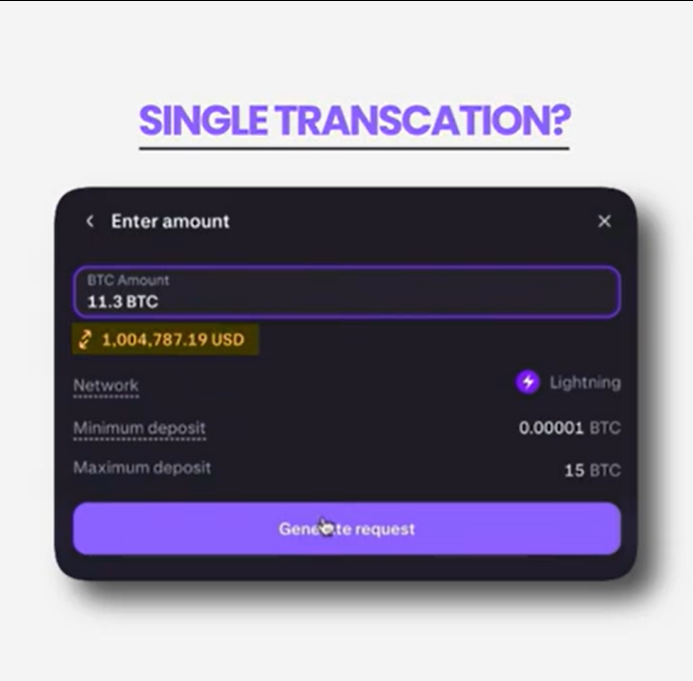

The launch of Voltage Credit builds upon Voltage‘s prior support of a $1 million Lightning Network payment between Secure Digital Markets and Kraken, which was considered the largest publicly reported transaction on the network at the time. This pilot demonstrated Lightning’s capacity for institutional-sized transactions, and Voltage is capitalizing on this to provide payment solutions for the industry. Krizek emphasized that the Lightning Network is ready for institutional-scale use, and this latest product is designed to facilitate that adoption.

Voltage Credit is initially available to qualified US-based businesses, with plans for expansion. Early traction has been seen from exchanges, Bitcoin miners, gaming platforms, and payment processors, all looking to optimize their working capital. Voltage Credit offers a competitive 12% annual percentage yield (APY) on outstanding balances and avoids transaction-based pricing, offering a predictable cost structure that scales with usage. By introducing the familiar concept of revolving credit into the instant payment environment of Bitcoin and Lightning, Voltage is modernizing financial infrastructure for the digital age.