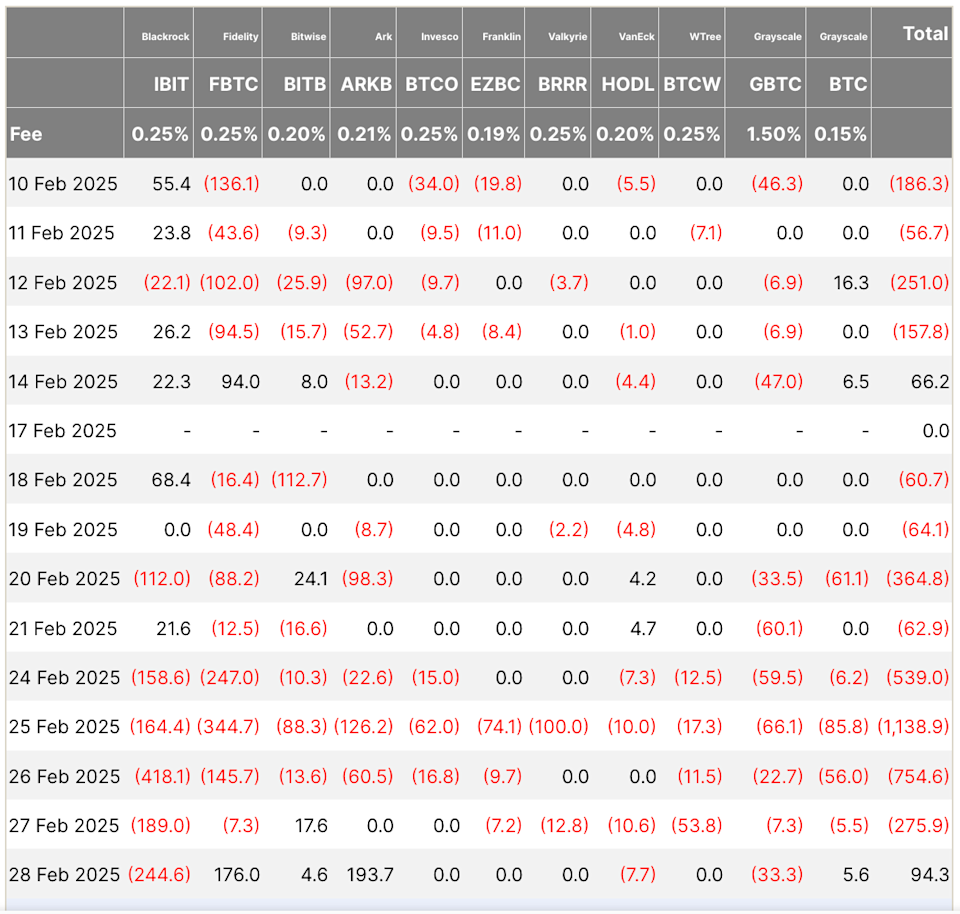

Spot Bitcoin exchange-traded funds (ETFs) in the U.S. recorded $94.3 million in inflows on the final day of February, marking a potential shift in investor sentiment after the worst month for crypto in three years.

This inflow brought an end to an eight-day streak of outflows that saw investors pull over $3.2 billion from Bitcoin ETFs amid a market downturn.

Despite the broader trend reversal, BlackRock’s iShares Bitcoin Trust (IBIT), the largest spot Bitcoin ETF by assets under management, experienced a notable $244.6 million in outflows on Friday. However, other major ETFs showed resilience—Fidelity’s FBTC attracted $176 million in fresh capital, while the ARK 21Shares Bitcoin ETF saw the highest inflows at $193.7 million, according to data from Farside Investors.

The shift in ETF flows coincided with signs of a market rebound. Bitcoin, which briefly dropped to $78,000 in the early hours of February 28, has since climbed 1.6% in the last 24 hours to trade around $84,900. Meanwhile, the broader CoinDesk 20 Index rose 0.3% to 2,705.

Despite this short-term recovery, Bitcoin remains down roughly 12% over the past week, with the broader crypto market, as tracked by the CoinDesk 20 Index, seeing a 15.8% decline. Spot Bitcoin ETFs had been experiencing sustained outflows since February 14, the last day they recorded inflows of $66.2 million.

In contrast, spot Ether ETFs continued their outflow streak on February’s final day, with $41.9 million leaving these funds. Since their last day of positive net flows, Ether ETFs have lost $357.5 million, according to Farside data.

The recent uptick in Bitcoin’s price and ETF inflows comes as the White House announced that former U.S. President Donald Trump will host a crypto summit on March 7. Additionally, BlackRock—the world’s largest asset manager—has reportedly allocated between 1% and 2% of its spot Bitcoin ETF to one of its model portfolios, signaling renewed institutional interest.