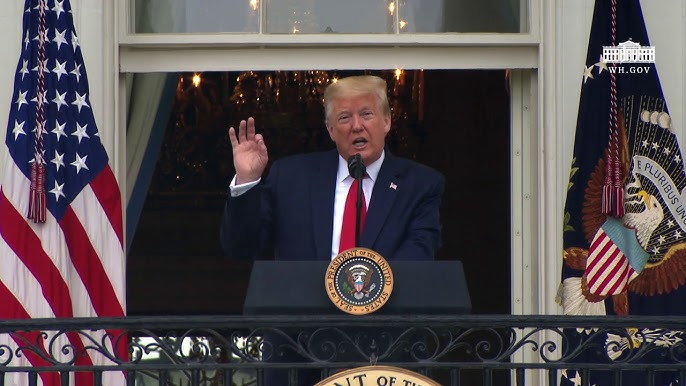

On March 7, 2025, US President Donald Trump is set to host a pioneering event—the first-ever White House Crypto Summit, which will bring together influential figures from the cryptocurrency sector to address key issues such as digital asset regulation, the oversight of stablecoins, and Bitcoin’s potential role in reshaping the US financial landscape.

Industry leaders, including top crypto founders, CEOs, and investors, are expected to attend the summit alongside members of the President’s Working Group on Digital Assets. The summit’s coordination will be led by David Sacks, the newly appointed White House Crypto and AI Czar, and Bo Hines, the executive director of the Working Group. Sacks, who was assigned this critical role in December 2024, has a clear mandate to work on establishing a robust legal framework that will provide the crypto industry with much-needed clarity, allowing it to flourish in the US.

Trump has long expressed his commitment to making cryptocurrency policy a national priority, with a focus on transforming the US into a global leader in blockchain innovation. This summit is seen as a key step in that direction, with potential implications for crypto regulations in the years ahead. As the summit draws near, the crypto community is eager to learn how Trump’s administration will balance regulatory concerns with fostering innovation in this fast-evolving space.

One of Sacks’ core responsibilities will be to ensure online speech protection, preventing the influence of Big Tech censorship on cryptocurrency discourse. This aligns with Trump’s broader efforts to safeguard freedom of speech on digital platforms.

While no specific agenda has been confirmed for the summit, the regulation of stablecoins remains a top priority. The recent call from Jeremy Allaire, co-founder of Circle—the issuer of the world’s second-largest stablecoin—for global stablecoin issuers to register with US authorities has reignited debates on the topic. Allaire stressed that stablecoin issuers should not be allowed to bypass US laws, urging compliance with US regulations regardless of the issuer’s country of origin.

The summit is also expected to touch on legislation related to the creation of a US-backed Bitcoin reserve. At least 24 US states have proposed bills regarding the establishment of Bitcoin reserves, signaling growing interest in Bitcoin as a financial asset of strategic importance. However, some experts caution that unless a significant move or purchase plan is announced at the summit, these state-level initiatives may not dramatically impact the broader market.

Iliya Kalchev, a dispatch analyst at Nexo, remarked that while Texas’ pro-crypto stance is well-known, the true market impact of such initiatives will only be felt if major policy shifts or large-scale Bitcoin purchases are unveiled. He notes that Bitcoin’s long-term returns—averaging over 1,000% in the past five years—demonstrate the lucrative potential for investors holding Bitcoin as part of a strategic portfolio.

As the crypto industry awaits the White House summit, many are hopeful that this event will provide clearer insights into the regulatory landscape of digital assets in the US. With significant decisions on the horizon, the summit may serve as a pivotal moment in shaping the future of crypto regulations and policy in the United States.