Introduction

Blockchain is revolutionizing industries by enabling secure, transparent, and decentralized record-keeping. But how does it actually work? This article provides a detailed, structured breakdown of blockchain’s underlying mechanisms, from transactions to consensus algorithms, making it suitable for academic and professional audiences.

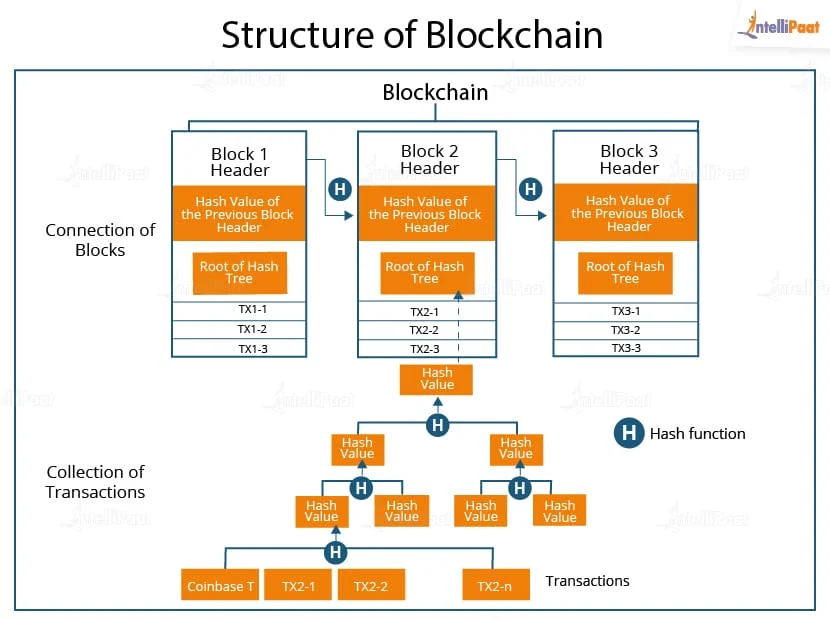

1. The Basic Structure of a Blockchain

A blockchain is a chain of blocks, where each block contains:

- Transaction data (e.g., sender, receiver, amount).

- A cryptographic hash (a unique digital fingerprint of the block).

- The previous block’s hash (linking blocks in chronological order).

This structure ensures:

✅ Immutability – Once data is recorded, it cannot be altered.

✅ Transparency – All transactions are publicly verifiable.

✅ Security – Tampering requires changing all subsequent blocks, which is computationally infeasible.

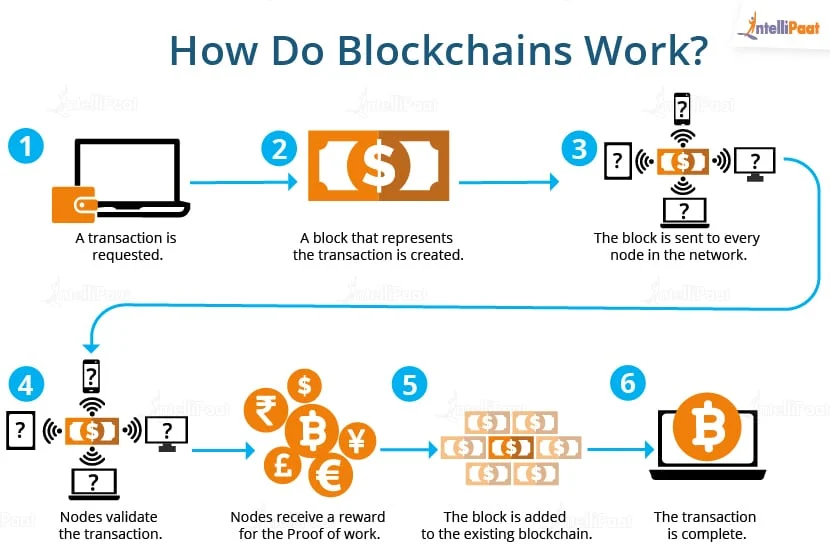

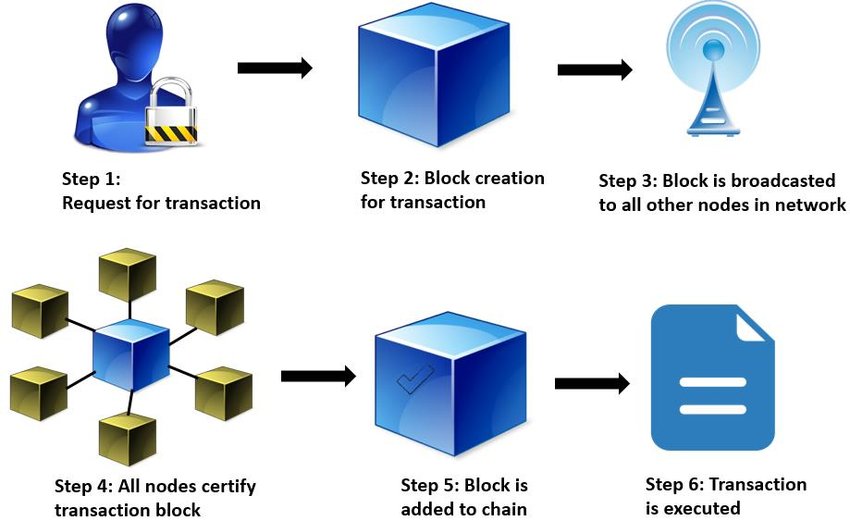

2. Step-by-Step: How a Transaction is Processed

Step 1: Transaction Initiation

- A user requests a transaction (e.g., sending cryptocurrency).

- The transaction is broadcast to a peer-to-peer (P2P) network of nodes (computers).

Step 2: Transaction Validation

- Nodes verify the transaction using consensus mechanisms (e.g., Proof of Work, Proof of Stake).

- Checks include:

- Digital signature (proof of ownership).

- Sufficient funds (no double-spending).

Step 3: Block Formation

- Valid transactions are grouped into a block.

- The block is given a unique hash (using algorithms like SHA-256).

Step 4: Block Addition to the Chain

- The new block is linked to the previous one via its hash.

- The updated blockchain is distributed across the network.

3. Key Mechanisms That Make Blockchain Secure

A. Cryptographic Hashing

- Each block has a unique hash generated from its data.

- Changing any data alters the hash, breaking the chain.

B. Consensus Algorithms (How Agreement is Reached)

| Algorithm | How It Works | Example Blockchains |

|---|---|---|

| Proof of Work (PoW) | Miners solve complex puzzles to validate blocks. | Bitcoin, Litecoin |

| Proof of Stake (PoS) | Validators are chosen based on coins staked. | Ethereum 2.0, Cardano |

| Delegated PoS (DPoS) | Stakeholders vote for delegates to validate. | EOS, Tron |

| Byzantine Fault Tolerance (BFT) | Nodes must agree on transaction validity. | Ripple, Stellar |

C. Decentralization & Node Participation

- No single entity controls the blockchain.

- Nodes maintain copies of the ledger, ensuring no single point of failure.

4. Real-World Blockchain Applications

A. Cryptocurrencies (Digital Money)

- Bitcoin: Decentralized peer-to-peer cash.

- Ethereum: Smart contracts & decentralized apps (DApps).

B. Smart Contracts (Self-Executing Agreements)

- Automate processes (e.g., insurance payouts, supply chain tracking).

- Used in DeFi (Decentralized Finance).

C. Supply Chain Transparency

- Track products from origin to consumer (e.g., Walmart’s food safety system).

D. Digital Identity & Voting

- Secure, tamper-proof identity verification.

- Prevents election fraud via blockchain-based voting.

5. Challenges & Limitations

- Scalability – Bitcoin processes ~7 transactions/second vs. Visa’s 24,000.

- Energy Consumption – PoW mining uses massive electricity (e.g., Bitcoin’s carbon footprint).

- Regulation – Governments struggle to classify crypto assets.

6. Why Understanding Blockchain Matters

- Career Opportunities – High demand for blockchain developers, auditors, and analysts.

- Academic Research – New consensus models, privacy solutions (ZK-Proofs), and scalability fixes (sharding).

- Business Innovation – Companies use blockchain for fraud prevention and efficiency.

Conclusion

Blockchain’s power lies in its decentralized, secure, and transparent nature. By combining cryptography, consensus algorithms, and peer-to-peer networking, it eliminates the need for intermediaries. While challenges like scalability remain, blockchain’s potential in finance, governance, and beyond is undeniable.