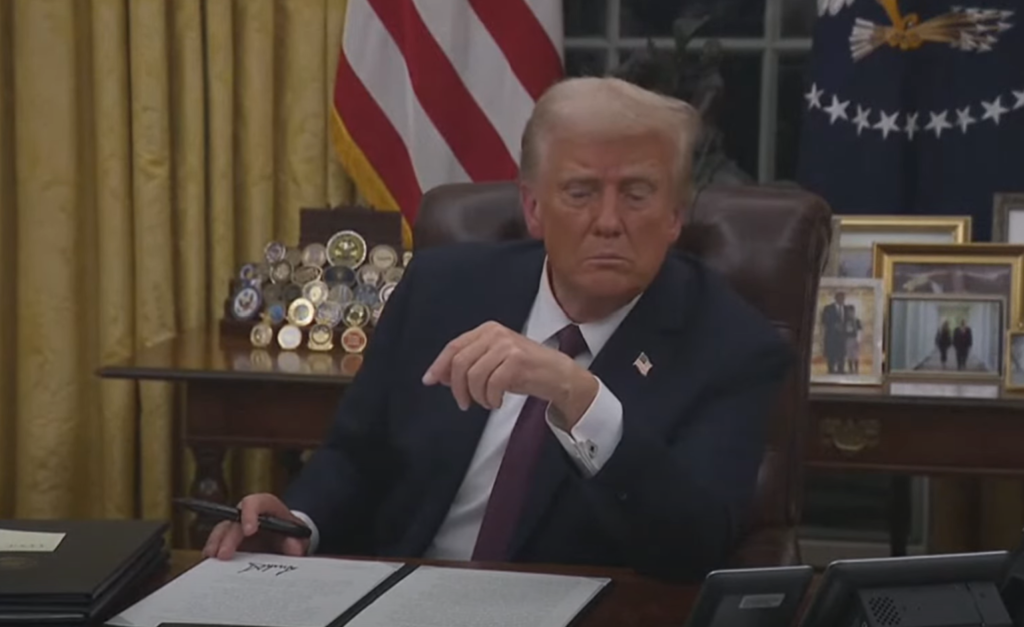

In a surprising twist, former U.S. President Donald Trump is reportedly considering replacing his proposed Crypto Council with a series of crypto summits. According to an insider, this shift in strategy is partly due to concerns over Ripple and its ongoing legal battles with the Securities and Exchange Commission (SEC). This development has sparked widespread speculation about the future of cryptocurrency regulation and Trump’s stance on digital assets. In this article, we’ll explore the details of this potential shift, analyze the implications for the crypto industry, and discuss what this means for investors and stakeholders.

The Proposed Crypto Council

Trump’s initial plan to establish a Crypto Council was aimed at providing a platform for industry leaders, regulators, and policymakers to collaborate on shaping the future of cryptocurrency regulation. Key objectives included:

- Regulatory Clarity: Creating clear and consistent regulations to foster innovation and protect investors.

- Industry Engagement: Engaging with crypto industry leaders to address challenges and opportunities.

- Economic Growth: Leveraging the potential of cryptocurrencies to drive economic growth and job creation.

Why the Shift to Crypto Summits?

According to an insider, the decision to replace the Crypto Council with a series of summits is influenced by several factors, with Ripple being a primary concern:

1. Ripple’s Legal Challenges

- SEC Lawsuit: Ripple’s ongoing legal battle with the SEC over whether XRP is a security has created significant uncertainty in the crypto industry.

- Regulatory Risks: The outcome of the lawsuit could have far-reaching implications for the entire crypto market, making it a contentious issue for any regulatory initiative.

2. Broader Industry Concerns

- Diverse Perspectives: The crypto industry is highly diverse, with varying interests and priorities. A single council may struggle to address the needs of all stakeholders.

- Flexibility: Summits offer a more flexible and dynamic approach to addressing emerging issues and opportunities in the crypto space.

3. Political Considerations

- Public Perception: Trump’s team may be concerned about the public perception of aligning too closely with a specific industry, especially given the controversies surrounding Ripple.

- Strategic Positioning: Summits allow for a more strategic and targeted approach to engaging with the crypto industry, without the formal structure of a council.

Implications for the Crypto Industry

The shift from a Crypto Council to summits has several important implications for the crypto industry:

1. Regulatory Clarity

- Ongoing Uncertainty: The lack of a formal council could delay efforts to achieve regulatory clarity, creating continued uncertainty for businesses and investors.

- Incremental Progress: Summits may lead to incremental progress on specific issues, but a comprehensive regulatory framework may remain elusive.

2. Industry Engagement

- Broader Participation: Summits could attract a wider range of participants, including regulators, industry leaders, and academics, fostering more inclusive discussions.

- Focused Discussions: Summits allow for more focused discussions on specific topics, such as DeFi, NFTs, and blockchain innovation.

3. Market Impact

- Investor Confidence: The shift in strategy could impact investor confidence, as the lack of a formal council may signal a less coordinated approach to regulation.

- Market Volatility: Continued regulatory uncertainty could contribute to market volatility, affecting the prices of cryptocurrencies like Bitcoin and Ethereum.

What This Means for Investors

For investors, the shift from a Crypto Council to summits presents both opportunities and challenges:

Opportunities:

- Informed Decision-Making: Summits could provide valuable insights into regulatory trends and industry developments, helping investors make informed decisions.

- Networking Opportunities: Summits offer opportunities to connect with industry leaders and gain a deeper understanding of the crypto landscape.

Challenges:

- Regulatory Uncertainty: The lack of a formal council could prolong regulatory uncertainty, creating challenges for long-term investment strategies.

- Market Volatility: Continued uncertainty could lead to increased market volatility, requiring careful risk management.

Key Takeaways

- Shift in Strategy: Trump may replace the proposed Crypto Council with a series of summits, partly due to concerns over Ripple’s legal challenges.

- Regulatory Clarity: The shift could delay efforts to achieve regulatory clarity, creating ongoing uncertainty for the crypto industry.

- Industry Engagement: Summits offer a more flexible and inclusive approach to engaging with the crypto industry.

- Investor Strategy: Investors should stay informed about regulatory developments and be prepared for potential market volatility.

Conclusion

The potential shift from a Crypto Council to summits reflects the complexities and challenges of regulating the rapidly evolving cryptocurrency industry. While summits offer a more flexible and inclusive approach, the lack of a formal council could delay efforts to achieve regulatory clarity and stability.

For investors and stakeholders, this development underscores the importance of staying informed, managing risk, and being prepared for ongoing uncertainty. Whether through a council or summits, the need for clear and consistent regulations remains critical to the future of the crypto industry.