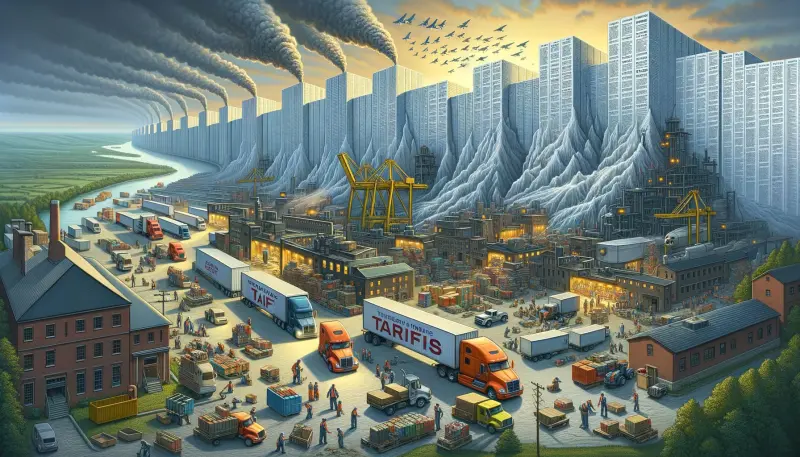

Former U.S. President Donald Trump has reiterated his stance on imposing hefty tariffs on imports if he is re-elected in 2024. Among the most impacted sectors could be electric vehicles (EVs), steel, and semiconductor chips, with some analysts warning of price hikes of up to 100% in these industries. The potential tariffs, aimed primarily at China and other major trading partners, could reshape global trade, impact U.S. manufacturing, and drive up consumer costs.

What Are Trump’s Proposed Tariffs?

Trump has proposed a universal baseline tariff of 10% on all imported goods and a staggering 60% tariff on Chinese imports. These figures mark a dramatic increase from the tariffs imposed during his first term and are intended to reduce dependency on foreign manufacturing while boosting domestic production. However, critics argue that such tariffs could have unintended consequences, particularly in industries heavily reliant on global supply chains.

How EV Prices Could Double

The electric vehicle industry could be among the hardest hit if Trump follows through on these tariff proposals. Here’s why:

🚗 Dependence on Chinese Batteries & Components – The vast majority of lithium-ion batteries, essential for EVs, come from China. If these imports are taxed at 60% or more, automakers will likely pass those costs onto consumers.

📈 Increased Vehicle Prices – Higher tariffs on raw materials like lithium, cobalt, and nickel, as well as EV components, could lead to price hikes of 50-100%. A vehicle that costs $40,000 today could surge to $60,000 or more under Trump’s proposed tariffs.

🏭 Strain on Domestic Manufacturing – While the goal is to encourage local production, building new battery factories and securing alternative supply chains takes years, making short-term price surges inevitable.

Steel Industry: Costs Set to Skyrocket

Steel, a critical material in construction, automotive, and manufacturing, could see major price increases under Trump’s tariff plan.

🔨 Higher Production Costs for U.S. Manufacturers – Many American companies rely on foreign steel imports, particularly from China, Canada, and Mexico. Tariffs would force businesses to pay significantly more for raw materials.

🏗️ Infrastructure & Construction Costs Soaring – Increased steel prices would drive up homebuilding, bridge repairs, and factory construction costs, slowing infrastructure projects and economic growth.

💰 Consumer Goods Impacted – Everything from appliances to machinery could become more expensive, with businesses passing costs onto consumers.

Semiconductor Chip Prices Could Surge

The U.S. remains heavily dependent on Asian chip manufacturing, particularly from Taiwan, South Korea, and China. Despite efforts to boost domestic chip production through the CHIPS Act, tariffs could still disrupt supply chains and increase costs.

🖥️ Tech & Auto Industries at Risk – Higher chip costs would raise the price of smartphones, laptops, gaming consoles, and even cars, all of which rely on semiconductors.

📊 Impact on AI & Data Centers – AI development and cloud computing require high-end chips, meaning tariffs could lead to higher costs for tech companies and services like Amazon Web Services, Google Cloud, and Microsoft Azure.

The Economic & Political Fallout

Trump’s tariff plan is expected to face strong opposition from businesses, trade partners, and even members of Congress who fear it could harm U.S. consumers more than foreign competitors. Here’s what could happen:

💼 Job Market Uncertainty – While tariffs may protect some domestic industries, companies that rely on imports may lay off workers due to rising costs.

📉 Stock Market Volatility – Markets typically react negatively to trade wars and economic uncertainty, leading to potential downturns in the S&P 500 and global markets.

🌎 Global Trade Tensions – Countries affected by Trump’s tariffs could retaliate with their own tariffs on U.S. goods, potentially hurting American exports.

Final Thoughts

If Trump implements his massive tariff plan, the cost of electric vehicles, steel, and semiconductor chips could skyrocket by up to 100%, impacting everyday consumers, businesses, and the broader economy. While the intention is to boost domestic manufacturing, the reality may be higher prices, economic strain, and prolonged trade wars.

With the 2024 election approaching, the future of U.S. trade policy remains uncertain—but one thing is clear: Trump’s proposed tariffs could reshape industries and global markets in ways not seen before.

🔎 What are your thoughts on Trump’s tariff plan? Will it help or hurt the economy? Let us know in the comments!