Bitcoin‘s Rapid Recovery Amid Market Shifts

Bitcoin (BTC) has staged a remarkable comeback, rapidly recovering from a recent dip and setting its sights on a $119,000 price target. This resurgence comes amidst a backdrop of shifting market sentiment, where anxieties surrounding Federal Reserve policy are being superseded by optimism surrounding potential strategic reserve initiatives.

Corporate Treasuries’ Buying Spree

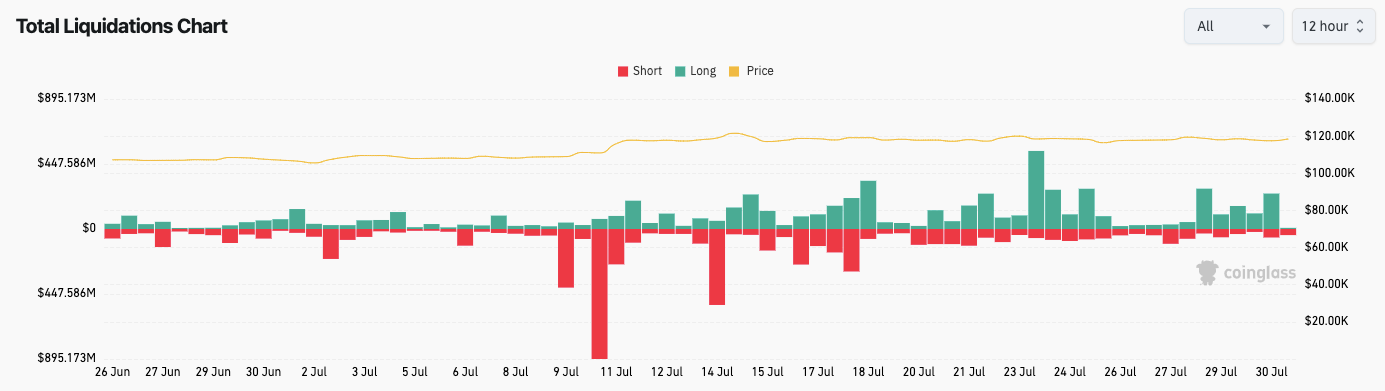

A key driver of this bullish momentum is the significant accumulation of Bitcoin by corporate treasuries. Data indicates that nearly 30,000 BTC were added to these reserves in a mere 48-hour period. This aggressive buying activity underscores the increasing confidence institutions have in Bitcoin‘s long-term potential, even in the face of market volatility. Some market participants have pointed out that this level of buying hasn’t been seen since August 2020.

Federal Reserve‘s Influence and Market Adjustments

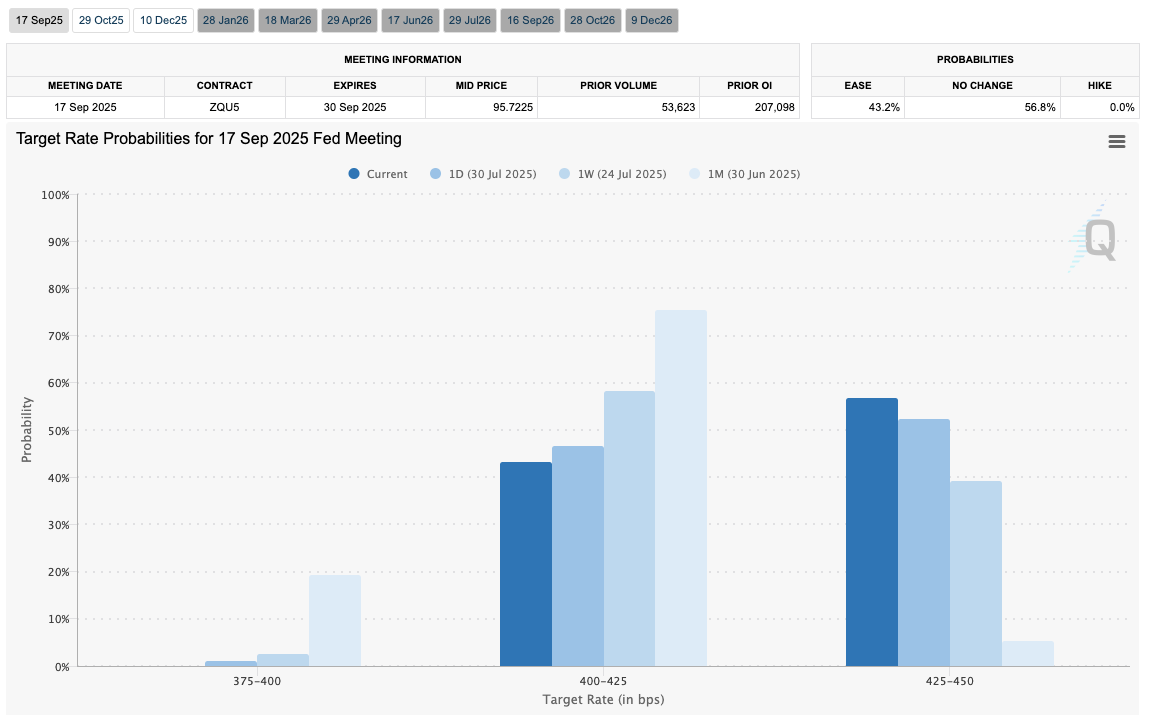

The initial dip in Bitcoin‘s price followed a more hawkish than anticipated Federal Reserve meeting on interest rates. Chair Jerome Powell’s reluctance to hint at upcoming rate cuts initially dampened market enthusiasm. However, this sentiment quickly reversed as traders recalibrated their expectations, particularly after hints of a strategic Bitcoin reserve by the White House.

Strategic Reserve Anticipation Fuels Optimism

The prospect of a strategic Bitcoin reserve has injected a dose of optimism into the market. Robert “Bo” Hines, the executive director of the US President’s Council of Advisers on Digital Assets, indicated that the White House is actively planning to establish such a reserve. This development signals potential institutional endorsement of Bitcoin as a key asset class.

Impact and Outlook

The market’s response to these events has been swift and decisive. Bitcoin‘s price has rebounded sharply, fueled by corporate buying and positive sentiment surrounding the strategic reserve. Traders are now closely watching key economic indicators, including initial jobless claims and the Personal Consumption Expenditures (PCE) index, to gauge the Federal Reserve‘s future policy moves. The combination of these factors suggests that the short-term outlook for Bitcoin is decidedly bullish, with the $119,000 target now within reach.

Looking Ahead

The coming weeks will be crucial in determining the long-term trajectory of Bitcoin. The interplay between Federal Reserve policies, institutional adoption, and market sentiment will shape the cryptocurrency’s price action. While volatility is expected, the current environment appears to be favoring the bulls, with corporate treasuries leading the charge.